Reuters' Digital News Report 2021 shows lasting impact of coronavirus on media

This year’s Reuters Institute Digital News Report is starker than ever about the issues facing news media across the globe. A perceived lack of representation among traditional media is driving younger audiences to the more opinionated personalities that thrive on social platforms – even as the reliability of news on those platforms is low.

This year’s Reuters Institute Digital News report looks at the commercial and cultural impact of Covid on newsrooms

The report, which notes that Covid has accelerated much of the trends – both positive and negative – for news outlets, also notes that the impact of coronavirus on news consumption will outlast the pandemic itself. While there is good news in there for publishers, particularly across Europe, the report also makes clear that future success relies on addressing endemic issues at news outlets, both commercial and cultural.

Lack of trust harms newspapers’ chances for government support

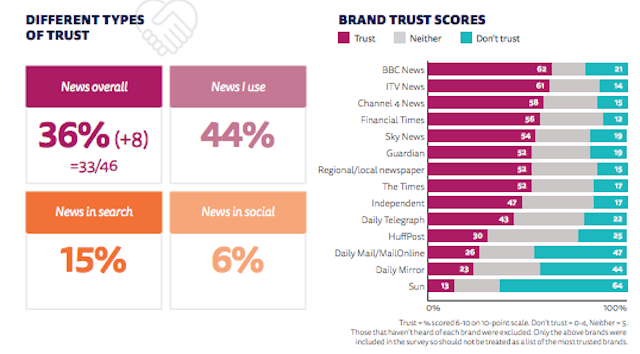

This year’s report makes plain the struggle for news outlets to find sustainable funding sources in light of the ongoing trust issue. Overall trust in media in the UK stands at 36% – up eight points on the previous year – but this is still 14 points lower than before the Brexit referendum, with the media blamed for fostering divisions.

Source: The Reuters Institute Digital News Report 2021

The report, compiled by the team at the Reuters Institute for the Study of Journalism, notes that while there are mooted government schemes to support journalism – such as those outlined in the Cairncross Review – there is little appetite among the public for those schemes.

The report notes that: “Across all 33 markets, just one quarter (27%) think that the government should step in to help, compared to 44% that think they should not. In all but a handful of markets, the proportion opposed to government intervention is larger than the proportion that supports it.”

The report states that the proportion of people who would support government financial intervention varies by nationality and by the level of awareness about the financial strictures in which newspapers find themselves. However, it also makes it plain that the trust issue, compounded by perceived failings in objectivity and representation, are also dulling public appetite for that intervention.

Broadcasters such as the BBC, ITV, Sky News and Channel 4 remain the most trusted news brands, followed by national broadsheet titles, which the report ascribes to their remit to provide balanced and objective coverage. Unsurprisingly the tabloids remain the most distrusted by audiences, with the report citing The Sun, The Mirror and The Daily Mail in particular as being the least trusted.

The risk v the reward of social publishing

The report is clear that social networks are eating publishers’ lunch, both in terms of ad spend and the amount of time that audiences spend on social platforms v news platforms.

It also cautions that news outlets looking to capitalize on the growth of those networks need to be more careful than ever about the sort of content they publish on the platforms: “For instance, some networks, such as Snapchat, have a separate space for news. But on Instagram and TikTok, news stories blend in with videos and images that other users share. Given that the algorithms are mainly driven by popularity and relevance, content needs to be highly engaging to reach a wide audience. This is perhaps even more important for newsrooms who are actively using, or are planning to use, TikTok, where users spend the most time ‘flopping’ through hundreds of videos on the ‘For You’ page.”

That need for caution is highlighted by the role the social networks play in spreading misinformation, which has been exemplified by the networks’ lax and sluggish moderation of Covid-related misinformation.

Covid accelerates existing revenue trends

The chilling effect of Covid has forced news outlets to adapt to pre-existing trends more rapidly than pre-pandemic. This has been good news for the publishers that had invested in their subscription and membership capabilities over the past few years, with the report singling out a few titles as having done well off the back of the public’s desire for accurate news over the pandemic: “Both The Telegraph and The Times now have around 400,000 digital subscribers, while The Guardian says 900,000 are regularly paying for its online journalism via a combination of subscription to their apps and recurring donations, though the website remains free to access.”

It is also noted that the government’s long-overdue move to scrap VAT for digital publications has benefited the industry by about £50m a year. Despite that, the cooling impact of the pandemic impacted the newspapers with less diverse revenue schemes, with local and national titles’ circulation down by an average of 10% each and freesheets like The Evening Standard down by 40%, according to industry data.

UK local news subscriptions lag behind the average

The UK population in general has one of the lowest propensities to pay for digital news – only 8% as of this year. That compares unfavorably to every other country in the report, which finds that around 17% of people across 20 countries have paid for online news. As before, many of the Nordic countries outperform in this area, with Norway in particular having a high proportion of people paying – 45%.

The divide is starker for local news subscriptions, however. Only 3% of the UK population is currently paying for local news in digital form: “One striking finding from our survey this year is the difference in contribution made by local and regional publications across countries. In Norway, 57% of subscribers pay for one or more local outlets in digital form. This compares with 23% in the United States.”

In that sense, the lack of trust in national titles is actively harming the future of those local papers, since it leads directly to a lack of appetite in providing financial assistance to those newspapers.

It is exacerbated by the fact that UK regional newspapers have lost the monopoly on providing local information as they once did: “Looking at the UK as one example, audiences are more likely to use search engines and other internet sites as the best place to access weather or local jobs information, along with social media for recommendations about ‘things to do’.”

The report also draws attention to the fact that the median number of digital subscriptions in the United States is now two, which it speculates is due to a wider choice of titles offering subscriptions – including those from individuals distributing paid-for newsletters on Substack.