Brains for sale: WPP shows its hand as AI race between holding companies heats up

Mark Read presented his holding company’s internal AI platform to investors in London.

WPP plans to build upon its existing AI offerings to strengthen its competitive edge. / Adobe Stock

After a financially rocky 2023, WPP is looking to gain a sturdy foothold in an increasingly tech-driven future by investing around $316.8m (£250m) in proprietary AI technology this year.

At a Capital Markets Day held yesterday in London, chief executive Mark Read unveiled demos of the holding company’s internal AI platform, WPP Open, and discussed initial products built for brands, including bespoke AI models the firm has dubbed ’Brains.’

“AI is transforming our industry and we see it as an opportunity, not a threat,” said Read. “We are already empowering our people with AI-based tools to augment their skills, produce work more efficiently and improve media performance, all of which will increase the effectiveness of our work.“

Advertisement

Read claims that AI tech investments will help drive back-office efficiencies and charge up its production business, consolidated under agency brand Hogarth in recent years. Read told the Financial Times that it was “too early” at this point to determine whether or not WPP’s plan to more deeply integrate AI will result in more or fewer jobs throughout the marketing industry. A WPP spokesperson confirmed the $316m investment will be rolled out annually, for the foreseeable future.

WPP has unveiled its plan during a moment of tension for marketing services groups. Omnicom and Dentsu are also quietly building similar clusters of products, while WPP's closest competitor, Publicis, announced plans last week to spend around $326m on an internal AI system called CoreAI, a beta version of which is expected to be deployed across the company’s extensive agency network sometime next year.

Advertisement

Scores of brands have recently begun to integrate AI into their marketing strategies, which in turn has put pressure on ad agencies to establish their own competitive approaches to the technology.

Open for business

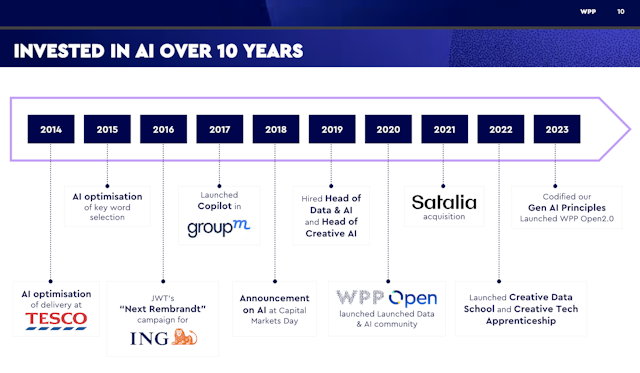

Read and his fellow WPP execs were at pains to emphasize WPP’s experience in the AI scene, pointing back to initial projects produced for British supermarket Tesco in 2014. But it is Satalia, an AI company WPP acquired in August 2021, that sits at the heart of the agency group’s current plans. Satalia was founded by Daniel Hulme, who was named WPP’s chief AI officer following the acquisition. A slide included in yesterday's presentation called Satalia ’WPP’s DeepMind,’ referencing the London-based AI lab that was acquired by Google in 2014.

The company formally launched WPP Open, an AI-powered platform designed to enable access to internal data and technology across the company's client network, back in 2020. The software provides a single user interface that combines several generative AI tools, WPP audience data and bespoke AI models trained using the proprietary data and assets of clients.

Suggested newsletters for you

Forrester principal analyst Jay Pattisall says platforms such as WPP Open will be key expressions of agencies’ ability to “take enterprise enablement of generative AI and AI foundation models and combine them with other capabilities and technology.“

Like Publicis’s CoreAI, the idea is to provide staffers a single, safe-for-work portal with which to leverage AI tools. To date, the company says it has handled 1.5m individual large language model prompts and 1.6m image generation prompts. According to Read, the platform currently has around 28,000 users and is being used by important clients like L'Oréal and Nestlé. Read credited last year’s account win with the latter company to WPP’s burgeoning AI capabilities.

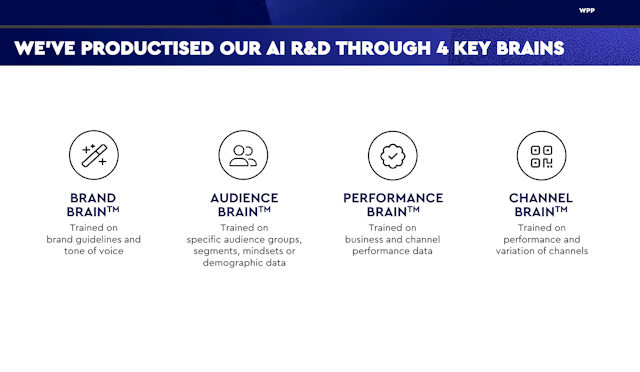

The company has been developing ’brains,’ or bespoke AI models – datasets including vast amounts of information on an advertiser’s business and trained on its brand guidelines and tone of voice. An audience ’brain’ developed for Mondelez chocolate brand Milka, for example, was trained on data relating to specific audience groups and demographic data covering 683m individual transactions across 220 million consumers.

WPP’s brains will likely become a key element of its AI proposition. It’s not alone in that; Publicis Groupe also discussed the creation of models built to individual brands’ specifications. Patissall suggests that licensing access to these models will become a key means of monetizing AI capabilities.

“Essentially I think what we’re looking at is a new kind of productized offering from agencies,“ he says.

In addition to continuing to develop its own internal AI capabilities, Read said WPP also intends to continue to build upon the “deep relationships” it has already cultivated with AI industry leaders Google, Microsoft, OpenAI and Nvidia. “Our long-standing investments in AI are at the heart of our competitive offer.”

Financial context

2023 was a year of internal transformation for WPP. The company’s PR and marketing agency holdings were recently restructured into six key brands: VML (a merger of Wunderman Thompson and VMLY&R), AKQA, Ogilvy, Hogarth, PR group Burson and GroupM. The company has announced that it plans to spend around $135.5m on costs associated with this restructuring in 2024.

Last year was also marred by financial difficulty, not only for WPP but across much of the advertising landscape, as clients hailing from the tech sector cut back on spending. But Read has sounded a note of optimism that the company’s reorganization and its ramped-up investments in AI will aid profit margins and its competitive advantage in the future. “While we had to navigate a more challenging environment in 2023, we see strong future demand for our services and are confident we can accelerate our growth over the medium-term,” he said.

WPP’s shorter-term financial predictions, however, are modest: it expects its revenue to grow up to 1% at the most in 2024. The company is slated to reveal its financial results for 2023 on February 22.

Additional reporting by Sam Bradley