UK ad spend: caution ahead and marketers may be falling into a promotions spiral

The latest IPA Bellwether report shows that UK brands have kept their confidence in marketing teams despite the cost of living crisis, but we may be seeing some worrying trends in the data.

36.6% of respondents believe they’ll see greater total marketing spend in real terms compared with 2022 / Unsplash

The IPA Bellwether explores how much budget marketers will have to play with and charts how optimistic they are. For many, it prophesizes any coming prosperity... or scarcity.

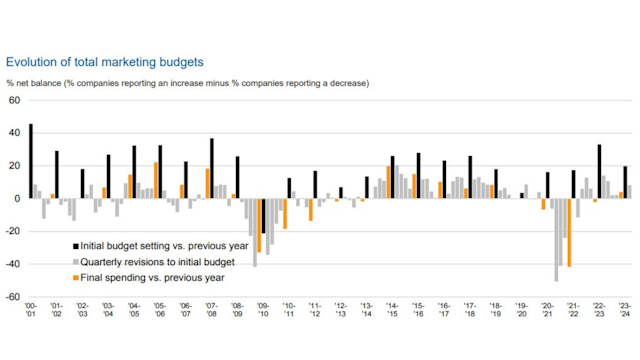

The good news for the first quarter of 2023 is that UK marketing budget growth is at its strongest since Q2 2022. After a difficult year, ad spend took an upward trajectory.

The questionnaire of 300 UK-based companies saw a net balance increase of 8.2% reporting marketing budget growth. It’s 2.2% higher than the previous quarter. Deeper into the data, the true picture is revealed. Two-thirds of respondents held the lines on their budgets, and 12.9% saw budget cuts. 21.1% expanded. Despite the challenging economic environment and the historically high inflation in the UK, marketers held their nerve.

Advertisement

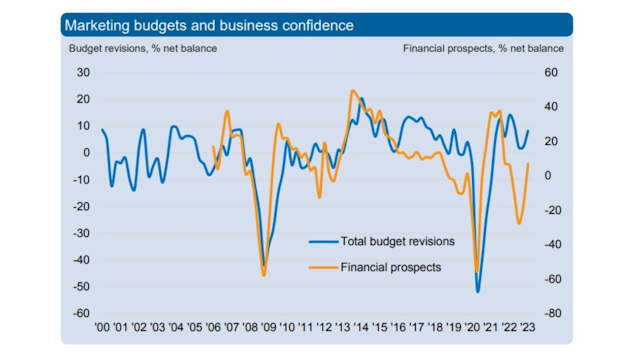

In isolation, any single Bellwether can’t tell a full story. The below graph helps contextualize the current situation against the pandemic, and even earlier the 2008 recession. Marketers are having to dig themselves out of a deep hole.

Most impacted media

Main media marketing (including online ads and TV) was at its highest since Q122. Up 5.8%. Published brands decelerated losses to -1.9% from -3.9%. Meanwhile, out-of-home saw 12.4% shrinkage. It was previously falling by 8.8%. And there were modest reductions in PR budgets and market research.

Sales promotions were up by a huge 8.8%. They will be up 6.3% for the year. This category rose at the strongest pace in nearly two decades.

The bigger picture

For 2023, 36.6% of respondents reckon they’ll see greater total marketing spend in real terms compared with 2022. 16.9% are anticipating cuts. The IPA says the net balance of 19.8% is “strongly positive”.

Bellwether tests respondent optimism. It’s a keen indicator of what lies ahead. Under anonymity, marketers theoretically, tell what’s really coming down the line.

Advertisement

There was a net balance growth of 7.0% for optimistic firms. One year ago that balance was -17.2%. Several panelists remained worried the UK could enter a recession. And the cost-of-living crisis remained the most commonly-mentioned business risk. We’re not out of trouble yet, but the route to safety looks closer.

UK GDP is set to perform slightly better than forecast, declining by 0.2% rather than 0.8%. It notes that the consumer wallet is under pressure. We could see a UK decline in ad spend as high as 0.9%. An increase of 0.5% is booked in for 2024, that’s down from 1.2%.

Threats

By category, these are the biggest threats marketers said were ahead:

-

Retail: “Decrease in general consumer spending due to cost of living.”

-

IT/computers: “Competitors undercutting our products and businesses being reluctant to spend on products they deem to be non-essential.”

-

Travel/entertainment: “Energy prices and living wage increases.”

-

Financial services: “High-interest rates may lead to householders struggling to afford mortgage repayments.”

-

Public/charities: “Strike action.”

-

Consumer durables: “Economic uncertainty leading to reduced demand as homeowners postpone big-ticket purchases.”

-

Industrials/utilities: “Many of our larger competitors have absorbed some of the price increases which we could not afford to do.”

-

Media/marketing: “Clients reducing their marketing budgets.”

-

Industrial/utilities: “Recession in Europe and US.”

-

FMCG: “Rising costs of manufacture will have to be passed to consumers, reducing demand.”

-

Media/marketing: “The cost of services is accelerating faster than budget growth.”

-

Consumer durables: “War in Ukraine.”

-

IT/computers: “Competitors slashing prices.

Marketers react

Paul Bainsfair, IPA director general, dubbed it a “positive start… all things considered”.

Joe Hayes, senior economist at S&P Global Market Intelligence, added: "Total marketing budget growth broadened out during the opening quarter, showing that more companies are tapping into their marketing resources to help them successfully navigate through economic turbulence."

Tony Mattson, head of strategy at Havas Media Group UK, feels he’s being a bit of a downer. “Far from being a positive forecast, I fear the Bellwether report shows businesses are fighting to shore themselves against further impending headwinds rather than opening the sails wide for greater opportunity farther afield."

Elliott Millard, chief strategy and planning officer at Wavemaker UK is worried “brands forget what they’re for. Brands are essentially designed to defend price premium.” He wonders if marketers are best channeling their brands to protect prices or are giving way to discount wars.

Ricardo Amboage, managing partner at Starcom points out that while the cost-of-living crisis may be shorter-lived than initially feared, brands must acknowledge that many are “struggling” and are making “more value-conscious behaviors”. Much of the increased marketing spend will help sell top-priced premium brands. Can they drown out their cheaper counterparts as well as those longer-lasting sustainable products?

Bainsfair added: “As the cost-of-living crisis continues, it is understandable for companies to offer sales promotions to help their customers’ tightened purse strings. To ensure brand loyalty isn’t eroded and to protect the long-term health of their brands, however, such activity must be coupled with investment in longer-term brand-building media. We are pleased, therefore, to see that while investment in sales promotion activity has spiked this quarter, investment in main media advertising was revised up to its strongest level since this time last year.”

Zuzanna Gierlinska, chief growth officer UK at GroupM Nexus, says there is “a laser focus on the need to prioritize efficiency” and was particularly enthused by the budget rises in online video and audio.

John Davidson, chief operations officer of OOH agency Kinetic Worldwide says the reported out-of-home spend slowdown isn’t what he’s seeing “on the ground” and expects advertisers to use the medium in new ways this year.

Emma Cranston, client services director at publisher ad network Ozone hopes “bumper interest in content around the King’s Coronation, a home-crowd Eurovision, and the lead-up to major sporting events like the Fifa Women’s World Cup kick-starting in mid-July” will lead to an upsurge in audiences as well as ad spend.

And finally, Marc Fischli, executive managing director, EMEA at Criteo says many advertisers have “doubled down” on performance, especially in retail media. He warns brands not to get hooked on the return on ad spend metric (ROAS). More on that here.

Read consultant Brian Wiesner’s views on how the global economy is impacting media spend here.