A $406bn gaming industry and the melee for advertiser's next frontier

Video games will soon become the largest entertainment medium in the world, says Creativ Strategies' Wes Morton, and advertisers should pay attention.

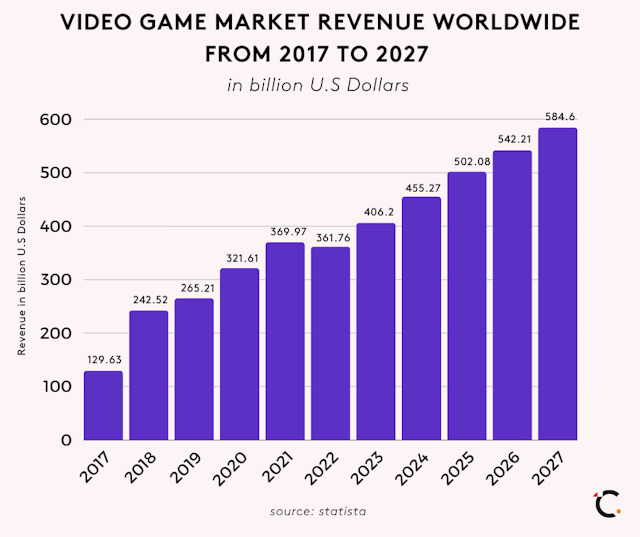

In 2023, the video game industry will generate $406bn in revenue worldwide, 18% more than the music and movie industry combined ($338bn). And in three to four years, video game revenues are even expected to close in on global TV revenues ($690bn).

Meanwhile, brands spend less than 5% of their advertising budget on gamers, according to a study by IAB, citing inventory, quality, measurement, and brand safety challenges.

Publishers, tech solutions, and agencies are racing to fill that demand, battling to become the leader in the next frontier in marketing - in-game advertising.

Gaming’s gargantuan consumer numbers

The gaming industry is experiencing explosive growth, with the total market forecast to expand by $178bn in the next four years, a 9% rate of growth year on year.

3 billion people, about 40% of the global population, now identify as gamers. That figure will grow as developing countries broaden their populations' access to the internet and devices.

In developed countries like the United States, over 80% of the population plays video games from one to 10 hours a week, according to a new Ventatus/GWI 2023 gaming study.

Video game players have spawned an entirely new ecosystem of content around them as well. The same study noted that 42% of gamers consume gaming-related content, whether it be streaming games, esports, walkthrough videos, Discord servers, reviews, podcasts, or forums. Twitch, the live streaming platform for gameplay streaming, has more than 2 billion streaming hours watched each month.

Advertisement

Video games also outperform other media in engagement, a key metric for advertisers to judge potential recall, action, and conversions. The increased engagement stems from video games’ key difference from most media, active participation versus passive viewing, notes Ryan Dow, head of gaming & esports at SportFive, a global sports marketing agency.

“It’s hard to ignore the true value video games bring to marketers,” says Dow. “Video games command a 72% active engagement rate with Gen Z consumers compared to just 30% for movies and series. That means players don’t just see your product or service, they truly engage with it, they utilize it in-game, and it lives on in perpetuity.”

The brand-gaming challenge

Despite the overwhelming evidence of gaming’s rise as a medium, marketing investments continue to lag.

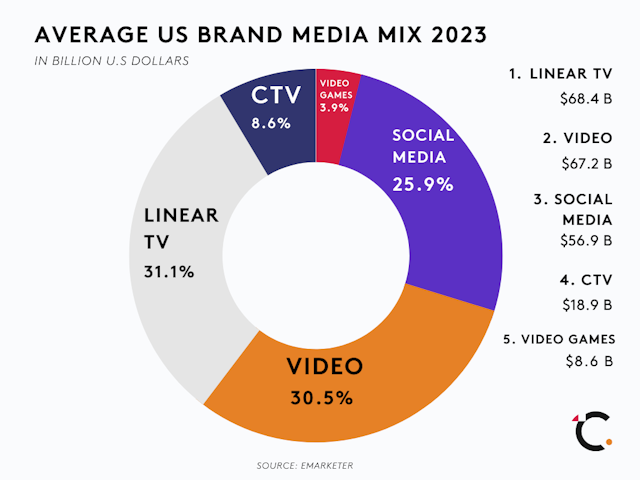

According to eMarketer, US ad spend on video games totaled $8.6bn in 2022, compared to $56.9bn on social media, $67.2bn on video, $68.4bn on linear TV and $18.9bn on connected TV (CTV).

With any new frontier, there are barriers to building new marketplaces. Natalia Vasilyeva, EVP marketing and strategy at Anzu, a programmatic in-game advertising platform, outlined three obstacles impeding in-game advertiser adoption — technology, standards and measurement, and education.

Creating a new advertising gaming marketplace requires connecting the digital pipes, necessitating in-game advertising firms build custom APIs and solutions for both the demand side (brands) and supply side (game publishers). The endeavor requires significant lobbying, partnership agreements, and investment.

Advertisement

“Building out a new marketplace has meant we’ve had to create bespoke tech solutions and encourage others to do the same,” says Vasilyeva. “A major challenge early on was working with the industry’s biggest players and helping them to understand that there is enough demand and excitement for them to invest considerable resources into the space and build out bespoke solutions for in-game.”

New in-game advertisements came with no blueprint and no standard measurement or accepted metrics. Many of the in-game advertising units introduced to the market have never been offered before, notes Vasilyeva. Anzu, Venatus, and other players had to work closely with the IAB, MRC, and viewability, uplift, and attention experts to understand and cement standards. These efforts aim to ensure compliance, understanding, and scale through standardization.

Education also remains a challenge for everyone in this multi-bit gaming world. “It’s new. Truly. Outside of sports simulation games like EA FC, Madden, NBA2K, and automotive games, in-game branding and product advertising is new for both the marketers and the developers,” remarks Dow from SportFive. “There’s a large degree of education that needs to happen on both sides to understand the best path forward.”

“We know that this is something we cannot do on our own,” says Vasilyeva. “Listening and working with our clients, partners, and the wider industry is paramount to ensuring in-game awareness continues to grow.”

The players racing to win

Several brands are pushing play and winning. Initial in-game brand results appear impressive.

“When we speak to brands directly, more often than not, they get it and are excited to get involved,” says Sterling Wharton, North American president at Venatus, an adtech gaming platform. “Visa, Samsung, and Mattel are just a few of the brands Venatus has worked with recently, leveraging games such as Minecraft, Roblox, and The Sims to create captivating brand experiences.”

Suggested newsletters for you

An in-game campaign for retail brand Tommy Hilfiger saw a 24 point lift in brand recommendations, a 23 point lift in brand favorability, and a 20 point lift in favorability, according to stats provided by Anzu.

TalkTalk coded into racing games

A study by TalkTalk, a UK broadband provider, found that an in-game advertising campaign in popular football and racing games delivered a 12% uplift in purchase intent. Whatsmore, almost half (48%) of the study participants were able to spontaneously recall TalkTalk, almost double that of digital display and social. Ad viewership hovered around 96%.

Nike, Disney and Balenciaga have partnered with Fortnite, the battle-royal game from Epic Games, to create custom ‘skins’ (avatar outfits) that players can purchase and sport in game as well as custom game modes in a player sandbox that regularly registers 250 million monthly active players.

Publishers, platforms, and tech companies smell money.

Unity and Unreal, massive game engines that power and provide the building blocks for AAA titles, are busy inking third party inventory partnerships and creating tools that will allow developers to insert ads into their games. Microsoft and Sony are both working to develop ad-platforms for Xbox and PlayStation respectively. Roblox, a game creation platform with 65 million daily active users, has created several custom brand worlds and announced new solutions to insert ads into digital experiences.

To win the melee, companies must assemble the right mix of premium advertising inventory and the network of advertisers to gain a market advantage.

“We anticipate that in-game advertising will become as commonplace for brands as social media advertising is today,” says Wharton. Premium game publishers like EA, Ubisoft, Microsoft, Sony, and Epic Games have echoed that sentiment.

Game on.

Content by The Drum Network member:

Creativ Strategies

Creativ Strategies is a full-service marketing consultancy and studio for media, entertainment, and tech brands. Challenges welcome.

Find out more