Google’s Universal Analytics sunsets in 51 days & cookies are crumbling: how to prepare

As part of The Drum’s latest Deep Dive, The New Data & Privacy Playbook, Gartner’s Mike Froggatt explains how marketers can prepare for the end of Google's Universal Analytics this summer.

/ Myriam Jessier

According to Gartner research, just over a quarter of all marketing budgets go toward paid media, with 56% of that spent on digital channels. Proving return on ad spend is already difficult for digital marketing leaders, and changes to cookies and walled gardens strengthening their own walls will make it even more challenging.

Third-party cookie data fueled two decades of digital media and data-driven performance advertising. It’s no wonder cookie deprecation and restrictions on third-party data are transforming the way marketers target, buy and measure digital media.

Advertisement

In addition to the immediate impacts of cookie loss, the increased regulatory pressures on walled gardens is creating an environment of more black box algorithms and fewer data points with which to measure and independently verify results. Of the three privacy scenarios proposed by my colleague Andrew Frank, we are quickly moving to a walled garden world. And the biggest among them, Google, is at the front of the pack.

Aside from the (continually delayed) deprecation of the cookie, Google has another fast-approaching deadline that will impact almost every marketer with a website: the sunsetting of Universal Analytics.

As my colleague Lizzy Foo Kune shared with The Drum last year, the migration to Google Analytics 4 (GA4) entails an urgent overhaul to long-standing marketing data collection, measurement baselines and operational approaches — and deeper ties to Google’s ad ecosystem. GA4 highlights the data usage and consent gaps between acquisition-oriented advertising and retention-and-growth marketing but provides bridging mechanisms such as lookalike modeling, retargeting, pathing and attribution.

Advertisement

Digital advertising is vital for the success of modern brands, for driving both top-of-funnel awareness and bottom-of-funnel consideration and sales. Key to their success is access to data about their prospects’ and customers’ online behavior, which helps marketers target and personalize their campaign efforts. Regulations on the collection and sharing of consumer data is prompting major data providers and adtech alike to change how their platforms collect, store and share this data with advertisers.

To maintain their digital media effectiveness, marketers need to build resilience and evaluate existing digital partners for cookie and walled garden alternatives.

Suggested newsletters for you

Build a cookieless and walled garden risk profile

Purchasing display ads indirectly indicates a high reliance on third-party cookies. Brands with campaigns that rely heavily on indirect impressions could be highly susceptible to disruption from additional privacy changes from walled gardens and limits on third-party tracking from regulatory bodies.

Brands should ensure that their website and digital media campaigns – and the data collected and used to target ads – are both privacy compliant and effective in the face of those challenges by:

-

Owning, assigning someone on the team or finding a trusted partner to keep up with the latest news on privacy changes, cookies and third-party data regulation and their impact on the brand’s business.

-

Building first-party data assets by homing in on core customers and building direct-buying relationships with strategically important media partners.

-

Working across the organization to ensure compliance across user data collection and digital media activation.

-

Partnering with media companies, as well as established and emerging technology firms, to test novel targeting strategies (e.g., Google’s Topics, contextual targeting, data clean rooms) that reduce the eventual impact of the loss of cookies on existing media strategies.

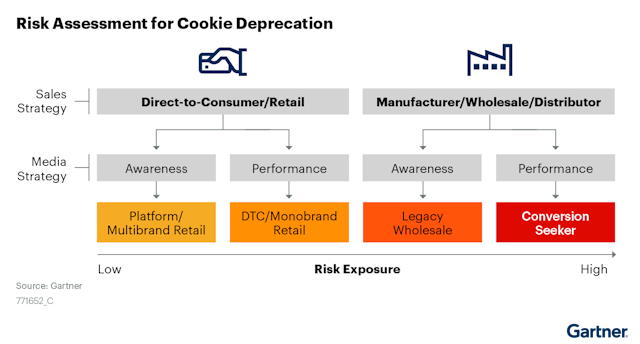

Once an organization understands how its digital media is purchased, either with an internal analysis or a report from its agency partners, determine the risk exposure to the company's marketing programs. Privacy changes and cookie deprecation’s impact on advertising depend on two factors: sales strategy (direct or third-party sales) and media strategy (brand versus performance marketing).

Source: Gartner (May 2023)

Sales strategy and the proximity to the final sale are indicative of the relationship with the customer, including the receiving consent to use their data for retargeting and other conversion-oriented digital advertising tactics. Media strategy indicates the number of existing relationships brands have with their target audiences to deploy in a privacy-safe way and their reliance on advertising partners.

Limit exposure to changes in the long run

After determining the organization's cookie risk profile and building overall resilience to disruption, follow some of these next steps, tailored for each profile, to limit exposure to changes:

-

Conversion-seeking brands should focus on the core value of their products to consumers and continue to build upon that niche in addition to investing in performance media partners. Work on increasing the loyalty of existing customers and growing through the network effects of word-of-mouth on social media and outside of digital.

-

Legacy wholesale brands should maintain mind share through their broad brand advertising strategies while leveraging emerging channels like retail media networks. These channels can help fill any potential gaps in performance advertising left by changes to walled gardens and third-party data.

-

Direct-to-consumer and mono-brand retail brands should leverage their consent-based first-party data and close relationships with customers to focus their ad spend across trusted sites and apps. With Universal Analytics’ sunset imminent, it is imperative for digital marketing leaders to start collecting data with both UA and GA4 now in order to test for data compatibility and source appropriate alternatives for signal loss.

-

Platform and multichannel retail brands must continue to innovate on their existing sites, apps and product suite to stay at the forefront of customer needs. If the brand is a Google Analytics site, it's important to prepare for fewer granular data points on site visitors in exchange for more targeting options within the Google media properties. In addition, work with marketing technology providers to expand revenue opportunities by leveraging audience and conversion data for brands in high-risk, legacy and direct profiles.

Mike Froggatt is senior director, analyst in Gartner's marketing practice. To read more from The Drum’s latest Deep Dive, where we’ll be demystifying data & privacy for marketers in 2023, head over to our special hub.