Can Tiffany’s pursuit of younger shoppers maintain its growth in a recovering economy?

A heritage brand with a legacy of classic American design, Tiffany & Co has reported strong growth since its acquisition by LVMH last year. But with the rising cost of living, the luxury market looks set to fall out of favor with the economically suppressed and politically radicalized younger generations. For The Drum’s latest Deep Dive, industry experts weigh in on how the classic jeweler might continue to remain relevant in an ever-evolving landscape.

Beyonce and Jay Z in the ‘All About Love’ campaign for Tiffany and Co

Tiffany and Co has been on the rise. Pegged by Interbrand as one of the fastest growing brands in 2021, the luxury jeweler has defied the odds of post-pandemic economic recovery.

Revenue at LMVH topped $71.6bn last year, with the company’s chief saying Tiffany in particular had a “remarkable” performance (it doesn’t break out individual company revenue).

Rob Sellers, head of retail at VCCP, thinks its growth is unsurprising given the market-wide trend in the luxury sector. “During the first lockdown, the people with stable incomes and stable jobs saved a lot of money, and this was well documented. So when the lockdowns lifted, we started to see what we’re calling ‘revenge spending’, where the people who could afford it are spending their money on luxury purchases.”

Deborah Marino, the deputy managing director at Publicis Luxe, says that coming out of the pandemic there has been a proportion of society for whom their wealth has grown. “There have never been so many billionaires, for example. The rich just keep getting richer.”

And, she says, the relative accessibility of Tiffany’s luxury items, combined with its timelessly classic design, makes it the perfect investment for people looking to compensate for the glamor and opportunities they missed out on during the worst of the pandemic.

Fresh faces

Tiffany has capitalized on this trend by accelerating its marketing efforts. This saw the brand appoint Andrea Davey to the role of chief marketing officer – the first time the position had been filled in over five years. Davey’s appointment followed that of Gavin Haig, who joined from Burberry as chief commercial officer.

Marino says that these new appointments mark a turning point in the evolution Tiffany has been aiming for since as early as 2017. “It is putting a lot of effort into rejuvenating the brand,” she explains, citing everything from its investment in creative touch points on social media to fresh faces in its campaigns including Elle Fanning to Anya Taylor Joy.

On last year’s earnings call, Tiffany’s chief financial officer Jean-Jacques Guiony confirmed the brand’s intentions to broaden its appeal to a wider range of customers: “We are analyzing all the different product categories, in particular from the perspective of pricing, and determining what the winning products are. Our objective is obviously to develop our operations with younger consumers.“

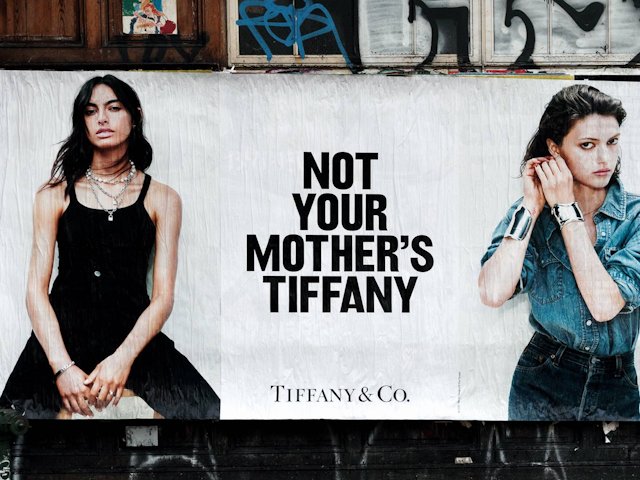

However, while the brand denies it is specifically targeting millennials, its desire to appeal to a younger crowd has become evident across its major marketing ploys these last few years, in everything from its ‘All About Love’ campaign featuring Beyonce and Jay Z to its lucrative collaboration with Supreme and its controversial ‘Not Your Mother’s’ ads.

Across the generations

Dipanjan Chatterjee, vice-president and principal analyst at Forrester, says managing brands across generations is fairly common. “The way to do it right is to build a core value proposition that is emotionally evergreen and then work to make that core relevant to every generation. When done right, the brand never ages.”

But it has not gone smoothly for Tiffany. Its ‘Not Your Mother’s‘ campaign experienced backlash for offending longtime customers.

Chatterjee says: “Courting one customer segment by alienating another is not a good strategy, especially when the one being put down is the bread and butter of Tiffany’s business. It does good for no one; not for the younger consumers who, contrary to the intent, are being reminded that this is a brand for their mothers, and not for the mothers who are loyal customers but were just told this brand isn’t for them any more.“

Marino feels that while it was a risky move for Tiffany, the age group the jeweler is targeting is perhaps not as young as critics are making out. “The campaign with the Carters, for example, is actually pretty universal,” she says. “They are people in their 40s and the brand was still working with traditional media to illustrate the power of the brand. All these things lean more millennial than Gen Z.”

Marino says that if luxury brands like Tiffany want to invest in their longevity by appealing to Gen Z, they would be better placed investing in the security of future generations through workplace initiatives rather than trying to reach them through creative.

”There are some people who would suggest that luxury is a doomed part of the economy… With everything that has happened to Gen Z, from the climate crisis to the impact of the pandemic, luxury products are no longer a sign of success but signs of inequality.

“Brands in this sector now need to consider their social contract, or their clients could become targets… Finding something to appeal to younger generations doesn’t have to just be cultural activity. It can look like charitable partnerships or scholarships, internship opportunities and graduate schemes. These things can run deeper than just trying to make a cool campaign.”

With the power of LMVH behind it, Tiffany has been well placed to capitalize on the market trends of the last few years. However, while the brand has remained aspirational to the more affluent and financially secure of the millennial generation, it remains to be seen whether its current strategy will continue to serve future generations.