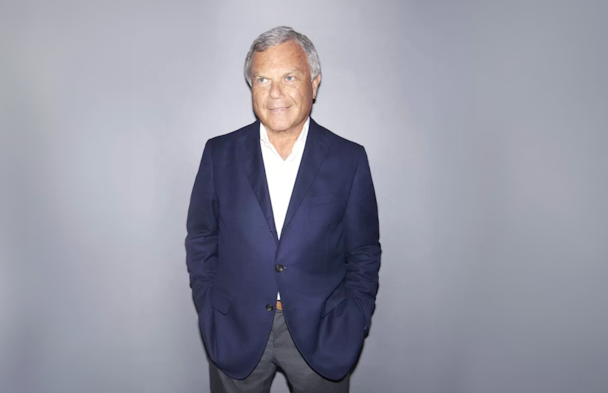

Sir Martin Sorrell issues profit warning for S4 Capital, announces hiring freeze

S4 Capital has issued a profit warning to investors as its operating costs threaten to rise beyond incoming revenue. It has put in place a hiring freeze and cost control measures to mitigate the damage.

Sir Martin Sorrell's S4 Capital issues profit warning

A statement issued to the London Stock Exchange told investors that higher labor costs, especially within its digital agency Media.Monks, following a hiring spree would eat into its operating margins despite revenue and gross profits remaining steady.

Its share price tanked 42.86% on the news.

In May, it reported like-for-like revenue growth of over 40% in the first three months of the financial year after landing several new clients in the quarter, including two in its target range of companies worth over $20m in revenue.

Previous estimates of its annual profit expected the firm to bring in £154m-£165m ($184m-$197m).

However, it has now lowered its expectations for target profits to £120m ($144m), while maintaining the expectation of 25% like-for-like net revenue growth.

In a statement, executive chairman Sir Martin Sorrell said: ”New business activity remains frenetic and the pipeline is above the level at this time last year, with considerable current pitch and land and expand opportunities across the board."

A statement from the board said that like-for-like revenue and gross profit/net revenue growth is in line with full year run rate expectations of 25% but “it is clear the company’s EBITDA and EBITDA margin will be below its expectations for the first half of the year“.

The statement added: “With the pattern of profitability already significantly skewed to the second half of the year, and as previously signaled more than the usual two-thirds weighting, this means that the profitability required for the second half of the year to meet market expectations will be even greater.”

The company’s ‘content practice’, primarily agency Media.Monks, accounted for most of the cost rise, it said. “The board expects data, digital media and technology services to deliver healthy EBITDA margins for the full year, but increased costs at our content practice will impact the company's overall operational EBITDA margin in 2022.”

S4’s cash and debt remain stable, but that it would put in place a hiring freeze and “discretionary cost controls”.

It assured investors that previous investments in financial controls and governance – promised to investors following its account snafu earlier this year – would not be affected by the “brake on hiring”.

It comes as the latest IPA Bellwether slashed its estimates for marketing spend for the next four years as it predicts mass cuts to account for stalling consumer spend.