Rebecca Jennings, senior client advisor at international benchmarking firm Global Reviews, shares findings from a recent survey on the online experiences of consumers seeking a current account provider.

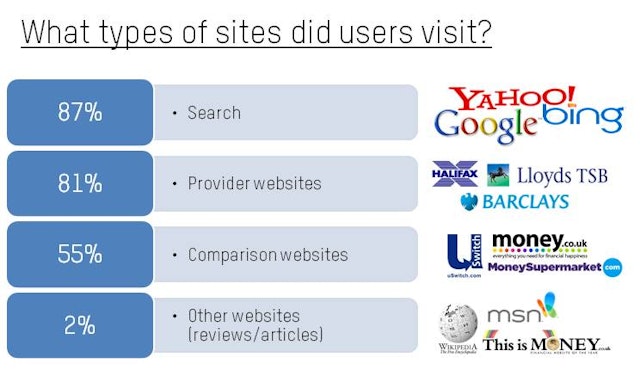

What works best when you want to open a current account? Use search sites? Think of a bank and check out their website? Or opt for the comparison websites? A new Global Reviews shortlist report analyses how consumers discover current account providers, how they make a shortlist of brands to investigate further, and how they make their final selection. Global Reviews asked respondents to research for a personal current account in exactly the way they would in real-life. They visited a variety of sites, with 87 per cent per cent using search sites, 81 per cent per cent visiting provider websites and 55 per cent visiting comparison websites.The research showed that, on average, UK consumers spend around 4 hours researching a new current account, over a period of a week. Most (73 per cent per cent) of consumers did three quarters of their research online.

When respondents were asked about their preferred current account providers – without being prompted on specific brands – the most popular choice was Lloyds TSB (68 per cent). This was followed by Barclays (63 per cent per cent), NatWest (57 per cent per cent) , HSBC (52 per cent per cent) and Santander (50 per cent). Some 60 per cent of respondents already had a preference for a current account provider before they started the research; 15 per cent of this group preferred Lloyds TSB, 14 per cent preferred NatWest or Halifax, and 12 per cent preferred Santander. Barclays captured just 7 per cent of pre-research preferences, behind The Co-operative Bank and Nationwide as well as the above-mentioned brands. The most popular reason given for this initial choice was brand; 60 per cent said they made their choice because it was a reputable brand, while 53 per cent had used the brand before, and 52 per cent said they trusted the provider.

Comparison sitesThe leading comparison site was MoneySupermarket, with 30 per cent of respondents visiting it, double the percentage who visited the next most visited site, Money Saving Expert. The three most visited brand sites were Halifax (32 per cent), Barclays (31 per cent) and Lloyds TSB (30 per cent). There were interesting findings on the use of search engines too. A total of 45 per cent of search engine users said they used one because they do so out of habit, while 42 per cent said they wanted to see if providers were promoting good deals. In addition, 46 per cent of search engine users used generic terms such as “best current account”, whilst 54 per cent searched for specific brands.

Shortlisting behavioursBy shortlist, we mean a list of around three brands that respondents intended to look at more closely before their final decision. Halifax was the most successful at the shortlist stage, despite a poor showing in terms of unprompted awareness (just 47 per cent of respondents mentioned them unprompted). Yet 32 per cent visited the Halifax site and 35 per cent put them on their shortlist. This contrasts with Lloyds TSB, which despite a high level of 68 per cent unprompted awareness, only attracted 30 per cent to the Lloyds TSB website with just 28 per cent putting Lloyds TSB on their shortlist. The top three shortlisted brands? They were Halifax (shortlisted by 35 per cent of users), Santander (31 per cent) and Lloyds TSB and Nationwide, both 28 per cent. The top three reasons for these shortlist choices were availability of online banking (53 per cent), good deals/offers (49 per cent) and familiarity with brand names (48 per cent).For those who shortlisted Halifax, good deals/offers and online banking were the top considerations. Those who shortlisted Lloyds TSB said familiarity with the brand was the top reason. While Barclays is widely known, just 18 per cent of respondents shortlisted the brand, suggesting it might be failing to communicate its product offering or online banking clearly. Just 58 per cent of users who first visited the Barclays website shortlisted the brand, a smaller percentage than all others. When respondents were asked about what they thought were the most important elements of a bank’s website during their research, the two most important features were information about fees/charges and the ability to manage the account online. The role of comparison sites and search results in putting brands on shortlist is very strong. In the case of several brands (including Santander, Nationwide and The Co-operative Bank) more respondents put them on their shortlist than visited the bank’s website. This may be the result of pre-research preferences. Or, in the case of The Co-operative Bank, it may be that respondents encountered branding on search pages or comparison pages. For example, 22 per cent of respondents shortlisted The Co-operative Bank, even though only 13 per cent either visited the bank’s website or named it as their pre-research preference. This suggests that 9 per cent of respondents decided to shortlist the brand as a result of comparison site content.

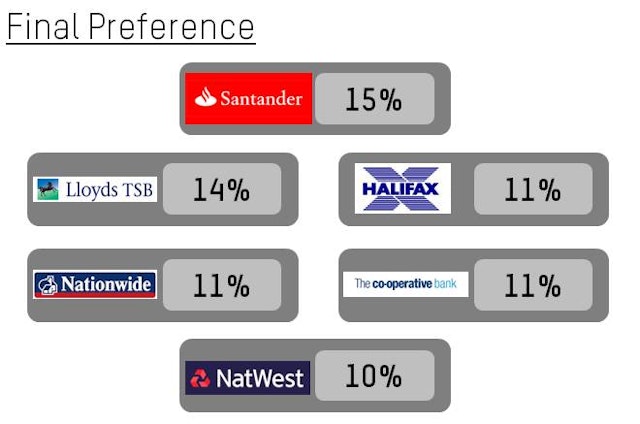

Final PreferencesIn terms of final preference, Santander (15 per cent of respondents) narrowly beat Lloyds TSB (14 per cent). Halifax, Nationwide and The Co-operative Bank got 11 per cent each, closely followed by NatWest at 10 per cent, and Barclays as well as First Direct each with 8 per cent.

The top reasons behind final decisions were online banking (cited by 55 per cent), familiarity with brand names (52 per cent) and good reputation (49 per cent). The sixth most popular reason was good deals/offers, with 31 per cent of respondents mentioning this. Reasons for final preference differed widely. For example, 80 per cent of those who chose First Direct cited the bank’s good reputation as a reason for the decision, though only 32 per cent of those who chose Halifax were motivated by good reputation. Halifax loyalists were more likely to be swayed by good deals/offers (59 per cent of those who chose Halifax said this was the reason for their choice). Yet 60 per cent of those who chose First Direct cited good service as a factor, while only 17 per cent of those who selected Santander were swayed by this. Those who chose Santander were more motivated by familiarity with the brand and online banking. So what does this mean for current account providers? It underlines the powerful influence of external websites on shortlisting behaviours: comparison sites and search certainly helped to promote brands to the shortlist stage. It showed too that the bank brand’s own website needs to communicate its key values and product strengths well.