Beauty and personal care e-commerce: How can brands optimize their online strategy?

The beauty and personal care e-commerce industry has taken off over the last few years, and things don’t appear to be slowing down, says Rachel Tipograph (founder and CEO, MikMak). With most brands having to adapt and optimize their online sales and marketing strategies to ensure they’re meeting consumer demand, here are the key things that brands must consider.

As one of the largest national markets in Europe for beauty and personal care, online sales in the UK are projected to contribute 44.2% of the total revenue in the market by 2023. It’s crucial for brands to tap into the data available to them to ensure they’re one step ahead of the competition.

Here are three ways for brands to effectively optimize their online strategies.

1. Uncover new paths to conversion in beauty marketing

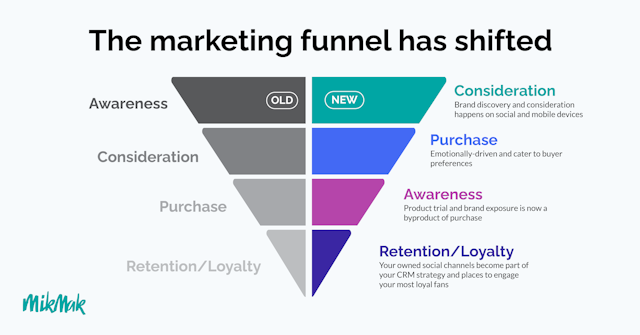

With the shift towards a digital society and data exchanges on social media platforms, the marketing funnel has changed considerably in recent years. It no longer starts with brand awareness, but with product discovery and consideration first. Brand building happens after the initial purchase. To drive conversion in e-commerce, brands must figure out what needs their product is meeting in the market, and how and where their target audiences engage with them.

In our 2023 Europe Beauty & Personal Care Benchmarks report, MikMak data reveals that Instagram is the leading social commerce channel in Germany, Italy and France for beauty and personal care products, whereas Facebook is the most popular amongst UK shoppers, with TikTok as a rising star.

According to the report, shoppers are using several social media platforms, so it’s important to use an e-commerce analytics platform like MikMak to test which combination works best with your different audiences and products, and to monitor purchase intent across all of these channels to identify the best approach to drive growth and consumer engagement.

2. Adapt your timing for optimal beauty and personal care e-commerce impact

What about timing? For beauty brands, the end-of-year festive season is crucial for e-commerce. Across Europe, MikMak data shows that holiday shopping starts to pick up from October and then intensifies in November to peak in December. UK beauty and personal care e-commerce consumers favor Tuesdays and Sundays for shopping.

Special promotions for key dates like Black Friday, Valentine’s Day, Mother’s Day and Father’s Day drive purchases. Identifying the best times to reach out to your audience for these sales opportunities allows you to make your campaigns more effective. In most cases, the optimum time for event-driven shopping occasions is two weeks prior to the celebration date, where multiple demand peaks are expected to occur.

3. Create a seamless customer experience

However, good timing is not enough to succeed in the competitive world of e-commerce. When consumers embark on their shopping journey for any given product, whether that be on social media or your website, it’s crucial that they can easily find and buy the product right there and then. If you fail to lead the consumer to retailers with available stock, they will most likely opt for a competitor’s product. This can also happen if you don’t provide flexible shopping options corresponding to your audience's shopping preferences.

This year, MikMak data shows that mass merchant and specialized retailers are UK shoppers’ top choices for beauty and personal care purchases, with Boots beating Amazon as the retailer of choice for beauty (21.4% against 11.7% share of purchase intent) and personal care (22.6% against 21.2%). Advertising on a range of channels and ensuring your products are available at various specialized and mass merchant retailers like Boots and Amazon, can help to position your brand as the go-to brand for beauty and personal care consumers.

With the right insights into shopper preferences and online engagement, beauty and personal care brands can better design and optimize their marketing and e-commerce approach to drive more sales.

Check if your strategy matches with the current shopping trends in our 2023 Beauty & Personal Care Benchmarks and Insights report.

Content by The Drum Network member:

MikMak

MikMak is a global software company that provides the leading e-commerce enablement and analytics platform for multichannel brands, helping them to better convert...

Find out more