It’s ‘transition time’ for consumers, so how are grocers faring in the UK?

It's important to note that right now is a transitory time, with trends changing monthly as new government rules come into place, consumers are experiencing a transitional period into what's now becoming ‘normal’. That being said, Blis’ data shows a few trends over the last few months that are worth brands taking note of.

It’s ‘transition time’ for consumers, so how are Grocers fairing in the UK?

Convenience is no longer the most convenient

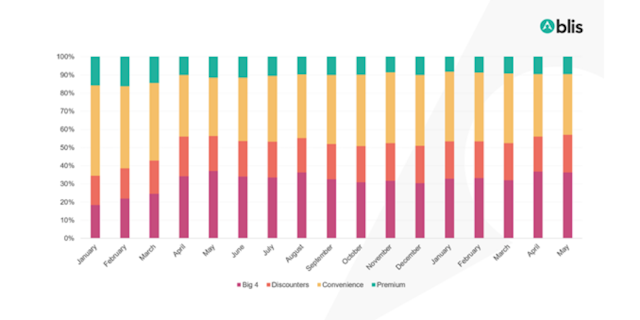

As lockdown restrictions are easing across the UK, we’ve seen a slight change in winners and losers in terms of share of footfall, in the last two months. The Big Four have stayed fairly consistent in terms of share, whereas convenience stores have lost footfall to other sectors. Discounters, and to a lesser extent premium stores, have gained share of footfall, especially in May. It could be the case that with the return of shoppers to high streets and their old habits and jobs, convenience stores are no longer their only option for quick and easy food.

Convenience formats are once again competing for shoppers with premium and discount stores, and shoppers that had been shopping at convenience stores may now have reverted back to the stores they used to shop at. It's also possible that convenience stores are losing out to stores outside of their immediate competitor set – for example, QSR visitation has been increasing over the last few weeks as well. Instead of going to convenience stores for food on the go, consumers could be trying different QSRs instead.

Consumers are becoming less loyal...

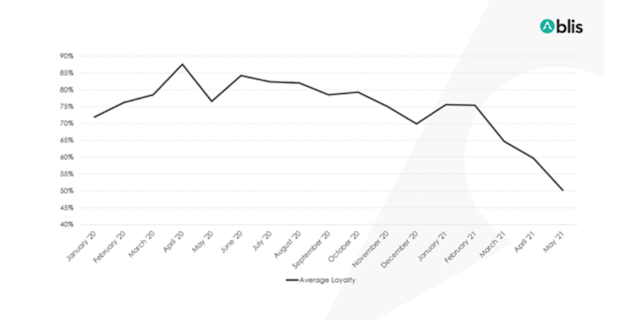

In terms of loyalty, we've seen a large decrease in store exclusivity in the last few months. This is prone to change, and loyalty does rise and fall slightly, but since mid-March it has been consistently below the pre-Covid baseline of January 2020. Up until this point, loyalty had been much higher than our baseline. The Big Four have had the highest loyalty since we began measuring last year, however in the last two months convenience stores have rivalled them for the top spot. Or are

Or are the 'early adopters' becoming more promiscuous?

It is possible that lack of loyalty could represent an increase in our 'early adopters' - groups of shoppers who are quick to return to their pre-Covid behaviour. As consumers are being less loyal and shopping about more, and the Big Four are losing their high loyalty, it suggests that fewer people are sticking to one large store for all their shopping as they had done during covid. This suggests a trend of moving away from the more restricted shopping habits we developed during lockdown, and towards more spontaneous and promiscuous behaviour.

Looking ahead

It seems that consumers' behaviour is beginning to return to 'normal' – probably as a result of everything being open and being able to socialise again – but it's too soon to tell if this will last. However, with the summer months approaching, in-door dining opening up and school holidays about to start – unless we encounter another lockdown – we can be hopeful that this ‘new normal’ is here to stay.

Emma Howes, insight executive UK at Blis

Content by The Drum Network member:

Blis

Blis is an omnichannel advertising platform like no other. We allow planners to plan, buy and measure high-performing audiences without relying on IDs, helping the...

Find out more