Can the maker of Echo Falls and Hardys wine mimic the marketing success of 19 Crimes?

Accolade Wines, the maker of Hardys and Echo Falls, has ambitious plans to shake up the wine category in its quest to attract a new generation of drinkers.

How to break through the 'wall of wine'

The wine industry has a generational challenge on its hands and could be at risk of losing relevancy if brands don’t inject more energy. The warning came from Accolade Wines marketing director Tom Smith as he set out the group’s blueprint for category growth.

“We’re not going to recruit new people to the category just by talking about vintages and chateaus that exist in France,” Smith says.

Advertisement

Smith, who previously worked for Asahi and Red Bull, says he’s fed up with losing out to beer and spirits and wine being seen as a “boring category” that sits on the side.

“I want consumers to start thinking differently about wine. The success of this category isn’t going to be built by doing the same things that it’s always done. It has to evolve, it has to move on and start behaving in a different way,” Smith urges. “This category is way too important and way too fun to fizzle out because it’s not getting enough energy.”

The ‘wall of wine’ in supermarkets is where consumers feel most overwhelmed by the number of brands available and is where brand marketing has the biggest role to play. It should be an easy win for the biggest brands in Accolade’s portfolio. A 2023 report by The Grocer listed Hardys as the fifth biggest alcohol brand in the UK, above Jack Daniels and Fosters, suggesting the value of having a well-known brand in a category where people feel inexperienced.

But the so-called ‘wall of wine’ has had one key disruptor in the past few years – 19 Crimes. Owned by rival Australian wine group Treasury Wine Estates, it changed the game in 2018 by launching an edgier wine bottle and partnering with Snoop Dog. Sales of 19 Crimes went from four million on its release to 18 million bottles in just 18 months.

Advertisement

The brand is still pushing the wine-marketing boundaries. Earlier this year, it released a “gritty" campaign that commanded its biggest spend to date. And just last week, it forged a partnership with entertainment giant Universal to release two limited-edition wines themed after classic horror monsters Dracula and Frankenstein’s Monster. Sporting a glow-in-the-dark label, the bottle also had a QR code that took people to a horror-themed AR experience.

Accolade wants to replicate that success with a marketing overhaul across its own suite of brands.

‘Blueprint for growth’

In a bid to “bring new news to a category that doesn’t have a lot of new news”, Smith set out Accolade’s ‘blueprint for growth.' The plans include major above-the-line investments, the launch of new wine brands, and the rollout of more sustainable boxed wine.

Following a consumer survey of over 3,500 wine and non-wine drinkers, it’s established the reasons why people drink wine. Now, its brand marketing teams have to deliver against one of those reasons.

“This underwrites all brand planning,” Smith says. “We are working very hard to try and make wine relevant for as many people and as many different places as possible, which is what the category needs.”

Suggested newsletters for you

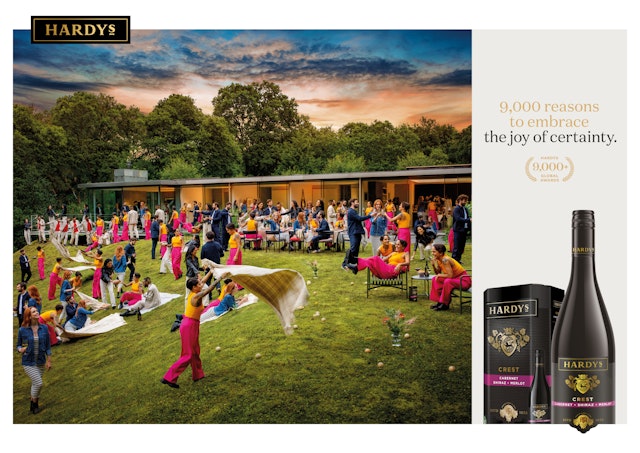

Take the group’s most popular brand, Hardys, for example. It’s undergoing a marketing refresh, with the help of creative agency Above+Beyond, that shifts from product-focused ads to more inspirational and style-led campaigns. It kicked off this new strategy with a £3m TV advertising investment from Yonder Media in March and has continued in its second campaign set at a party set in a trendy Australian home.

Smith says to expect some “large scale” campaigns from Accolade’s brands in the coming year. He acknowledged that wine “doesn’t have the deep pockets” compared with others in the alcohol category.

“But we have to, as a business, invest in big above-the-line campaigns on the right brands when we’re trying to drive different parts of the consumption funnel.”

Jam Shed will also be a key focus. With a ‘jammier’ flavor more palatable to non-wine drinkers, Smith says the brand “helps people understand the category.” In 2022 Jam Shed delivered £17.3m increase in sales – more than double that of 19 Crimes.

Meanwhile, Echo Falls is well positioned to capture younger drinkers and non-wine drinkers with its fruit and lower-proof products. To tap into next-gen drinkers, Echo Falls will be releasing new products inspired by popular fruit flavors. The marketing also leans heavily into TikTok and social as well as borrowing from the Barbie movie playbook by encouraging Echo Falls fans to take selfies with the marketing.

“Quite frankly, not all of this will work, and we know that, but it’s important to throw new stuff at the category and engage younger consumers and make sure not all the fun is being had in beer and spirits,” Smith says.