Big Oil’s green PR disproportionate to its investment, finds research

Oil and gas companies are spending around $750m each year cumulatively on climate-related communications – but only 12% of their average capital expenditure goes on low carbon investments, according to a report by climate think tank InfluenceMap.

The biggest divergence between ‘green’ claims and ‘low carbon’ capex was by Shell, followed by ExxonMobil / Image via Pexels

The research, which analyzed communications from the five big oil companies during 2021, found that 60% of the public messages from BP, Shell, Chevron, ExxonMobil and TotalEnergies contain ‘green’ claims, and 23% promote oil and gas.

Yet the same companies are forecast to spend a relatively small fraction (12% on average) of their capital expenditure budgets on ‘low carbon’ investments this year.

It also conservatively estimates that these five companies combined spent at least $750m on climate-related messaging (including both ‘green’ claims and pro-oil messaging) during 2021, although the real figure is likely to be significantly higher because this calculation does not include the cost of external advertising or PR agencies.

Advertisement

The report concludes there is a “systematic misalignment” between the business models and lobbying activities of oil’s big players when compared with their public relations strategies, and highlights that several of these companies are forecast to expand oil and gas production through to 2026.

The study was conducted by climate think tank InfluenceMap. Its program manager Faye Holder said: “The world’s big oil and gas companies are spending huge amounts of time and money talking up their ‘green’ credentials, while their business investments and lobbying activities tell a very different story.

“These companies talk about cutting emissions and transitioning the energy mix, but at the same time continue to invest heavily in new fossil fuels.

“While this PR strategy might convince some people, it doesn’t change the fact that these companies are out of step with science-based pathways to net zero.”

Advertisement

Big Oil’s ‘green’ PR strategy

The research analyzed 3,421 individual evidence items of public communication from the big oil giants during 2021. This included company and chief executive social media accounts, press releases, speeches and secondary websites intended for outreach purposes.

It then categorized each item based on its narrative, noting that some items contained multiple messages (for example, both ‘green’ and pro-oil claims).

Overall, the report shows 60% of public messages contained at least one ‘green’ claim, such as emissions reduction targets, transitioning the energy mix or promoting fossil gas as part of a clean energy solution.

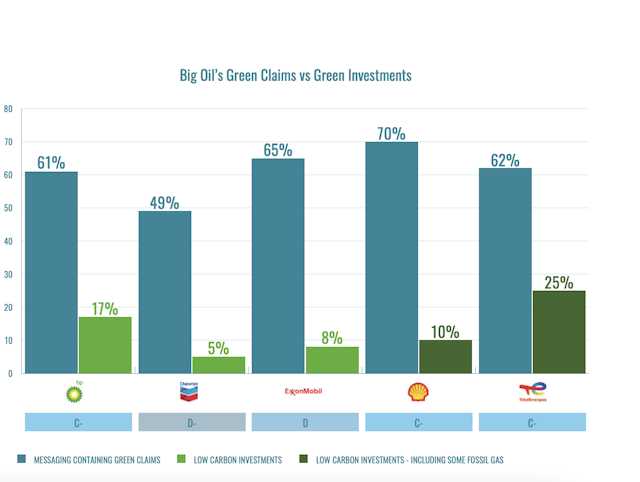

However, there were significant differences between the five supermajors, with 70% of Shell’s public messages containing at least one ‘green’ claim, compared with 49% of Chevron’s.

Suggested newsletters for you

By further analyzing the types of ‘green’ claims, the research shows the three European-based supermajors – Shell, BP, and TotalEnergies – focused more on energy transition claims than their US-based competitors. This in effect presented them as broad energy companies.

ExxonMobil, by comparison, focused most of its public messaging on emissions reductions, suggesting its strategy is to present itself as a ‘low emission’ oil and gas producer.

Chevron appears less concerned about promoting its climate credentials than the other four companies – it used more pro-oil and gas messages (37%) than any of its competitors.

PR versus investments

Big Oil’s ‘green’-focused public communications strategies contrast with its investment in ‘low carbon’ activities.

Based on public disclosures, the five companies analyzed as part of this research are forecast to spend just 12% of their capital expenditure (capex) budgets on ‘low carbon’ activities in 2022.

Furthermore, some of these ‘low carbon’ activities are likely to include fossil fuel investments, given both TotalEnergies and Shell include fossil gas-related investments in their ‘low carbon’ capex outlook.

As a result, the report finds: “It is therefore likely that the disparity in spending on fossil fuel-related investments as compared to zero-emission technologies is even greater” than publicly disclosed.

The biggest divergence between ‘green’ claims and ‘low carbon’ capex was by Shell, followed by ExxonMobil.

Pro-fossil fuel lobbying

None of the companies assessed by InfluenceMap have aligned their climate policy engagement activities with the goals of the Paris Agreement. Shell, TotalEnergies and BP rank a ‘C-’ on InfluenceMap’s A-to-F scale, indicating mixed support. ExxonMobil and Chevron rank a ‘D’ and ‘D-’ respectively, indicating broad opposition to Paris-aligned climate policy.

And none of the oil majors have lobbied to strengthen the stringency of methane emissions reduction regulations since 2021, despite the importance of methane mitigation being a key claim from the industry.

Furthermore, InfluenceMap says each company retains memberships to a dense network of industry groups that are actively engaged in blocking or watering down climate policy.