‘Return to mean?’: Alphabet joins tech companies reporting profits slump

Google’s parent company Alphabet has released its Q2 results, joining the list of tech companies that have underperformed against expectations. It recorded around $16bn in profit during Q2, down from $18.5bn year-on-year.

The results pour more cold water on tech companies’ short-term advertising / The Drum

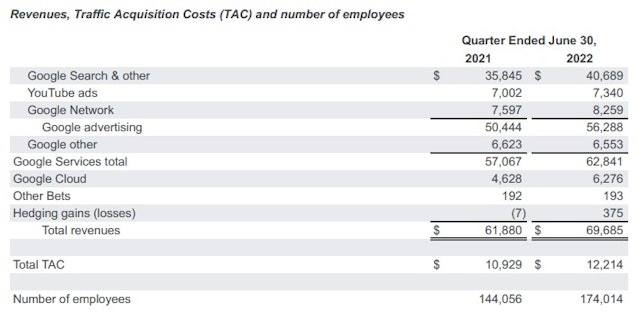

Google delivered a 13% increase in revenue over the same period in 2021, and its products all tell different stories. Search and YouTube ad revenue all increased over the same period in 2021. However, they were all outpaced in terms of growth by Google’s Cloud solutions. It remains one of the strongest-performing platforms on the ad market by exhibiting modest growth.

Growth in revenue for YouTube, however, has slowed. It speaks to the warnings from Google execs and those of the heads of its rivals at Meta and TikTok about an overall slowdown in advertising spend.

In the release, Sundar Pichai, chief executive of Alphabet and Google, said: “In the second quarter our performance was driven by Search and Cloud. The investments we’ve made over the years in AI and computing are helping to make our services particularly valuable for consumers, and highly effective for businesses of all sizes. As we sharpen our focus, we’ll continue to invest responsibly in deep computer science for the long-term.”

Speaking of the results, co-founder and chief operating officer of BrightBid Gustav Westman said: “The Google Adwords search product continues to generate strong revenues for the company, and this hyper-targeted advertising channel will continue to be critical to help other businesses grow as they navigate the darkening economic outlook.”

Liam Patterson, chief executive officer of Bidnamic, believes that the results demonstrate a regression to the mean following outsized performance during the pandemic: “E-commerce is one of the biggest revenue drivers for Google’s advertising services and Alphabet’s overall revenue.

“Following the explosion of online retail during the pandemic, it’s no surprise that the results do not reflect the growth seen in the previous quarter. As inflation continues, retailers are struggling with extra costs – including stock pricing and shipping costs – while consumers are spending less, so we’re seeing a downturn in ad spend, which has had an impact on Alphabet’s results.”

According to the results, it appears that Google’s overall drop in profits can be attributed in part to an overall increase in headcount – from around 144,000 employees to 174,000 over the course of the year. That’s been addressed with a hiring freeze.

The future of e-commerce and ads

Looking ahead, Google’s dominance in the market still provides it with a number of advantages that its competitors cannot easily replicate. Scott Sullivan, chief revenue officer at Adswerve, explains: “Google’s earnings showcase that the tech company still has much to offer this year, despite an increasingly competitive market. As economic growth slows for the tech industry, Google has shifted its focus toward areas where the company can be sharper and hone in on securing its newest updates to be compatible with consumer privacy and personalization needs.

“As some anticipate an e-commerce slowdown, Google can take advantage of the opportunity to emphasize first-party data and personalization strategies to retailers looking to grab the attention of valuable consumers and stand out among the competition for ad space.”

However, Alphabet is also facing the threat of antitrust legislation in the US. The Department of Justice has rejected the company’s proposal to split its buy and sell sides up between Google and the parent company. That would have in theory opened its advertising ecosystem up to third parties – though it is unclear whether that would have worked in practice.