Rebecca Jennings, senior client advisor at international benchmarking firm Global Reviews, provides a snapshot from a recent survey into how consumers make decisions when seeking a mortgage provider.

How do consumers discover brands when looking for a new mortgage provider? Then what prompts them regarding which brands to shortlist? And how do they make their final selection. The Global Reviews UK Mortgages Shortlist Report examines how users behave at each step of the journey. It also highlights where financial services brands are losing potential customers – and why.

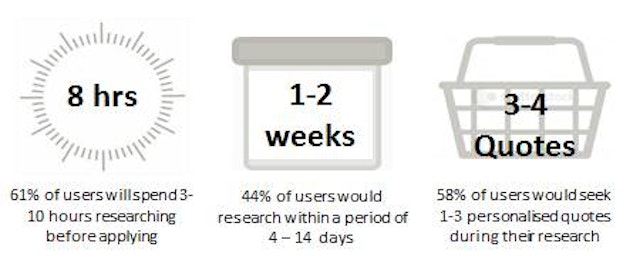

Consumer work hard on their searchUsers were asked to undertake research for a mortgage for themselves, doing whatever they would do if it were a real-life situation, but stopping short of completing a formal application. On average, UK consumers spend around an average of eight hours researching a new mortgage provider, over a period of a week or two, with most (58 per cent per cent) of consumers doing over three quarters of their research online. They typically get three or four personalised quotations from different brands before making a final decision.

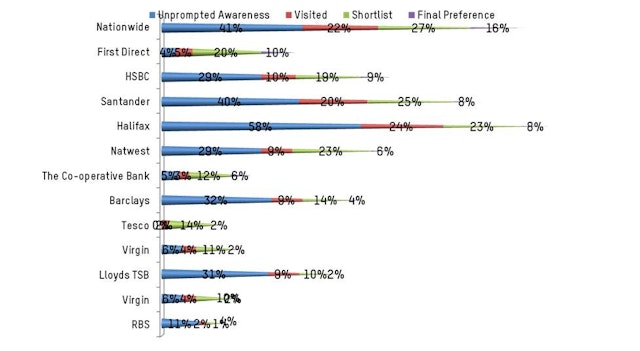

The brand users mentioned most as a mortgage provider – unprompted – was Halifax, with 58 per cent mentioning them, followed by Nationwide (41 per cent), Santander (40 per cent) and Barclays (32 per cent). When prompted, recognition levels shot up and the most recognised brands were Halifax (94 per cent), Santander and NatWest (both 93 per cent).Some 50 per cent of users already had a prior preference for a provider going into the research; 25 per cent of this group preferred Nationwide, 13 per cent preferred Halifax, and 10 per cent preferred Santander. Interestingly, major brand Barclays gathered no pre-research preferences.

The most popular reason given for prior preference was previous experience. A total of 64 per cent said they selected their choice because they had used the brand before, and 56 per cent said they were influenced by their trust in the provider. Brand was also a factor with 51 per cent saying they were influenced by the brand’s good reputation. At this point in the process, very few people (7 per cent) said they were influenced by recommendations from others.

Which research channels do people like?The report showed that people visited a wide variety of sites, with 45 per cent using search sites, 57 per cent visiting provider websites and 70 per cent visiting comparison websites. Around 7 per cent visited broker sites such as John Charcol.The leading comparison site was MoneySupermarket, with 48 per cent of users visiting it, more than treble the percentage of the next most popular site, Money Savings Expert (15 per cent). The three most visited “brand sites” were Halifax (24 per cent of users visited them), Nationwide (22 per cent) and Santander (20 per cent).

Does brand awareness get you onto the shortlist?Brand is only part of the picture. At the shortlist stage, Nationwide was most successful, with 27 per cent of consumers placing them on their shortlist. This was closely followed by Santander (25 per cent) and both Halifax and NatWest with 23 per cent. The top three reasons for shortlist choices were availability of good rates, familiarity with brand names, and good reputations. When asked the reasons for their shortlist choices, a third of respondents who chose Nationwide said the website helped them chose products quickly. But this was the case for just 17 per cent of those who shortlisted NatWest.Despite Barclays being a well-known financial services provider, just 14 per cent of consumers would put them on their shortlist, suggesting that the brand has not managed to communicate either its product or service offering sufficiently well either through it’s own site or through comparison sites.

Comparison sites at the shortlist stageComparison sites and search results play a very strong role in putting brands on shortlists in this market. In the case of many brands (including Nationwide, Santander and NatWest), more consumers put them on their shortlist than visited their sites. In some cases this may be to do with pre-research preferences, but in many cases (such as First Direct) it is more likely to be the result of users being exposed to brand information on search pages or across comparison pages. For example, First Direct was shortlisted by 20 per cent of users, even though only 4 per cent recalled the brand unprompted, 5 per cent of users visited it and just 1 per cent placed it as their pre-research preference. This suggests that around 15 per cent of users were prompted to place it on their shortlist because they used search engines or comparison sites.

Nationwide is the top final preferenceIn terms of final preference, Nationwide (16 per cent of users chose them) were the clear leaders, with second placed First Direct attracting 10 per cent of final preferences, closely followed by HSBC with 9 per cent. Overall, the top reasons for the final preference were trust in the provider (cited by 49 per cent), the best deal for consumer’s needs (48 per cent) and good brand reputation (46 per cent). The reasons for making a final preference differed widely across brands. For example, 71 per cent of those who chose First Direct cited their deals as one of the reasons for the choice, compared to 28 per cent for Nationwide. For Nationwide, people were more influenced by the brand’s reputation, with 72 per cent citing this as an influence. The success story in the shortlist process is clearly First Direct, who managed to convert a very low (4 per cent) unprompted awareness into 10 per cent of users making them their final choice. Conversely, Halifax appear to perform poorly when it comes to converting consumers; yes they had the highest unprompted awareness at 58 per cent, yet finally convinced just 8 per cent of users to pick a Halifax product. The majority of those who did choose Halifax had previously used the brand, suggesting Halifax have a small group of loyal consumers but are failing to convert newcomers: just a quarter of those who visited the site chose the brand as their final preference.

The Mortgage Provider’s ShortlistSo what does this mean for mortgage providers? First, it reinforces the power of external sites on a consumer’s behaviour when making a shortlist, with both comparison site and search results being successful in promoting brands to shortlist stage on their own. Second, the brand’s own website needs to immediately communicate its key values and product strengths. If a prospective customer can’t see what products you are selling that might suit them, they will go elsewhere.

This article is the third in a series exploring consumer attitudes to financial brands, including a look at how consumers discover credit cards and the online experience for consumers seeking a new current account provider.