We calculated the Amazon Advertising iROAS across 16 brands and used these insights to develop tailored strategies, eliminating revenue cannibalisation and increasing iROAS and revenue

Mars Petcare is a global manufacturer of pet food and provider of animal care services. They do not have an ecommerce site and instead use global platforms like Amazon to sell their products and brands.

Many of Mars Petcare’s brands have a strong organic presence on Amazon in the UK and we believed that revenue cannibalisation was occurring for traffic they would have received for free.

Determining how much cannibalisation was occurring, and where, would allow us to tailor the Amazon Advertising strategy to achieve optimal sales without paying for traffic they would achieve organically, making better use of their budget and increasing overall revenue.

Identifying incremental return on ad spend (iROAS)

Calculating the incremental return on ad spend (iROAS) allowed us to determine how much revenue Mars Petcare would make if they did not run Amazon ads, meaning we could measure how much cannibalisation was occurring. iROAS is also a better way of showing the true value of paid ads, making it a better metric for reports.

We had access to Mars’ historical paid and organic Amazon data for 700 products across 16 brands. However, this data looked at a period when both channels were ‘competing’ – we needed to see how organic revenue performed without paid advertising over a significant period of time without compromising overall revenue.

We suspended all paid activity for two weeks to identify true organic performance and then measured how much organic revenue was lost when paid advertising was resumed by subtracting actual organic revenue from the two-week test organic revenue.

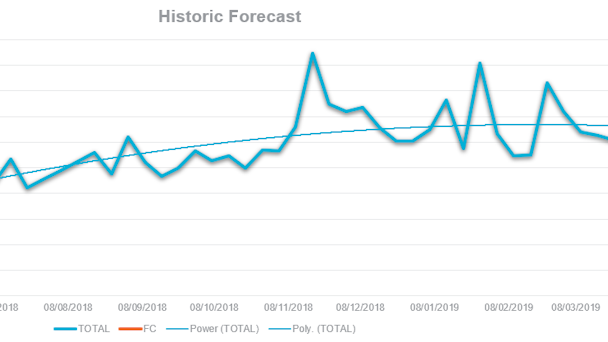

We needed to forecast what organic revenue would look like without paid activity over a longer period than the two weeks tested. We ran a forecast model on 14 months of historical organic revenue data at a product level (to understand seasonality and growth) and the test period to forecast revenue. The model we chose uses a form of time series decomposition called Holt-Winters exponential smoothing to produce forecast values based on historical patterns. Both long-term trend, seasonality and recency of data are used to inform the forecast.

This chart shows a test of the forecast model. The blue line shows organic revenue over time. This data was used to predict the final values shown by the orange line to determine how accurate the model’s predictions were. Although the test did not project the drop in actual revenue (shown by the last three points in blue), it was determined this was due to a number of significant peaks and troughs in the revenue which are not seasonal and are therefore hard to predict to an exact amount. Despite this, the model’s projection closely follows the long-term trends and is suitable for use.

Once the forecast model was established, we ran separate forecasts for each Amazon Standard Identification Number (ASIN) and combined these to produce a singular forecast. The individual ASIN data is noisier, with larger peaks and troughs and movement over time. Forecasts at this individual level could be heavily influenced by recent fluctuations, but the Holt-Winters model smooths out this noise and we can see that the aggregated values cohere tidily to the long-term trend.

What we found

We looked at the following metrics over a four-week comparison period, calculating each metric at a product level and allowing for aggregation by brand and overall:

Actual organic revenuePredicted organic revenue (without the effect of paid)Lost organic revenue (predicted organic minus actual organic)Paid revenueIncremental paid revenue (additional paid revenue over and above the amount lost from organic)Incremental proportion percentage.

The data determined that 46% of paid revenue was incremental paid revenue, while 54% would have gone to organic listings if paid ads were not active – meaning the ROI for the paid activity was under half of what had been previously reported. This figure varied significantly across products and brands.

Adjusting the Amazon Advertising strategy

The incremental return on advertising spend (iROAS) data identified several brands where natural search was more valuable than ad traffic due to high organic presence. For these brands, we turned off or reduced defensive campaigns and split the remaining budget between generic, auto and competitor campaigns, tailoring the mix depending on each brand’s historical performance.

We were also able to identify brands where having defensive campaigns is justifiable as there is little to no lost organic revenue due to limited organic visibility.

Results

Tailoring the paid strategy for each brand using these insights has led to an 11.26% increase in iROAS across all brands, and overall revenue (organic and paid) increase by 45%.