Black Friday in a cost of living crisis: do consumers still want to shop?

Alexandra Sheppard of digital agency Roast, part of the Tipi Group, looks at the current data and recent history to figure out who will be spending on what this Black Friday.

Will Black Friday in 2022 look different from the ones we’ve seen before? / Carl Raw via Unsplash

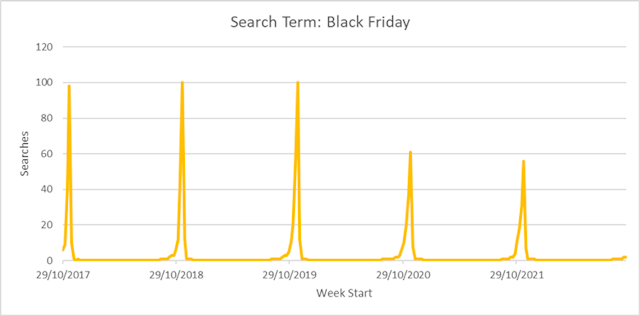

As we move into a peak season like no other, attitudes to Black Friday and Cyber Monday are harder to predict than ever. In line with ever-increasing economic uncertainty, initial attitudes to Black Friday are dubious; but Black Friday search interest is gathering pace.

In the UK, interest peaked in 2019, followed by the disruption of Covid-19 and growing skepticism about the event’s value. Is 2022 going to be the year we see the big drop, or will we see a post-Covid resurgence?

Image: GWI September 2022 Zeitgeist: Black Friday Shopping, Number of Responses: 2,207

Facing one battle after another, retailers in 2021 had to contend with conservative spending habits and people trying to avoid Covid ahead of Christmas. YouGov reports that there was very little variation regarding what shoppers predicted they would purchase and what they went on to purchase: 9.99% predicted they would purchase clothes/shoes and 10.78% went on to purchase these. Similarly, 6.58% predicted they would make purchases in the health and beauty sector; 6.60% did.

The little difference in intended v actualized purchases suggests that in 2021’s uncertain economic situation, consumers researched deals and products, then followed through. Black Friday will always attract bargain-hunting thrill seekers, but 2021 saw the start of savvier shopping, and we expect this trend to continue this year. While consumer behavior across the pandemic and into 2021 proved invaluable for the growth in e-commerce, it created questions of whether Black Friday genuinely provides shoppers with good value for money.

Advertisement

The data: who’s shopping for what?

Survey results from GWI’s Black Friday 2022 Zeitgeist platform reveal that 45% of consumers are not expecting to shop at all this Black Friday. As we would expect with greater skepticism around the ethics and value of Black Friday, as well as increased financial concerns, 45-64-year-olds are the most likely not to shop.

16-24-year-olds are looking to take advantage of Black Friday deals for gifts, with 43% looking to make purchases. This, however, does not mean they are without financial woes or skepticism; 24% plan to make no purchases at all.

Of those planning to shop this Black Friday, the cost of living crisis isn’t likely to deter many consumers from maintaining spend, with 45% looking to spend about the same amount as last year. With fewer financial priorities, 28% of 16-24-year-olds are looking to spend the same as last year; 16% believe they can spend a little more. Despite greater financial responsibilities than generation Z, 27% of 35-44-year-olds are planning on spending about the same as last year.

Looking at expected purchases, 21% of consumers are looking to use Black Friday offerings to buy Christmas gifts. This jumped since 2021, where just 4% planned to buy gifts across Black Friday. The cost of living crisis, for all its concerns and uncertainties, has cultivated a sense of selflessness and realigned purchasing priorities as we enter Black Friday this year.

Advertisement

Strategies to win

With an impending recession at the forefront of everyone’s mind (brands and consumers alike), approaches to Black Friday will differ. Financials are going to be a focus for brands. To ensure they can compete, we are likely to see smaller discounts while still maximizing brand advertising to drive awareness and consideration.

Despite the likelihood of smaller discounts across sectors, brand loyalty is going to be a key factor in purchasing. With customer sentiment seeing the largest sustained decline on PWC’s Consumer Sentiment Survey since the 2008 global financial crisis, and growing skepticism around Black Friday, consumers are going to rely on trusted brands to bring the best value and a positive user experience.

While the e-commerce landscape is vastly different now, attitudes to brand loyalty and spending during the 2008 financial crisis provide indications of consumer behavior in times of economic uncertainty. The lack of change between predicted and actual purchases in 2021 was mirrored in 2008. In periods when consumers have less disposable income, they’re more likely to consider purchases in advance and discuss them with friends and family.

Suggested newsletters for you

Discounts are important to consumers; during that tricky financial period, sales remained consistent for some retailers due to promotions, boding well for retailers during Black Friday. Brand loyalty is not about price, making Black Friday a test as to whether loyalty can outweigh discounts. For brands looking to capitalize on any wavering brand loyalty, consumers will be willing to move away from brands they’re familiar with if the social cues are right. Authority bias in the form of recommendations as well as scarcity bias will also be crucial in driving consideration and purchase away from the regular brands.

A peak ahead

Peak season is already the most competitive and expensive period of the year for both consumers and brands. We’re heading in a direction of growing uncertainty and – despite opportunities to succeed – brands need to be prepared for the fact that Black Friday is going to be different this year.

Initial searches show that increasing doubt around Black Friday deals is going to continue. Those who can’t resist the allure of discounts are going to think more carefully about their purchases, carrying out research beforehand to ensure they’re getting the best deal and value for money. Brand loyalty is going to undergo a test. Periods of uncertainty may increase brand loyalty, but deals and core social cues can always draw consumers away from the brands they love.

Content by The Drum Network member:

TIPi Group

TIPi Group is an award winning network of specialist digital agencies. Our agencies are built on performance and profitability and share an ambition to use the power...

Find out more