‘Crypto influencers’ getting paid in dollars reveals the industry’s sleaziness

Cryptocurrencies started to gain popularity long before last week’s release of a ‘shill price list’ for influencer promotion. In his new column, Samuel Scott looks at the history of crypto marketing and interviews people including Brian Shuster, who invented pop-up banner ads in the 1990s before later creating the Utherverse metaverse platform and a planned Uther Coin.

What is Bitcoin really worth?

During the Great Depression in the 1930s, many people no longer trusted banks and buried their savings in the ground. After the Great Recession in the late 2000s, some felt the same way and bought Bitcoin. Time will tell if there is any difference.

Roughly 2,000 years ago, Publilius Syrus wrote in ancient Rome that “everything is worth what its purchaser will pay for it.” Cryptocurrency enthusiasts use such statements to prove that those such as Bitcoin have real value – if people buy and use them – compared to government-issued ‘fiat’ currencies that are supposedly not ‘backed’ by anything.

Of course, Syrus was correct on a basic level. But the crypto community forgets the reason that the demand for US dollars is so high throughout the world.

According to the US Federal Reserve, the bulk of global dollar reserves – most foreign currency holdings in the world are in US dollars – are in the form of US Treasury securities (Treasury Bills, Bonds and Notes). They have low interest rates and are seen as some of the safest investments. Why?

While the US dollar did leave the gold standard in 1971, the currency is still backed by the American government and the fact that it always pays its debts. That is the intrinsic value of the US dollar. Cryptocurrencies do not have anything like that. They are forms of gambling, not actual stable mediums of exchange.

Marketing, in part, is about communicating value to a target audience. Now, imagine doing that for something that literally has no value at all – at least at the beginning. That is cryptocurrency. Here is how it was done.

The goal: get more people to use it

First, there is nothing inherently wrong with convincing more people to buy or use something. That is part of marketing in general – the product, price, distribution and promotion all play roles. But one problem can be the promotion.

There is a spectrum ranging from gentle persuasion to tacky pushiness to subtle manipulation to intentional misinformation to outright fraud to organized crime. Somewhere in that sentence is the line between product hype and jail time – and the crypto world has done many of those things.

Crypto marketing, of course, aims to get more people to buy and use cryptocurrencies. As I wrote two months ago, NFTs, for example, are actually just ways to get more people to use cryptocurrency, and thereby increase the artificial money’s value.

Here is how currencies work.

Say that an Israeli high-tech startup here raises $10m in funding. The investment firm wires the money. To rent office space and pay salaries, the startup converts the dollars to shekels. Basically, it is selling off $10m at whatever price in shekels someone will pay for that amount. (The Bank of Israel does set a representative exchange rate each day.)

There are untold hundreds of high-tech Israeli startups that are raising money. That is a lot of dollars being sold off for shekels. Basically, the demand for dollars falls, and the demand for shekels increases.

That is why the ILS-USD exchange rate has changed from 1 ILS getting $0.21 in February 2006 to $0.31 today – a 48% increase. The shekel is strong because the demand for the currency is high. (And that is partly why the Israeli government could pay a lot in dollars for so many coronavirus vaccine doses as soon as they became available.)

The more that people buy and use cryptocurrencies – through NFT purchases or whatever else – the more that their values will increase in a similar way. And remember that the top 2% of Bitcoin accounts own 95% of the supply – meaning that a few rich people will become even richer as more people use it.

The claim: Bitcoin is the future

On October 31 2008 – right as the financial crisis was becoming very serious – ‘Satoshi Nakamoto’ published a paper detailing ‘his’ ‘Bitcoin,’ a “peer-to-peer version of electronic cash, would allow online payments to be sent directly from one party to another without going through a financial institution.” (The name is a pseudonym for a person or group of people who have remained unknown to this day.)

As the world economy started to return to normal over the next few years, some of the world’s most credible financial experts started to describe Bitcoin as the next big thing. (After, presumably, buying some.)

“Cryptocurrencies are unquestionably the next iteration of money, being a huge improvement over paper currency and coins,” Brian Shuster, the person who invented pop-up banner ads in the 1990s before later creating the Utherverse ‘metaverse’ platform and a planned Uther Coin, tells me in an interview.

“Crypto is here to stay and, like all transformative technology, it’s really best to understand it early before it becomes too late,” he adds. “My suggestion is to learn what a wallet is, how Bitcoin works and how you can buy it. This is an action toward educating yourself on what transactions will be like in the future. It is a small price to pay and it’s likely that this will put you at an advantage. Get in now, learn it now.”

But the tech and marketing worlds jump on bandwagons and always assume that whatever is new is the future and must be better. But here are just a few counterpoints:

The target: libertarian tech bros

The high-tech worlds in Silicon Valley and elsewhere are full of libertarian tech bros who love new technology and hate the government. (Basically, they want to run their private fiefdoms without any outside interference – especially while paying as little in taxes as possible.)

Bitcoin was the perfect encapsulation of both attitudes. When financial institutions are removed from transactions, so are regulations, oversight and taxation.

The 2008 financial crisis added fuel to their beliefs that government and banks cannot be trusted and that people should fend for themselves. (Remember: few, if any, people went to prison for causing the meltdown.) That explains the popular messaging of ‘decentralization.’

“If a currency is centralized, it means markets are manipulated,” Shuster argues. “Markets aren’t truly free markets. This creates investor and business uncertainty because at the end of the day, your investment can be completely made or broken based on unpredictable decisions of the central authority.

“This is what we have seen particularly egregiously since the 2008 financial crisis. You cannot base reliable investing on centralization when one person could change the entire scene in an instant. Essentially, a single person or group can make or break your investment when money is centralized.”

But ‘decentralized’ is just different messaging for ‘unregulated.’ And that leads to illegal activity. The US Secret Service reported last week that it has seized more than $100m in cryptocurrency in fraud-related investigations since 2015. Russia may also be using the digital currencies to evade financial sanctions over its invasion of Ukraine.

The fear: spread inflation panic

If this is one thing that rich people hate as much as taxes, it is inflation.

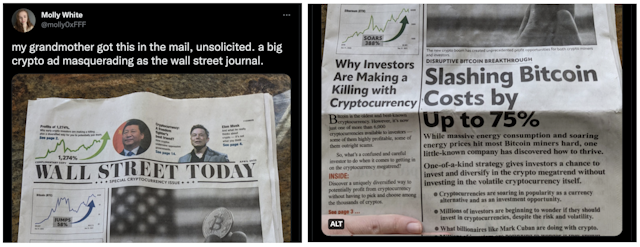

On right-wing TV news programs and websites, much of the advertising is for gold. The tactic is to scare people – especially the elderly – into believing that a financial catastrophe is coming and that governments will ‘print money’ and cause hyperinflation as a cure, thereby making their fortunes and savings worthless.

The only way to protect their money? Buying gold, of course – it supposedly ‘never loses value.’ For cryptocurrencies, the song remains the same.

“We live in inflationary times,” Hayley McCool Smith, marketing director of cryptocurrency infrastructure provider Wyre, tells me. “The cost of living is rising across the world due to geopolitical factors and fiscal spending. Inflation is one of the hottest topics in the media and for everyday consumers, as it affects their day-to-day lives and spending habits. The crypto ecosystem has been discussing inflation for years.”

“In the case of Bitcoin, there is a limited supply of 21m – no more can be created, printed or issued by a central entity,” she adds. “It is written into the code that there are only 21m and that code cannot be changed. Due to this limited supply, many commentators speculate that it is a deflationary asset.”

The crossover: get mainstream appeal

Getting a niche of libertarian tech bros to buy Bitcoin and other cryptocurrencies is one thing. But creating mass interest among everyday people is another. How did they first do it? Erin Griffith, then a senior writer for Wired who is now at The New York Times, found the answer in 2018.

By that year, the initial coin offering market for new cryptocurrencies had cooled. A Wall Street Journal investigation had found that nearly 20% of 1,450 crypto projects were frauds. Google, Facebook, Twitter, Reddit, Snap and MailChimp had banned cryptocurrency advertising.

Griffith discovered that crypto enthusiasts had moved, in large part, to the private, encrypted messaging app Telegram.

“Each [new cryptocurrency] project needs a Telegram group to recruit users and investors, keep them interested and answer their many questions,” Griffith wrote. “The easiest way to attract users to a Telegram group is by giving away free money – or rather, ‘pre-money’ in the form of tokens – as ‘bounties’ for a not-yet-launched crypto project.”

Kartik Mandaville, chief executive of SpringRole, a blockchain-based recruiting, onboarding and retention platform, told Griffith at the time: “It’s a very simple growth hack ... this is the first time in this world where you can acquire users without actually paying anything. You are paying them in tokens, which right now have no value.”

The lie: say there is no marketing

Tech companies love to claim that their products are so popular that they do not need marketing. (That sound you hear is every marketer in the world doing a simultaneous facepalm.) To them, marketing is something they do not understand at best or something sleazy at worst.

In 2019, Elon Musk tweeted: “Tesla does not advertise or pay for endorsements. Instead, we use that money to make the product great.” GoPro and WhatsApp are a few others that reportedly also do not do traditional advertising. (But remove Musk and his Twitter account from Tesla and see what happens to sales.)

Crypto enthusiasts make similar statements.

“Bitcoin had zero marketing budget or strategy but was a true ‘viral’ phenomenon that accelerated in popularity over the past 12 years, driven by a white paper and strong believers in the need for a decentralized store of value,” David Weisberger, chief executive of crypto exchange platform CoinRoutes, tells me.

“There was [no] real tactic from specific people, but rather different tactics from different adherents operating without any real cohesion. Bitcoin is the best example of viral growth without centrally directed marketing that I have seen.”

Of course, there is likely no secret cabal of people directing all of the cryptocurrency industry’s promotional activities. But as in most fields, a hive mind has developed in which many companies have similar positioning and messaging (decentralized, freedom from banks, inflation hedge) long before doing the marcom.

Remember: many think ‘marketing’ is just another word for ‘advertising.’ But advertising is only one type of promotion, which is only one part of marketing.

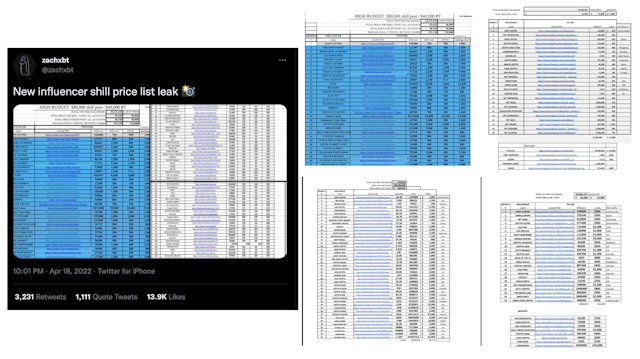

Today, social media – particularly the use of ‘crypto influencers’ – has become popular. Just see the price list that was leaked last week of how much they charge to hype some new ‘currency’ or project on Twitter, YouTube, Instagram and TikTok.

“Bitcoin is not a product or a service that has been marketed by a team or business, but rather an invention that has gained mass adoption through use cases and word of mouth,” Harrison Hosking, marketing manager of cryptocurrency wallet tracker Keak, tells me. “Much like the internet, there was no single marketing effort to push Bitcoin, just hundreds of thousands of referrals from advocates and crypto enthusiasts.

“As crypto, Bitcoin and the blockchain hit the mainstream, the single most used tool to market new projects is social media – particularly YouTube and Twitter. If a project doesn’t use these mediums, they’re doomed to fail.”

And of course, a crypto platform finally entered the world of mass brand advertising with perhaps the biggest tech bro of all – Jason Bourne.

The dark side of crypto marketing

But it is not Matt Damon or the influencers that bother me. Celebrities endorse products and start businesses all the time. Sarah Michelle Gellar founded the baking company Foodstirs. Blake Lively created the Betty Buzz line of sparkling beverages. Ryan Reynolds has several different ones.

What bothers me is that the more money that exists in an industry, the more that there will be scams, fraud and organized crime. (Again, look at the adtech world.) And crypto is literally a money industry. (Gizmodo found this week that 14 former US government regulators are now shilling for it as well.)

Last week, American software engineer Molly White tweeted that her grandmother had received in the mail a fake version of The Wall Street Journal that hyped cryptocurrency. Remember: just like many gold advertisers, as shown above, crypto sometimes preys on senior citizens.

As Pat Dennis, vice-president of research at the US liberal activist political organization American Bridge, wrote a few days ago in a viral, tongue-in-cheek tweet: “Sick of people calling everything in crypto a Ponzi scheme. Some crypto projects are pump and dump schemes, while others are pyramid schemes. Others are just standard issue fraud. Others are just middlemen skimming [off] the top. Stop glossing over the diversity in the industry.”

However, Shuster, the pop-up banner ads and Utherverse creator, says that concerns over illegal activity are “disproven stereotypes.” (Read the transcript of my full interview with him here.)

“Cryptocurrency is traded on a public [blockchain] ledger, which means every movement of every coin is tracked and the record is kept for anyone to be able to look at for all time,” he says. “It’s the worst way to move and launder money and to do black market transactions – cash is the best for that.

“These crypto hacks result in crypto assets ending up in a wallet, and law enforcement agencies all over the world have that wallet on a list. Any place that money goes – any transaction with those assets – is flagged. ‘Decentralized’ does not mean ‘untraceable.’”

Still, I remain skeptical about the future of cryptocurrencies. Why? Take those ‘crypto influencers’ above in the Twitter leak. They listed their promotional fees in US dollars – not Bitcoin.

The Promotion Fix is an exclusive column for The Drum contributed by global keynote marketing speaker Samuel Scott, a former journalist, newspaper editor and director of marketing in the high-tech industry. He is based out of Tel Aviv, Israel.