Has the pandemic created a brief blip or permanent shift in traditional media consumption?

There are plenty of articles, whitepapers and reports out there that have been tracking the changes in media consumption over the past year and, perhaps inevitably, an acceleration further into certain digital channels is quite apparent.

Space & Time considers the lasting effects of the pandemic on traditional media and what opportunities now await marketers

But for a while now, having read and heard various things, I’ve been musing over whether this tells the whole story. A frequently recurring theme that has been present over the past year has been one of nostalgia, and it got me wondering whether this has begun a trend toward an occasional hankering for some traditional media, or is it merely a fad; a symptom of these extraordinary times.

Record breakers

The British Phonographic Industry (BPI) reported in December that sales of vinyl records in the UK had reached their highest since the early 1990s. Now, this was following a trend in growth for the 13th consecutive year, but given the frequency and depth of lockdowns during this period and people’s focus on their finances in other areas, this is some achievement. The fact sales are 10% up on 2019 alone is testament to this, and a glance at the top ten best-sellers of the year certainly suggests the category is being fueled by a certain demographic with an ear firmly on the 80s and 90s.

A big advocate of vinyl myself, I am somewhat biased and delighted to see this story, but while there is a time and a place for streaming, there’s something very immersive and inherently tactile about vinyl music, which cannot be replicated in other formats. The feel, smell and of course sound of it are all very evocative of a different, simpler era – surely something we have all sought in these troubled times. But perhaps we are starting to see a renaissance across other media.

Anti-social media

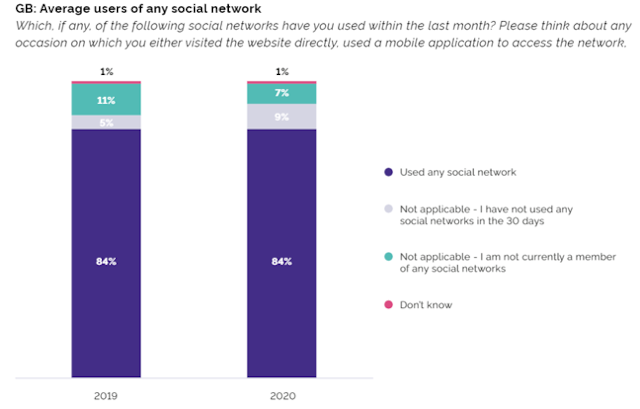

While it’s hard to truly frame any question of nostalgia around the use of a relatively youthful medium – unless we’re making reference to Myspace, Friends Reunited or Bebo (which has in fact just relaunched) – YouGov’s International Media Consumption Report 2021 indicates that nearly twice as many people claimed not to have interacted with any social media compared with 2019.

Social media – along with the belated boom in video calling – has been a valuable tool for many who would otherwise have been completely isolated over the past year, and there is still much to be found that is positive in the medium (especially for advertisers) despite the growing challenges over privacy and targeting.

But perhaps the scourge of disinformation that has permeated various social media platforms over recent years, from Brexit to Donald Trump to coronavirus, has given some of us pause for thought as to how and when we use social media.

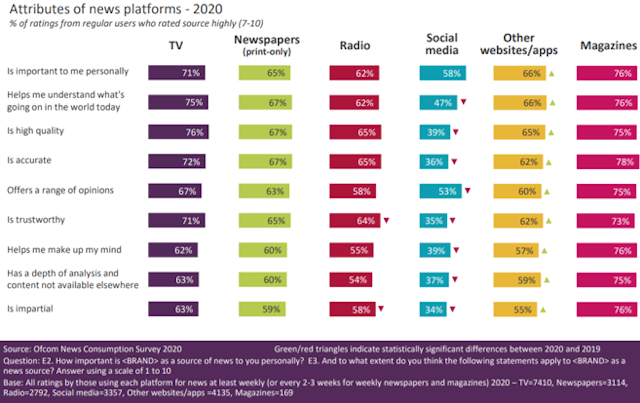

That perceived lack of trust can be evident in Ofcom’s News Consumption in the UK: 2020 report, which indicates that although 45% of UK adults use social media for news (a decrease from 2019), its trustworthiness is typically ranked well behind magazines, TV, print newspapers, radio and other websites.

Print’s stay of execution

Aside from the out-of-home (OOH) sector, which has been affected for reasons apparent merely from its very name, printed media was the next biggest media victim of lockdown. This is an example of where the pandemic accelerated rather than shifted media consumption; the physical barriers to production, distribution and consumption all had an impact as nearly 30% fewer regular printed national newspaper buyers bought newspapers in the last quarter of 2020.

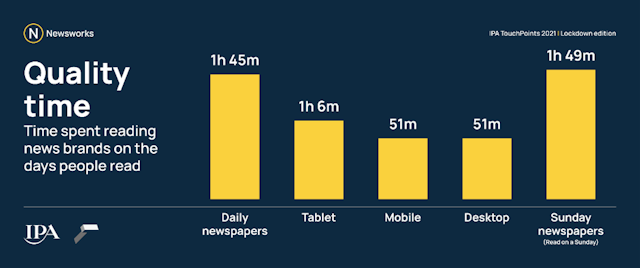

But it’s not all doom and gloom. Recent IPA TouchPoints figures indicate that during the second lockdown (January-March 2021) people spent 30% more time with their daily newspapers, and March 2021’s latest ABC figures saw a period-on-period increase for all dailies, Sunday papers and the London free market titles.

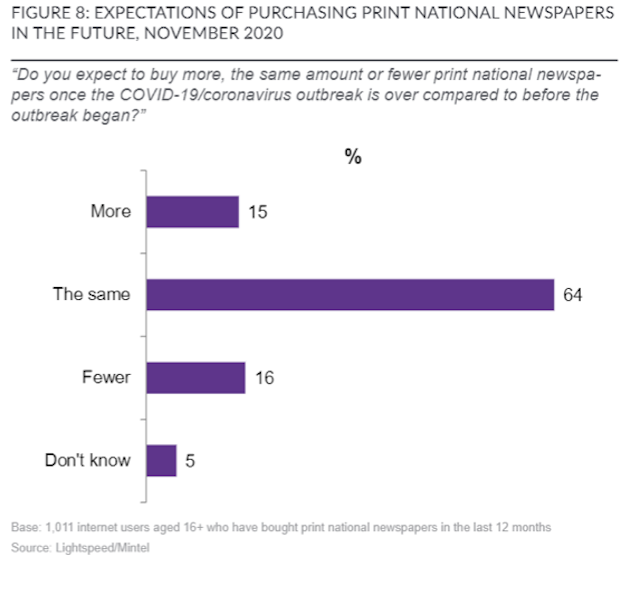

In fact, despite print newspapers’ steady demise over the past decade, the below graphic from Mintel’s March 2021 National Newspapers report suggests survey respondents are just as likely to buy more physical national newspaper copies in the future than they aren’t.

As seen on TV

One medium that was a beneficiary of lockdown was TV in all its forms. With limited outdoor movement, and swathes of the country suddenly finding themselves on furlough, reduced hours or even redundant, TV provided the perfect form of escapism.

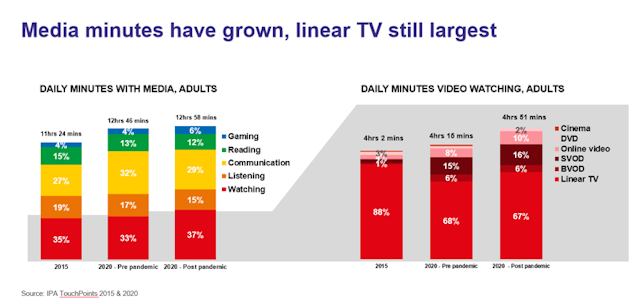

The below chart from Thinkbox, using IPA TouchPoints data, demonstrates that time spent watching grew the most compared to other media interactions. But more interestingly, while subscription video on demand (SVOD) services grew – especially at the outset with the likes of Netflix hugely profiting – regular, broadcast and linear TV still retains the largest share of the TV market by quite some way.

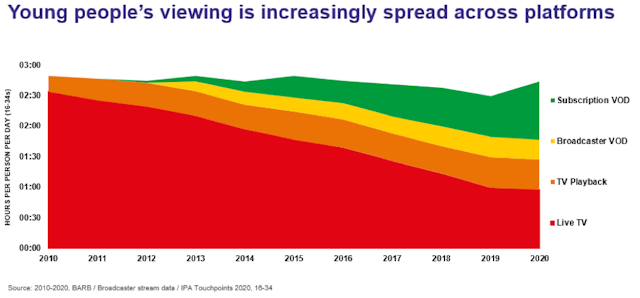

And while it is true, the 16-34 age group is becoming increasingly disparate and harder for advertisers to reach, they too still consume a sizable chunk of live TV, with 2020 indicating a clear and significant slowing of their decline with this format. Now while, as with all adult viewing, this was no doubt driven by government briefings and the news in general, it will be interesting to see whether the previous downward trend continues once normal service is resumed – or have millennials and gen Z started to see linear TV in a different light?

It would be remiss to talk about TV and not mention the TV event of the past 12 months, as the BBC’s Line of Duty concluded at the end of April. A combination of great scheduling, a captive lockdown audience, past series freely available on catch-up and, undoubtedly, a well-written and acted program inevitably helped propel this show to its stellar heights. But, equally, perhaps we as viewers actually valued and rediscovered the traditional linear format of more evenly-paced, weekly storytelling, rather than just binging, which helped develop suspense and wider awareness of the show as it grew exponentially.

Though not one of many competition-themed linear TV shows such as The Great British Bake Off that pepper the broadcast schedules, where there is a more apparent newsworthiness to knowing a winner, there was clearly a shared viewing experience. People planned their Sunday evening around watching it broadcast live on linear TV, no doubt with other members of their household in their living rooms rather than on separate devices at a time convenient to them.

The sense that its star was everywhere you turned was backed up with a record 12.8 million viewers watching the finale when it aired, equivalent to 56.2% of the UK’s TV audience, and it became the most watched episode of any drama since records began in 2002. Mother of god, indeed.

Omnichannel and omnipresent

The last year has taught us it’s impossible to make predictions with any certainty, with our media behaviors affected in many ways; some enforced, some by choice.

With the constant development and release of new digital forms and channels and what was traditional media now often, largely, consumed via digital means, there really isn’t much of a digital v traditional battle any longer.

With the impending deprecation of third-party cookies and big tech players such as Apple enforcing stricter privacy rules, first-party data is more important than ever but also, perhaps, a place to sometimes take a step back from personalization and granular targeting and let broader reach media and targeting play its part too.

The examples explored here may not determine a real change so much as a transient blip, but from a marketing perspective there is very much an argument to keep strategies broad, open and omnichannel to continue to connect with audiences for both brand growth and driving response.

Gearing up for the future

At Space & Time, we felt it necessary to recognize the convergence that has taken place over a number of years between digital and traditional media. Be it programmatically-bought OOH or the major publishers reverting to a first-party data subscription model that allows them to blend their products across on- and offline, the two needn’t be mutually exclusive.

When you combine this with an increasingly complex path to purchase for the consumer nowadays, we see the need for our capability to cover the entire customer journey, giving clients greater control and opportunity to influence their customers. Furthermore, we believe true strategic and commercial alignment with clients also means whatever capability we provide needs to be on a model that aligns with their objectives, ranging from full managed, hybrid or in-house. The establishment of a technology, creative and training division within Space & Time is a necessary step for the media landscape today.

Lastly, we believe this breadth of capability and flexibility in how we work enables us to continue driving exemplary results and what we call growth marketing, where the value we bring goes much further than simply generating a transaction and dusting our hands down. By forming deeper partnerships and ensuring long-term alignment with clients, our goal is to unlock growth not just in media performance, but in your customers.

Lyle Kercher, associate director, agency development at Space & Time.

Content by The Drum Network member:

Space & Time

Space & Time is a growth marketing agency, enabling clients to secure optimal value from every part of the customer experience and their marketing investment....

Find out more