With vaccinations on the rise British retail is bouncing back

With more than half the British population having now received both doses of the Covid vaccine, consumer confidence appears to be at its highest levels since the start of the pandemic and it has enabled even more consumers to return to physical retail. As of the end of May ‘21 Blis has observed that the number of visitors to high street retailers in the UK is at 95% of our pre-Covid benchmark and this is the highest level seen for the last 15 months.

With vaccinations on the rise, British retail is bouncing back

High street rebounds

The vaccination rollout has removed one of the last barriers for a retail recovery and has enabled vulnerable or anxious consumers that have been sheltering in place for much of the past year to return with a newfound sense of safety. This has underpinned the shift from ‘early embracers’ to a ‘confident majority’ on the UK’s high streets as an even greater proportion of British society is looking to shop, dine and entertain themselves outside the home.

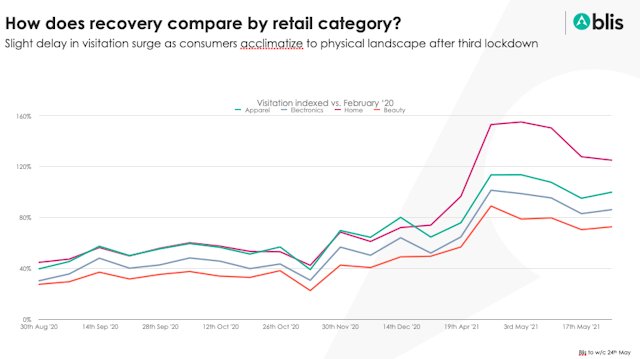

Retailers within the home and the apparel categories are currently driving recovery. Home stores have gone from strength to strength relatively speaking within retail, with the essential status enabling many retailers to operate throughout the crisis, the urge for home improvement and the latest seasonal demand for garden furnishings through the summer. In addition these retailers have been buoyed by an increase of new homeowners. Whilst home improvement has been an overriding theme of the pandemic the performance of apparel retailers is particularly positive given the increasing penetration of online competitors and closure of high street stalwarts like Topshop and Debenhams. YouGov found that for 69% of British shoppers the opportunity to physically experience a product was the motivation for using brick and mortar stores prior to purchase and this experience cannot be delivered by online solutions.

By contrast, Beauty and electronics are two sectors of retail which are lagging behind. The underperformance of specialised beauty retailers may be due to several factors; need states pending (e.g. nights out or return to the office), store network location (primarily in central cities & shopping centres where consumers have yet to return at full scale), as well as consumer defection with the ‘essential’ retailers like Grocery stores (e.g.Tesco, Asda) and pharmacies (e.g. Boots, Superdrug). Therefore some of the factors underpinning their prospective recoveries are more broadly societal and outside of their control. Without a holistic realignment of their store network, media activation and their omnichannel solutions will be even more important in reconnecting consumers.

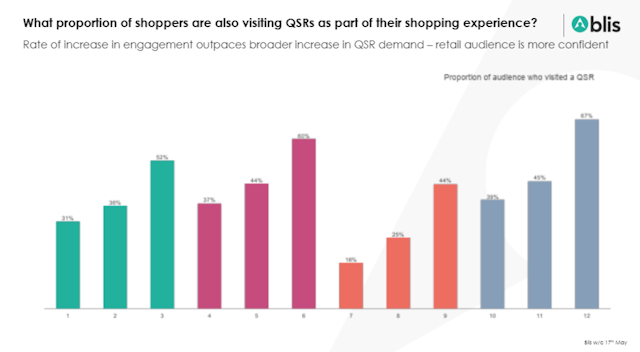

QSR cross-pollination

With the return en masse to the high streets there is also the opportunity to introduce your retailer or brand as the incremental visit. As consumer confidence grows we find that not only is in person browsing between competitors increasing but those shoppers who are returning to physical retail are also interacting more regularly with parallel categories. For instance in December ’20 36% of shoppers visited a QSR as part of their retail experience but this has now increased to 56% in May ’21. This provides audiences at scale for both retailers and QSRs simply by targeting those consumers already in proximity and incorporating themselves into a shopper or diner’s journey.

Travel trends

Travel stands out amongst all other verticals as the area which has been hit most significantly by Covid, but in the last couple of months we have seen a boom in domestic travel when compared to last summer. The number of travellers from London and Manchester to destinations across the UK increased by +38% and +20% in April ’21 compared to August ’20, and these individuals were travelling even greater distances, +13% and +18% further on average.

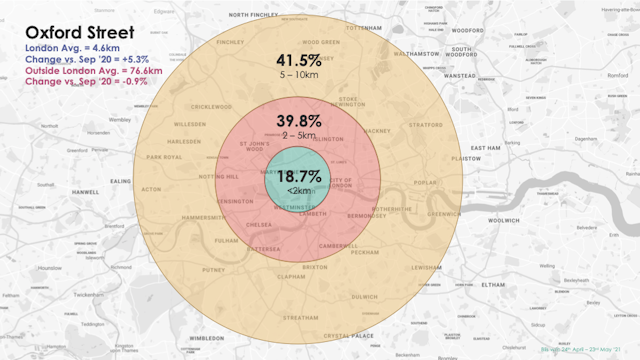

However, this behaviour does not yet appear to have crossed into leisure and retail travel. When we examine key shopping destinations such as Bicester Village, the Bull Ring and Oxford Street we find that shoppers are coming from shorter distances than last summer both within the metropolitan area and from across the UK. For instance in the case of Bicester Village and the Bull Ring the average distance consumers are coming from has declined -32% and -14% vs. last summer respectively. The experience for Oxford Street is slightly more optimistic with a 5% increase in the distance people are coming from within London and a decline of -1% outside of London. However this is far below the double digit increases in domestic travel we have seen, and so while we are seeing retail visitation near ‘normal’ across the UK, consumers do not appear to be in the mindset for travelling to retail destinations and these locations will be increasingly dependent on local consumers at least in the short term.

Where are Oxford Street shoppers coming from?

If we are looking for a framework for understanding consumer behaviour then perhaps the rate and speed of return of consumers could be seen to reflect Maslow’s hierarchy of needs, with basic needs like Grocery, QSRs and Pharmacies seeing the fastest return, followed by high street retail, pubs, and essential travel that fulfil psychological needs, before late stage destinations like offices and leisure travel that meet our self fulfilment needs. It may require clairvoyance to perfectly navigate the emergence from the Covid crisis, however as we look across industries consumer behaviour is following a positive track and the recovery horizon for even the most beleaguered categories may not be too far away.

Nathan Lawson, senior insights manager, Blis

Content by The Drum Network member:

Blis

Blis is an omnichannel advertising platform like no other. We allow planners to plan, buy and measure high-performing audiences without relying on IDs, helping the...

Find out more