Will we ever see the likes of Yahoo Answers again?

Yahoo was a pioneer of the early internet era. Evolving from a human-edited directory of websites, in 1995 Yahoo launched its first search engine – Yahoo Search. By the year 2000 it was the most popular website in the world.

Croud questions whether the closure of community-driven website Yahoo Answers could lead its competitors to the same fate

Yahoo Search opened up the internet for millions. It was a simple tool that offered anyone with an internet connection a gateway to the sum of human knowledge. But, despite its best efforts, the search engine could not always provide people with the knowledge they were looking for, or answer the questions they had.

And so, in 2005, Yahoo Answers was born. Yahoo Answers was a community-driven question-and-answer website where users would ask questions and answer those submitted by others, and upvote them to increase their visibility.

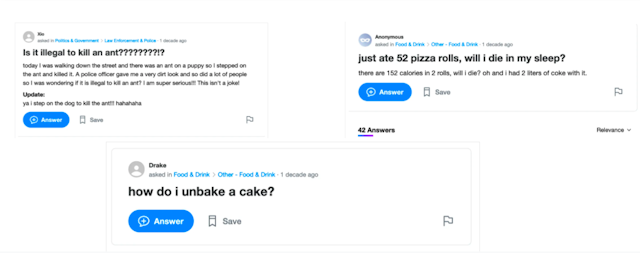

In theory, it was a place where crowdsourced knowledge could provide the answer to every question. The culmination of technological advances and human collaboration.

In reality, it looked more like this.

On May 4 this year, 16 years after it went live, Yahoo Answers was shut down for good. And this raises the question – as we see this giant of the internet fall, can we imagine a day where Google falls into obscurity too?

Searching for alternatives

Google controls 91.8% of the global search engine market – a far cry from the early ’90s landscape where services like Yahoo, AOL, AskJeeves, AltaVista and MSN were all viable options that each attracted a significant share of users.

Though this vice-like grip on the sector may seem insurmountable, there are some key areas in which a rival brand could steal some yards.

Privacy

The first is through privacy. Google has amassed an immense amount of data from its users – and has strategically guarded this data within its ‘walled gardens’. Consumers and policymakers alike have become more cognisant of their data and how it is being used, with measures like the GDPR rolling out across Europe and the Data Protection Act of 2018 in the UK.

Google is hyper-conscious of this privacy focus, and has shifted its communications strategy as much as its technical data-collection policy to reflect these concerns.

“Today, we’re making explicit that once third-party cookies are phased out, we will not build alternate identifiers to track individuals as they browse across the web, nor will we use them in our products,” wrote David Temkin, director of product management, ads privacy and trust at Google, in a company blog post published on March 3.

Google created a digital ad ecosystem that relied on tracking users across the web and targeting them with personalized adverts. With the death of the third-party cookie, Google is effectively ending that era. This increases privacy for users – but in turn also increases the reliance of marketers on Google and the data it holds.

New startup search engines have identified privacy as Google’s Achilles’ heel – though all have slightly different ways of dealing with the privacy problem.

DuckDuckGo has managed to quickly capture a marginal market share with its mission statement of “protecting searchers’ privacy and avoiding the filter bubble of personalized search results”. As Google announced plans to test its replacement for the third-party cookie, the Federated Learning for Cohorts (Floc), DuckDuckGo quickly countered and declared that it would block this tracking through its browser and on its Chrome extension.

Other players include Neeva, which has opted for a subscription model, and You.com, funded by Salesforce’s founder Marc Benioff, which will not only sell your data to advertisers but also change how search works by summarizing the web for you.

On the other end of the spectrum you have Ecosia, which offers a more sustainable approach to searching.

The east

Most of the world searches on Google, but not all. Outside of Europe, brands like Yandex and Baidu are the dominant forces in their respective regions.

Baidu in particular has the technical capacity and financial muscle to make significant inroads into emerging markets – and will certainly look to expand if the opportune moment presents itself. However, any expansion would likely come with significant amounts of red tape and legislative action due to the sensitive geopolitical relations between their nation states – as TikTok would attest.

Key areas in which a rival brand could steal some yards

Apple could make a significant dent in Google’s dominance if it chose to release its own search engine. Google invests a huge amount – a fee rumored to range from $8-12bn – to appear as the default search engine on Apple phones and products. If this were to change, Google could lose almost half of its traffic overnight.

Such a move is likely to be on Apple’s radar, spurred on by antitrust regulators in the US accusing Google of dominating the market. The tech giant is already hiring various experts in search-related roles – and with Siri already essentially working as a basic search engine, the potential room for expansion here is huge.

Equally, it’s important to note that privacy is embedded deeply into Apple’s brand, and it would be able to tap into the desire from consumers for increased privacy with real credibility.

What does the future look like and what are the lessons for marketers?

Change is in the air for search engines, but marketers shouldn’t change their strategy too drastically. Google is incredibly dominant (and effective) and will likely remain so for the foreseeable future. It has laid strong foundations and built deep moats. Fundamental changes to the digital ad landscape like Apple’s iOS 14.5 update, which has panicked the likes of Facebook, have not phased Google. While there are some threats to its dominance, Google’s synonymy with search will be difficult to dislodge.

In saying that, marketers should always be looking at other platforms and assessing user behaviors on these search engines. Search is still largely a manual process. But as the world around us changes and technology progresses, it will naturally develop. How could widely-available AR transform search? Driverless cars? Better voice assistants?

While we may never see the likes of Yahoo Answers again, there is no doubt that new digital platforms will continue to emerge and evolve alongside society. Google has a vice-like grip on the market for now, but there are areas of weakness in which competitors could strike. Marketers should keep their fingers on the pulse of the privacy debate, and developments from Apple and competitors from further east. Because if Yahoo can attest to anything, it’s that the king never wears the crown for long.

Peter Eckersley is organic strategy director at Croud.

Content by The Drum Network member:

Croud

Croud is a global, full-service digital agency that helps businesses drive sustainable growth in the new world of marketing. With a rich heritage in performance,...

Find out more