Millennials bond strongly with media and entertainment brands

Younger consumers have, generally, displayed different priorities, preferences, and behaviors than their older counterparts. In particular, today’s millennials are tech-savvy, experience-focused, highly connected, and receptive to new ideas. According to MBLM’s 2019 Brand Intimacy Study, millennials also have the strongest emotional connection with media and entertainment brands.

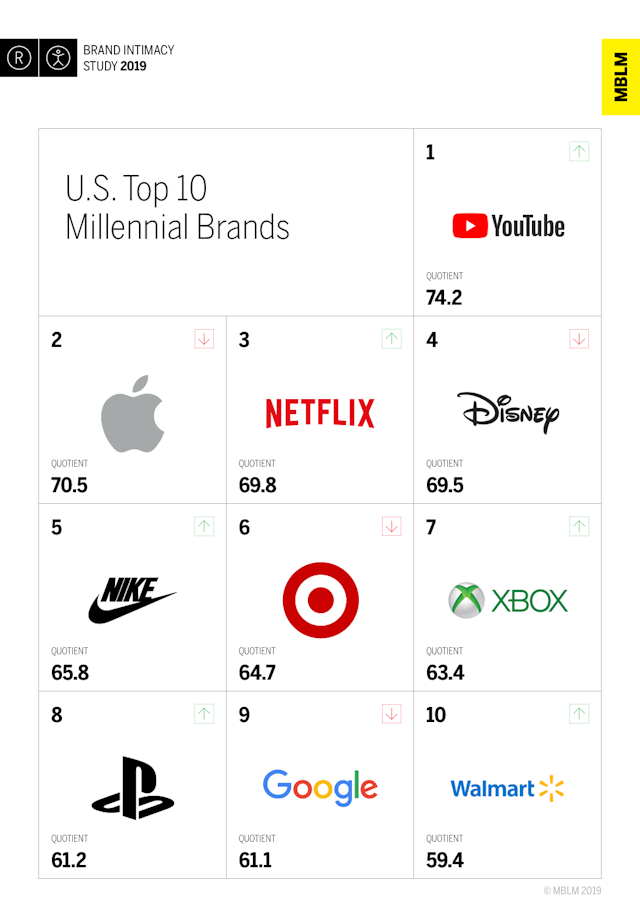

Here are millennials’ top 10 media and entertainment brands, according to the study:

- YouTube

- Netflix

- Disney

- Xbox

- Amazon Prime

- PlayStation

- Nintendo

- Hulu

- ESPN

- Showtime

For the third year in a row, the media and entertainment industry has built powerful bonds with millennials. What is it about media and entertainment brands that enables them to reach that important consumer segment and connect so solidly with them?

Several notable insights from the study help explain the strong performance of media & entertainment brands related to their ability to establish meaningful emotional connections. Those insights speak to mindset, gender implications, usage patterns, and the role technology plays in those brands.

Escapism

What’s interesting about the top 10 media and entertainment brands is that seven of those brands (including the top three) relate to programmable content and movies, while the brands ranked fourth, sixth, and seventh are gaming brands. Those two facets of media and entertainment are remarkably successful with millennials. Both of those appeal to a growing need to escape and retreat, and they cater to bingeing and cocooning, sensibilities that continue to gain prominence in our stressful world. Millennials, in particular, are comfortable with on-demand streaming content, preferring to watch a series all at once instead of waiting for weekly episodes.

The need for pampering

Millennials have been called the “Me Me Me Generation.” That label gives us insight into the strength of media and entertainment. Those brands let us reimagine, as they offer fantasy, creativity, and pleasure for moments or hours of distraction. Perhaps that’s why the archetype of indulgence (creating a close relationship centered around moments of pampering and gratification) is the strongest in this industry. Media and entertainment brands let us take time for ourselves to watch, to play, and to pretend.

Gender matters

Most millennial men prefer and bond with gaming brands, whereas most millennial women prefer movies and programmable content. The top two most intimate media and entertainment brands for millennial men are Xbox and PlayStation. In contrast, millennial women rank Disney and Netflix highest. That suggests that, while media and entertainment engagement is strong for both genders, their preferences differ significantly. To generalize, men appear to prefer the more active gaming format, while women prefer the more passive act of watching.

Frequency and immediacy

The average media and entertainment brand has nearly 40% of millennials experiencing some level of intimacy. Compare that with the proportion of millennials experiencing intimacy with the average brand across all 15 industries covered in the study (24%) and you can see the strong connection this category enjoys. Additionally, on average, nearly half of millennials (47%) feel an immediate emotional connection with media and entertainment brands, suggesting there is fast impact. That finding aligns with behavioral science advances that suggest people make instinctive decisions and process information quickly based on emotion.

Deep bonds and willingness to pay

In addition to entertainment being the leading industry for millennials, they appear to be growing more attached to their intimate media ad and entertainment brands. The percentage of millennials in “fusing,” the highest stage of Brand Intimacy — when a person and a brand are inexorably linked and co-identified — increased this year from 6% to 9%. Furthermore, the category doubled its price resilience. In 2018, 8.7% of intimate consumers were willing to pay 20% more for their favorite media and entertainment brands; in 2019 that percentage of intimate consumers rose to 18.3%. Given that this is an industry that can be expensive, this result is significant and shows the degree to which people are unwilling to live without their favorite intimate brands.

Smartphone ecosystem

Most millennials interact all day almost entirely through a screen. Over the past several years we’ve noticed that brands with a strong presence on smartphones generally outperform those that don’t. We refer to this phenomenon as the “smartphone ecosystem.” That ecosystem is divided into four groups: apps, access, content/info services, and devices. The content/info services category consists mostly of media and entertainment brands. Content services such as Netflix, Amazon Prime, and YouTube have leveraged the popularity and versatility of smartphones to be in consumers’ pockets at all times and play an increasingly integral and intimate role in their daily lives.

Building connections in any category

The undeniable intimacy between millennial consumers and their preferred media and entertainment brands, along with the growth of the category, suggests it will continue to have success. Millennials carry significant buying power, as well as the ability to influence and set trends for both older and younger generations.

Based on the findings from the 2019 Brand Intimacy Study, brands within this media and entertainment—and across others—can learn valuable lessons about this demographic and how these individuals build connections with the brands they use. By offering millennials multimedia experiences, opportunities for both on-demand escape and moments of indulgence, brands can enjoy great success in building Brand Intimacy, creating stronger bonds, and driving real results.

Mario Natarelli is managing partner of MBLM