What you need to know before your brand enters China

Bringing your brand to the Chinese market can be attractive, but make sure you do your homework first. In the first of a two-part blog, Eve Lo of Isobar China reveals how a brand can succeed in China.

Taking brands to China

With an e-commerce value larger than US, UK, Japan, Germany and France together, China is the largest cross-border market in the world. In addition, a recent Ad Spend report shows that the advertising market in China is expected to grow by 6.5% in 2018 to RMB 630 billion, representing 16.2% of global advertising investments.

Choose your brand name wisely

Do not choose the Chinese version of your brand name lightly. Consumers may see an English logo but pronounce a Chinese name and when literally translated, your brand name can have a different meaning. Coca-Cola "Ko Ka Ko La," to Chinese people means something like a "waxed horse". Fortunately, the brand chose "Ke Kou Ke Le" a name which stands for "tasty" and "happy", which is a much better fit for its brand values. When Chinese consumers don’t understand the literal translation of your brand, they will give it their own meaning. The best thing to do is to align your brand name both literally and phonetically. The growing number of Chinese brand naming agencies says it all – make sure you ask for advice from the experts.

Understand the playing field

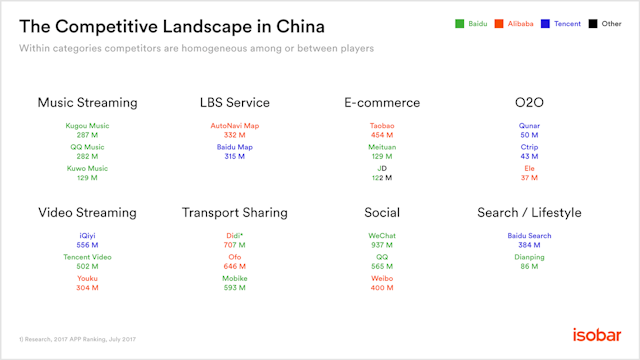

Western brands do not necessarily have a head start in the Chinese market today. In some cases, you can benefit from the good brand image of other foreign brands in your brand product category. Nutrilon and Friso (Friesland Campina) are very successful. This is partly due to food scandals in China and the high quality baby milk powder from the Netherlands. Due to the brand perception Dutch products have in the baby products category, unknown brands in China can benefit from a European connection. The most popular categories in foreign products are cosmetics, fashion, food, baby products and health products and the fastest growing online sectors in China are bike sharing, food delivery services, taxi services and financial service providers. (iResearch, 2017 APP Ranking, July 2017).

Get to know the Chinese consumer

It is also important to understand what really moves the Chinese consumer. Although there are many regional differences in China, the group responsible for the majority of online purchases is young (20-35), female and often lives in urban coastal areas. They are continuously connected to their smartphone following the latest trends via the Chinese social media.

Characteristics and trends in Chinese consumer behaviour include:

• The functionality and aesthetics of the product;

• Chinese customers are flexible, they change providers easily and often try out new products;

• Carefully branding your product is very important. The brand values must match the personal values of the consumer;

• 'Guanxi', the building of relationships and group cohesion, remains an important value, despite the individual wishes of the consumer;

• Chinese consumers are communicative, they often like to contact the provider - more than 70% use customer service to place the order. They also leave reviews relatively often;

• China is at the forefront when it comes to mobile payments.In the newspaper kiosk, you can pay via a QR code. Payments are mainly made via Alipay or WeChat pay.

Consumer trends

- Online-offline convergence: Online and offline channels work together. Online shopping in China is about convenience and speed, while offline shopping is more about an all in one seamless experience.

- Socialized online shopping: Word of mouth recommendation from friends is the most effective to convert shopping behavior. As WeChat has become part of everyday life conversations between friends stimulate impulse purchase.

- Experience is king: 59% of surveyed subjects agree that shopping is not only about products, but also about experience.For Cornetto, Isobar created a series of melting digital love letters. Through a QR code on the Cornetto packaging, lovers could select their colorful submission templates, create unique own confessions and send the love letters via WeChat or QQ. The recipient only has 520 seconds to read the confession before it melts away. We also implemented the idea offline. We placed Cornetto machines in major cities such as Beijing, Shanghai and Guangzhou. Consumers could take a photo, make their love message and print a customized DIY packaging sticker.

- Embrace value economy: Shopping is often impulsive. More than 50% of surveyed subjects said they don’t use the products they purchased after a while. 60% of them have experience using second-hand product transaction platform.

(Chinese Consumer Digital Trends Report 2017-2018 by Accenture)

In practice: rebranding of Mamaway

A good example of a brand that has achieved success in China by making smart use of target group insights and mapping competition is Mamaway. This (originally) Taiwanese company sells all kinds of baby products. Over the years, the product range has become broader, making the brand promise 'solving breastfeeding problems' no longer appropriate. There is strong competition in baby products market, and it was important that Mamaway was able to deliver a relevant message to the target group. By using big data Isobar China discovered that one of the most important challenges that young mothers struggle with is the need for self-development. Unlike the traditional ideology where the baby is top priority, we encouraged mothers to break the stereotype of "unconditional dedication". This is how we helped Mamaway to set a new standard for successful modern mothers. These target group insights gave us the opportunity to set Mamaway apart in relation to other brands in this product category.

The second part of this blog can be found here

Eve Lo, chief strategy officer, Isobar China

Content by The Drum Network member:

Isobar

Isobar is dentsu’s global creative agency focusing on building a differentiated offering around Strategy and Innovation, Product and Experience, Brand Design &...

Find out more