No, advertising spend is not moving online – here's why

TV is dead. People want to have relationships with brands on social media. The marketing world is full of grand proclamations that turn out to be completely wrong when you look at the data. The latest belief is that digital advertising spend surpassed that of television last year.

If you want to terrify traditional marketers, show them this chart that Recode created in December 2017 based on data from Magna, the research arm of media buying company IPG Mediabrands:

The fear is real. Late last year, I gave a keynote talk at CASBAA’s annual convention in Macau on how television is not actually dying. Among the gathered TV, cable, and satellite executives, much of the talk that I overhead focused on one question: when will the digital Sword of Damocles finally fall and cut their jobs?

But that fear is misguided as well. When you focus on the definition of the word “advertising” and look deeper into the trends, the big picture changes dramatically. A simplistic view of “digital” versus “television” – or even “online” versus “offline” – hides a reality that is much more complicated because not all media spend is created equal. This column details my findings.

Here is the data I collected

For this column, I contacted advertising measurement company Zenith, London media analyst firm Enders Analysis, and Forrester Research – all of whom shared internal data with me. The information covers annual global spend from 2015 to 2017 on various mediums and the specific advertising tactics of brand advertising or direct response. To my knowledge, this is the first time that such an analysis has been done.

Most studies focus on where advertising is placed but ignore the tactics of the ads. (As anyone who has a seen both a creative brand advertisement and a direct-response infomercial on television knows, the same medium can be used in entirely different ways.)

Instead, I have examined data on both where ad spends are moving as well as whether the ads are brand advertising or direct response. After all, marketing mediums and marketing tactics are not the same thing.

Here is my summary of the data that I compiled:

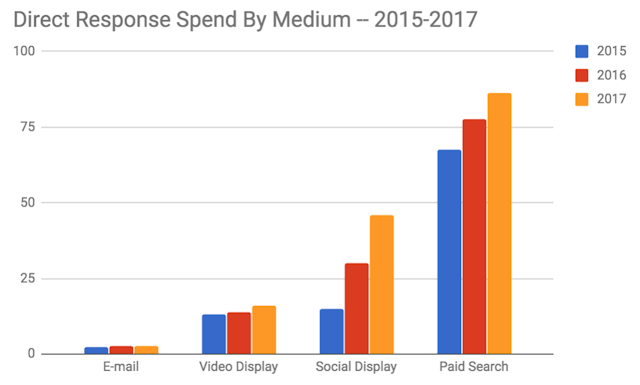

For more detail, Enders Analysis exclusively shared with me their breakdown and this graphic that for the first time separates global online display spend between brand advertising and direct response marketing:

“With retail growth moving to e-commerce, we’ve seen marketers traditionally concerned with trade promotion (such as buying premium shelf space in physical stores) embrace targeted, dynamically generated direct response ads online,” Enders Analysis senior research analyst Matti Littunen said. “The scale of this shift is difficult to quantify, as the budgets come from outside the usual client base of the display advertising world.”

“There’s little evidence of large-scale online direct response display being effective relative to cost in the long-term, and a backlash is mounting against profiling consumers for the purposes of targeted direct response ads. Are enough brands thinking about the long-term sustainability of these growing practices?” he continued.

Some disclosures on methodology

Journalism is the first draft of history, and this overview is the first draft of an important topic that our industry needs to examine further. I am not a data scientist, so I will be the first to state that this research is incomplete. I am aiming to identify not specific numbers but overall trends. I hope academics will look more into this area – and I will be interested to see what they find.

That being said, here are some notes. While a little TV, radio, and print spend is direct response, I have grouped it all under brand advertising for the sake of simplicity. Social display is advertising on any social media network, and “video” or “other” display is advertising on platforms such as the Google Display Network or ad tech platforms. Either social or other display can be brand advertising or direct response.

I was unable to obtain a good figure for global direct mail spend, so I have not included that tactic and medium. Obviously, it would have added to the direct response and offline numbers.

Of course, if you ask five media analyst or measurement companies how much marketers are spending on which mediums and for what purpose, you will get six different answers. This column is an estimation that aims to start further discussion.

Lastly, I have focused on only the two categories of advertising – brand and direct marketing. I did not look into global spends on other promotional tactics such as public relations, SEO, and direct sales. These areas – along with other segmentations such as between B2C and B2B spend or within categories or sectors – could be addressed in future studies.

My major findings

The data that I collected can be sliced and diced in numerous ways. Here are some interesting things that I noted as well as the charts that I then created. Note: all spend numbers are in billions of US dollars worldwide.

Brand advertising

TV is still the undisputed leader specifically in brand advertising campaigns. Spends on other mediums are increasing or decreasing to various degrees, but there will not be a credible challenger to television for the foreseeable future.

In 2017, the brand advertising spend on TV was more than six times that of the nearest digital competitor – video display. I am not surprised. Television and other traditional media have always been the best ways to build brands.

So I must wonder why alleged gurus such as Gary Vaynerchuk claim that television advertisers are wasting $80bn. I can only think that he knows little about the value of branding. Those who think that the internet is the future of brand advertising probably still think that S Club 7 should have been the future of pop music.

Direct response

This data is good news for Google and social media. Marketers who want to use digital channels for direct response purposes overwhelmingly choose Google AdWords. It makes sense. If someone searches for something in Google, then he or she is already interested in the product.

Social media as the second choice also makes sense. After all, Facebook pushes people to “like,” sign up, or otherwise convert. Twitter wants people to click on links. LinkedIn focuses on B2B lead generation.

However, this finding is bad news for companies such as HubSpot and Marketo. As much as they trumpet the value of email automation, it seems that direct response marketers are spending comparatively little on that medium. The spend is flat. Those who think that email spam has a future are as deluded as those who thought that Vanilla Ice was a great rapper.

What all ad spend shows

Here, I have segmented the data by both medium and tactic. In the chart, (A) refers to the use of a medium specifically for brand advertising and (DR) refers to direct response.

The rise in digital advertising is actually driven by direct response activities primarily through paid search and secondarily through display advertising on social media (most of which is targeted). But these designations still come with problems.

First, as Faris Yakob once wrote, “personalised advertising is an oxymoron” because “advertising,” strictly defined, is a tactic done over mass media for a mass audience. Second, as Byron Sharp recently tweeted, paid search is little more than the online version of putting a product on a shelf for display:

“Search advertising (which is huge chunk of what is called “digital”) isn’t like advertising at all. It’s physical availability.”

As the chart immediately above shows and with apologies to JRR Tolkien, television is still the one medium to rule them all.

Advertising vs direct response

When you zoom out at put all of the spend into brand advertising and direct response buckets, it turns out that the share of total advertising spend going to direct response has been increasing since 2015. Data can tell you what is happening – but it cannot tell you why. I do not know the reason, but I have a few guesses.

First, the average tenure of a consumer brand chief marketing officer has reportedly fallen to 42 months – a decline of six months over the past two years. If I were a CMO who knew that he would lose his job within four years, I would focus more on direct response – especially if my compensation were based in part on gains in short-term revenue or the stock price. I would let the next person care about the long-term brand.

Second, the marketing world in general has fallen victim to “short-termism” based in part on the easy availability of cheap, digital-based metrics. But such a mentality ignores the facts that not everything that is measurable is important, not everything that is important is measurable, direct response over digital is the least-liked advertising tactic among consumers, and a lot of digital metrics are incomplete at best or fraudulent at worst.

Still, what I found interesting is that the breakdowns fall far outside the longstanding rule that there should be a 60-40 divide between brand advertising and activation in favor of branding.

What it all means

In the marketing industry, there is a lot of unintentional misinformation because many people – especially those in the digital space – do not have a traditional marketing education and rarely look at total media spends to see what is truly going on in the proper context.

Longtime readers of this column know that my journalism background from before I went into marketing makes me extremely pedantic. I discuss how people define terms and what assumptions they have in order to be as neutral as possible in analyses such as this one.

So, based on this limited study, it is not precise to say that the majority of “advertising” spend has moved online despite what lines were purportedly crossed in 2017. It is accurate to say that direct response spend has moved online – but also that television is still the most used medium for brand advertising specifically and for media spends in general.

No, TV is nowhere close to dying. And that might prove even more true after GDPR takes effect next month and limits the use of consumer tracking and marketing surveillance.

The Promotion Fix is an exclusive biweekly column for The Drum contributed by global marketing and technology keynote speaker Samuel Scott, a former journalist, consultant and director of marketing in the high-tech industry. Follow him on Twitter and Facebook. Scott is based out of Tel Aviv, Israel.