How newsprint pounds turned to digital pennies: Newspapers and the dominance of Facebook and Google

Media commentator and advertising industry expert Torin Douglas continues his look at the battle facing traditional news publishers from today's digital behemoths.

The Guardian and the Daily Mail group were among the smart newspaper publishers, gaining a lucrative foothold in the digital world. But the gains there still did not make up for the loss of classified print revenue.

One reason for the discrepancy was advertising space on the internet was infinite, whereas space in a printed newspaper was relatively scarce, and could be made scarcer by publishers cutting paging at times when the price of newsprint was going up. In traditional advertising terms, when demand for space exceeds the supply, the price goes up, but on the internet the supply is limitless. Where there were newsprint pounds, there are now only digital pennies (at least for traditional publishers: Google and Facebook, using a different model, have precipitated a digital gold rush).

Nowhere did this become clearer than at the Guardian. Despite becoming one of the largest and most influential English-language newspaper websites in the world, with 155 million monthly browsers in April 2016, it posted a £69m loss for the year (and a total loss of £173m, after exceptional items and write downs) as, like other newspapers, its print circulation and advertising revenue sharply declined. And though its global audience continued to rise, its digital revenues fell by almost £2m to £81.9m as – the paper itself reported online – "Facebook and Google ate up the bulk of the money made from mobile advertising."

“Facebook’s quarterly profit and revenue blew past Wall Street estimates on Wednesday as the company’s hugely popular mobile app and a push into video attracted new advertisers and encouraged existing ones to spend more. Total revenue rose 59.2 per cent to $6.44bn, compared with the estimate of $6.02bn.” (Tynan, Guardian, 27 July, 2016.)

The same week, Adweek reported: “Google is still the primary moneymaker for parent company Alphabet. During the second quarter of 2016, Alphabet’s revenue hit $21.5bn, a 21 per cent year-over-year increase. Of that revenue, $19.1bn came from Google’s advertising business, up from $16bn a year ago.”

So dominant have Google and Facebook become in the digital advertising world that the News Media Association, the UK’s trade body for publishers, has called on the government to intervene. It estimates the two giant US companies now take 90 pence of every pound spent of publishers’ digital revenue.

So how have Facebook and Google built such a huge share of the market?

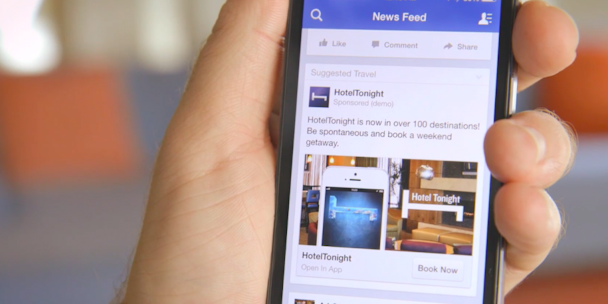

“Facebook is winning because it has amazing advertising products that work incredibly well,” said Will Haywood, former vice president for Europe at Buzzfeed, at a recent Newsbrands debate.

Many would say the same holds true for Google, which revolutionised the advertising process in 2000, when it launched AdWords, linked to its world-beating search engine.

“The bulk of Google’s $75bn revenue in 2015 came from its proprietary advertising service, Google AdWords,” reported Eric Rosenberg, in Investopaedia.

The report continued: “When you use Google to search for anything from financial information to local weather, you’re given a list of search results generated by Google’s algorithm. The algorithm attempts to provide the most relevant results for your query, and, along with these results, you may find related suggested pages from an AdWords advertiser. Any recommended websites you see when logged into Gmail, YouTube, Google Maps, and other Google sites are generated through the AdWords platform.

“To gain the top spot in Google advertisements, advertisers have to outbid each other. Advertisers pay Google each time a visitor clicks on an advertisement. A click may be worth anywhere from a few cents to over $50 for highly competitive search terms, including insurance, loans and other financial services.”

I know half of my advertising works, I just don’t know which half

Through a second advertising programme, AdSense, “Google served as a matchmaker, marrying advertisers with web destinations,” wrote Ken Auletta, in Googled: The End of the World As We Know It. “If Intel wanted to advertise on technology blogs or a hotel in London wanted to promote itself on travel sites, Google put them together via a similar automated auction system.”

Revenue from AdSense advertising made up 23% – or $15 bn – of Google’s total 2015 ad revenue.

Auletta wrote: “It was Google’s ambition, its founders liked to say, to provide an answer to the adman’s legendary line: ‘I know half of my advertising works, I just don’t know which half’. Unlike the ads traditional media had sold for more than a century, based on the estimated number of people reading a newspaper or watching a programme, Google’s system ensured advertisers were charged only when the user clicked on an ad.

“And unlike traditional analog media companies, which can’t measure the effectiveness of their advertising, Google offered each advertiser a free tool: Google Analytics, which allowed the advertiser to track hour by hour, the number of clicks and sales, the traffic produced by the keywords, the conversion rate from click to sale.”

Further innovations enhanced Google’s offering to advertisers. And the scale of Google and, increasingly, Facebook make their algorithms even more effective and attractive to advertisers. “These two global behemoths are forcefields so magnetic that they suck every penny towards them," wrote Tess Alps, chair of the TV research and marketing body Thinkbox.

And as Auletta put it in Googled, they were also helped in the early days by the complacency of publishers and advertisers:

“In 1995, Craig Newmarket launched craigslist.org, a website where people could post apartments for rent, job openings, services for hire, products for sale, dating invitations. It seems clear this posed a threat to newspaper classified sections, which produced about a third of their ad revenue. But newspapers usually saw craigslist as a quaint web bulletin board.”

In 1996, nine of the ten major US newspaper groups were invited to save their classified business by joining a network to sell advertising on the web. The advice was rejected. “Newspaper classified advertising plummeted from nearly 18bn dollars in 2005 to about nine billion dollars in 2008," Auletta wrote.

The end of the world as we know it

UK local newspaper publishers were almost equally slow to respond, according to Matthew Engel, writing in the 20th anniversary edition of the British Journalism Review (June 2009):

“By the millennium, the future of ink on paper as a means of communication was already starting to be questioned, but the new Big Four powers of the regional press pushed on regardless. They did invest in the internet but without any clear idea how this would pay for itself. There was an assumption their traditional small-ad revenue would migrate to the web with the readership. It didn’t.”

But what more could newspapers have done? In the early days, they should have responded to the challenge of the specialist websites, which were the first to eat their lunch. Local newspapers had ‘owned’ their classified advertising markets and could have held onto more of their revenue if they had recognised the threat earlier and acted smartly, though digital pennies would still not have added up to the print pounds.

But I believe there is little publishers could have done to stop Google and Facebook, which are in a different business and, indeed, league. The arrival of internet search and algorithm-based targeting really did mean ‘the end of the world as we know it’ for traditional media.

Most newspapers have now ‘gone digital’ and are trying to generate new forms of income: paywalls to replace cover price revenue; schemes to share editorial material with Google and Facebook (which, to the frustration of publishers, distribute – but don’t directly invest in – their editorial content); and, in the case of the Guardian, ‘membership’ to help fund its journalism.

But should advertisers now do more to help? Responding to news of the Guardian’s losses and Facebook’s gains, Thinkbox's Alps urged advertisers and agencies to consider the longer-term effect of where they spent their media money. “Do they really want a world where there is no national, quality journalism or culturally specific entertainment to place their ads in?”

Torin Douglas has been writing about advertising and media for more than 40 years, and was the media correspondent for BBC News for 24 years. If you missed the first part of this piece, 'Where did the advertising go?', catch up here.

This is an extract from Last Words? How Can Journalism Survive the Decline of Print? Edited by John Mair, Tor Clark, Neil Fowler, Raymond Snoddy and Richard Tait, and published by Abramis on 23 January at £19.95. Readers of The Drum can order copies at a special pre-publication discounted price of £15 from Richard@abramis.co.uk