UK’s 2023 ad spend growth slows to 0.5%

The projection, courtesy of AA/Warc, is down from a more optimistic forecast of 3.9% made in January.

The forecast won’t improve until 2023 H2

It’s bad news for UK marketers looking for a strong recovery in ad spend in 2023 after a few tough years of trading. After seeing the first Q4 spend decreases since the Great Recession, in 2022 (-5.8%), the “downturn… has continued into the first half of 2023”.

The quarterly report anticipates reduced growth expectations for nearly all sectors of advertising, paired with high inflation, the slowest growth of G7 nations, as well as a talent shortage.

Advertisement

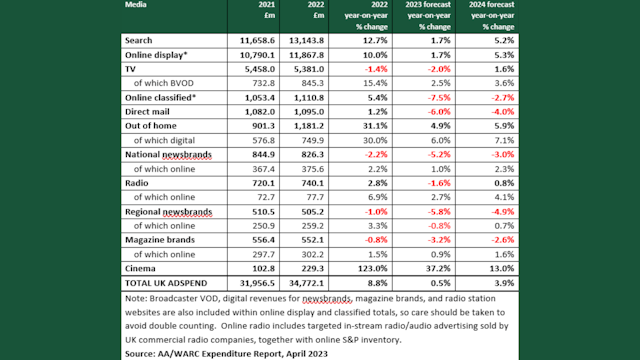

Last year saw growth of 8.8%, coming from a comparatively low base after a pandemic slump. The total spend figure was £34.8bn. The first half of the year was the strongest, before a worrying slowdown. The total ad market contracted by 5.7% in H2.

So the slow growth anticipated for 2023 of 3.9% is now 0.5%. That’s had a knock-on effect on the following year, of 3.9% growth for 2024, bringing us to £36.3bn. This will be a “more reasonable” rate of growth claims the report.

Despite the doom and gloom, there is still opportunity aplenty for marketers. AA/Warc assures that the UK will remain the third-largest ad market in the world. However, the nation is slipping. The UK is forecast to post the slowest growth among the top 10 ad markets this year.

Advertisement

Stephen Woodford, chief exec of Advertising Association, points out that we “narrowly avoided recession,” and adds that there are “very little signs of real growth”.

James McDonald, director of data, intelligence and forecasting at Warc highlights a significant moment. It’s the first time a sharp fall in social media spend has been recorded. He accounts that to “reduced advertising activity among the SMEs who comprise a ‘long tail’ of ad volume on social platforms and whose margins are under incredible stress as inflation bites.”

Suggested newsletters for you

Making the reality hit home, “one in every 202 UK companies entered liquidation in 2022 – the highest rate in seven years”. The spend is gone, in some respects, because the businesses themselves are gone. McDonald’s does not expect an improvement in trading conditions until H2 2023.

In general, money continues to flow toward digital channels but Elliott Millard, chief strategy and planning officer, Wavemaker UK, has found some actionable advice in the stats, based on the growth of OOH and cinema.

“The UK is more divided and polarized than ever before. We are deep in a cost of living crisis and have been in political turmoil. At the same time, advertising is less trusted than it has ever been.”

“At moments like these, people seek familiarity, they seek unification, and they seek togetherness. That’s why cinema and OOH are so powerful right now – they are public, which means they’re trusted, and they’re a shared experience which means that advertising (or at least the best advertising) is a part of that shared experience. The bravest brands will find ways to turn that to their advantage by being more public, more emotional and more unifying. And by doing that, they’ll be more trusted by the public during a crisis.”

The AA/Warc is a regular forecaster for UK ad spend, but it’s far from the only one.

IPA’s Bellwether recently released, based on a survey of 300 marketers, and it made for a somewhat less worrying read, although it hinted that a lot of the budget growth may be getting funneled into promotions, which in turn, if incorrectly activated, could impact revenue and future ad spend growth.