Clearpay memes branded ‘socially irresponsible’ by ASA

Buy now, pay later brand sanctioned by the Advertising Standards Authority (ASA) for memes encouraging consumers to spend money they don’t have.

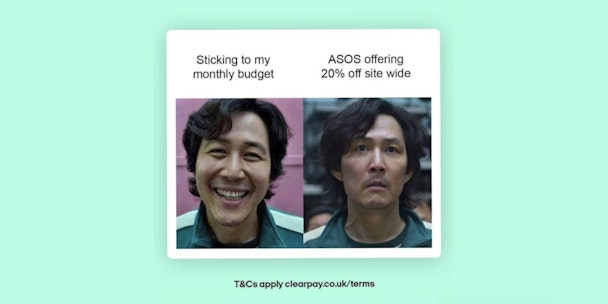

This Clearpay Squid Game Instagram meme has been banned by the ASA

Advertising watchdog the ASA has banned a series of Instagram posts by buy now, pay later company Clearpay for being “socially irresponsible” and “making light” of not having self-control when shopping.

One post had two images of the Squid Game character Seong Gi-hun, the first with the text ‘sticking to my monthly budget’ and the second reading ‘Asos offering 20% off site-wide.’ The post was captioned ‘*turns off push notifications* T&Cs apply http://clearpay.co.uk/terms #clearpay #LiveClear.’

Clearpay said the ad suggested turning off notifications to avoid irresponsible spending and that its intention was to educate about irresponsible lending.

Advertisement

Another post used the ‘Tell me without telling’ meme and encouraged Instagram users to tag a friend who has a ‘Clearpay addiction’ with the caption: ‘Remember to spend responsibly and return some of those!’

Clearpay said the emphasis on returning items was socially responsible marketing for promoting sensible shopping.

The most recent post featured a pie chart titled: ‘Why I need new clothes.’ The majority of the pie chart corresponded with the key that stated, ‘[insert brand here] is having a 40% off sale’ and a small section of the pie chart corresponded with the key that stated, ‘I need jumpers for winter.’ The post included the caption: ‘Why am I like this [woman raising hand emoji] #clearpay #shopping.’

Advertisement

In its defense, Clearpay said it used memes as the most effective way to engage with its young adult audience. It added that the ads would have only been seen by users who followed the account, and by following Clearpay users would have been familiar with the BNPL service.

The ASA overruled all of Clearpay’s objections, banned the ads and warned the company to ensure its future marketing doesn’t encourage people to spend money they don’t have.

In a statement to The Drum, Clearpay said: "Clearpay has strict guidelines to ensure our advertising does not encourage people to spend beyond their means and our business model is designed to support responsible spending."

Suggested newsletters for you

The ads were posted in October 2021 and January 2022. Since then the Financial Conduct Authority (FCA) has warned BNPL companies it would use criminal and financial penalties to crack down on social media advertising.

The intervention by the FCA has created some confusion over which body has regulatory responsibility over BNPL advertising. A legal consultant from Hashtag Ad, Rupa Shah, previously told The Drum the FCA had stepped on the toes of the ASA and that the advertising watchdog was the right body to handle these cases.