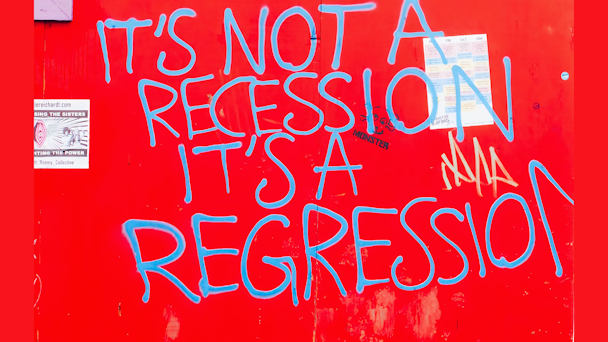

GroupM: war and recession won’t quite smother ad revenue growth in 2022

The latest GroupM mid-year advertising forecast has arrived, and there’s little adjustment on 2022 predictions from an ad revenue perspective.

The GroupM mid-year advertising forecast is here

Shrugging aside fears of a looming recession and the ongoing geopolitical ramifications of the war in Ukraine, the latest projection showed advertising revenues continuing their upward trajectory – good news for platforms, but perhaps a sign of inflating prices for buyers.

Detaching the ad industry from the broad strokes GDP figures, GroupM explained the divergence by pointing to a low unemployment rate, high household savings and a rapid rate of new business formation as grounds for optimism. This could be enough to ensure steady advertising growth even as interest rates rise and economic growth slips into reverse.

While GroupM was not so blasé as to believe no marketers will reduce spending, it believed that this will be offset by the profligacy of others.

In 2022 the ad industry is expected to grow by 10% (discounting US political advertising), in line with the December prognosis – even though China is now expected to grow at a much slower pace.

Looking further into the future over the next five years, India is likely to outperform with consistent double-digit growth, ahead of France, Germany, Brazil and Canada in the high single digits. All these nations will outperform the US, UK and Australia, where growth is expected to fall in the mid-single digits, with China bringing up the rear in the low single digit range.

Fueling growth will be digital exclusive platforms with 12% growth in 2022, albeit a significant drop from the 30% growth rate attained in 2021. Google, Facebook, Alibaba and Bytedance were among the top ad sellers last year, generating $408bn in ad revenue – or 53% of the global total. When traditional media’s digital operations are included the sector will account for $617bn of ad revenue this year – 73% of the total.

Other bright spots include television advertising, which is expected to grow 4% when the year is out, buoyed by the aggressive expansion of US streaming services into global markets with knock-on benefits for connected TV (CTV) budgets.

Out-of-home (OOH) advertising is also expected to log growth of 12% as the market finally exceeds its pre-pandemic mark.

UK ad spend ended 2021 on a high, up 30% on the year before.