E-commerce helps drive strong year of growth at Future plc

Fresh off its acquisition of Dennis Publishing, Future plc has revealed the extent to which its e-commerce proposition is accelerating the growth of the entire company. The publisher, which has a US expansion in mind, is building upon its expertise in affiliate revenue and subscriptions developed over the course of the past few years.

Future’s latest results demonstrate the impact of its investment in e-commerce

Future plc’s full-year 2021 report demonstrates triple-digit growth in terms of revenue and adjusted operating profit. While a rebound might be expected after 2020, the group lost no momentum as more regular habits returned in the second half of the year, with full-year revenue up 79% to £606.8m.

While UK organic revenue rose 17%, Future will be pleased with the 27% organic growth in the US, driven in no small part by the development of its acquired properties from TI Media.

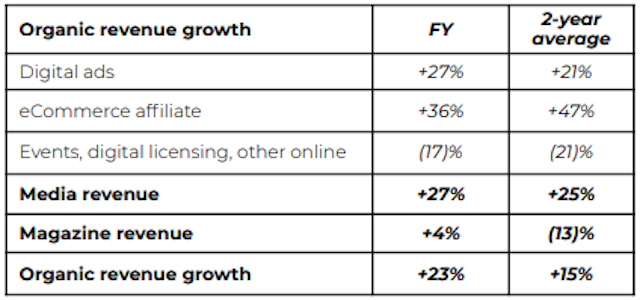

Over the past two years, the group has quietly become one of the key beneficiaries and drivers of the e-commerce boom among publishers. From these results, it is revealed that the group saw strong organic growth of its media portfolio, up 27%, with robust performance in digital advertising and e-commerce, an average growth over a two-year period of 25%. Specifically, e-commerce continues to perform well with growth of 36%, with a notably improved conversion rate in H2. Average organic growth over a two-year period was 47%.

As a result of investment in e-commerce tech and practices, Future saw improved intent with click-through rates up 75% year-on-year and improved conversion in the second half (+22%). The result makes it clear that such growth is based on continued development of technology including Aperture, its customer audience data platform, and improvements to Hawk, Future’s in-house e-commerce platform.

It says: “Whilst the backdrop of the last 12 months has been highly unusual, management believes that the trends noted above are largely reflective of the ongoing momentum in the business. As stated at the half-year, it is our view that the impact of the prolonged UK lockdown in January-March, coupled with the US government stimulus checks in the US, resulted in an estimated £5m of one-off Covid-19-related benefit to e-commerce revenues.”

Meanwhile, continued growth in direct advertising campaigns underpinned digital advertising organic growth of 27%, with average growth over a two-year period hitting 21%.

Future’s chief executive Zillah Byng-Thorne explained that the ongoing investment in e-commerce is part of its strategy of shoring up a diverse mix of revenue streams. “Our performance reflects the diversity of our revenue streams and our global reach and the operating leverage of our business model.

“We generated 23% organic growth in the period, driven by the strength of our trusted content, which continues to attract a high-value audience. The growth was accelerated in the US and we are confident about our ability to capitalize on the opportunity in North America to further strengthen and diversify our revenue streams.”

Byng-Thorne also mentions the group’s acquisition of GoCo Group, the parent company of Go Compare. The takeover is complete as of the time of the results being released, with the company now fully integrated and reportedly uplifting the rest of the portfolio. The results revealed £6m of cost synergies delivered in the year, with a further £8m to come during 2022 and £15m by the end of 2023. It also used the development of its proprietary voucher technology Eagle to bed that GoCo capability in across the wider portfolio.

It echoes a lot of the sentiment following the Dennis acquisition, with the implication that Future was set to use Dennis’s subscription expertise to benefit the rest of its media holdings. Analyst Colin Morrison noted “[it] creates the opportunity for Future to grow further and faster in the US and also in financial media. It is also expected to apply its successful e-commerce affiliate marketing skills to the new portfolio.”

Content created with:

Future

Find out more