How will Britons watch the Tokyo Olympics?

Audiences have more choice than ever when it comes to watching sport. While that’s great for audiences, it presents brands with a challenge when it comes to apportioning adspend. How do you decide the best message for your consumers when you don’t even know where they are going to be?

Which sponsors are cutting through with viewers?

The (belated) Tokyo 2020 Summer Olympics are set to begin later this month, and most of the nation intends to watch at least some of the many sporting events on offer. Data from YouGov Profiles suggests that over half of the public (54%) plan to watch the Games in some form or another.

In terms of how Britons intend to watch the Tokyo Olympics, nearly half (48%) say they’ll watch on free-to-air TV, while a third (34%) say they’ll follow the competition via online streaming or downloading. Over a quarter (27%) say they’ll use paid TV services, while one in nine (11%) plan to use catch-up, on-demand or recorded services.

Younger Britons who intend to watch the Games are eleven percentage points less likely to watch the Olympics on free TV (37%) compared to just under half of those aged 35-54 and nearly three in five (57%) of over-55s. This demographic is dramatically more likely to watch the Games via a livestream on a site such as BBC iPlayer or YouTube (50% v 37% of Brits aged 35-54, 21% of over-55s).

Patriot Games: Britons most likely to watch the Olympics to ‘support their country and athletes’

In terms of overall interest, most are not Olympic obsessives. Among those who said they plan to watch the 2021 Games, slightly under half (47%) said they were only ‘a little bit interested’, while under two in five (37%) said they were ‘somewhat interested’. Only 14% described the Tokyo games as a ‘top interest’.

When asked why they’re watching the Games, the most popular reason given is ‘to support my country and athletes’ (47%). More than two in five (44%) say they just plain love to watch the Olympics, while a third (34%) described ‘watching the best athletes compete against each other’ as a reason to watch the Games. The relative infrequency of the Summer Olympics when compared to other annual events may also work in its favor: a third (33%) also said the fact that the competition only comes around once every four years was a key motivation for watching.

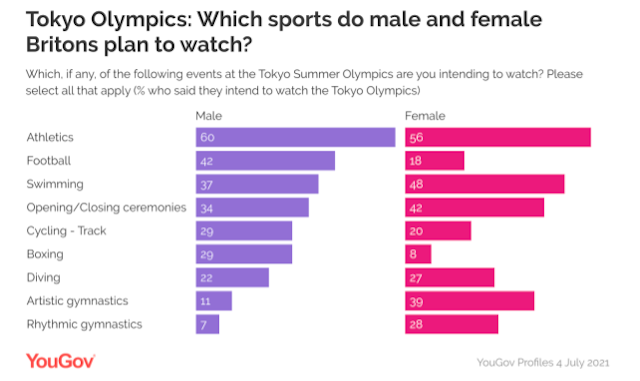

As for the specific events Britons will be watching, nothing comes close to athletics. Among Britons who say they’ll watch the Games, nearly three in five (58%) plan to watch the track and field, road running and racewalking contests, with swimming (42%) a distant second and the opening/closing ceremonies even further away in third (37%). While Britain is not entering a men’s team this year, football comes in fourth (31%), with diving a close fifth (29%).

Along gender lines, men and women have meaningfully different preferences when it comes to the Summer Olympics. While both sexes favor athletics (Men: 60%; Women 56%), male viewers are significantly more likely to favor football (42% v 18%), track cycling (29% v 20%) and boxing (29% v 8%). Women, on the other hand, are more likely to watch swimming (48% v 37%), the opening/closing ceremonies (42% v 34%), artistic gymnastics (39% v 11%) and diving (27% v 22%). Sponsors should therefore keep these demographic realities firmly in mind.

It’s also worth noting that globally, as our recent white paper on women’s sport revealed, women – who often hold household spending power – are significantly more likely to look favorably on brands supporting women’s sport than men’s (36% v 26%).

Which sponsors are cutting through with viewers?

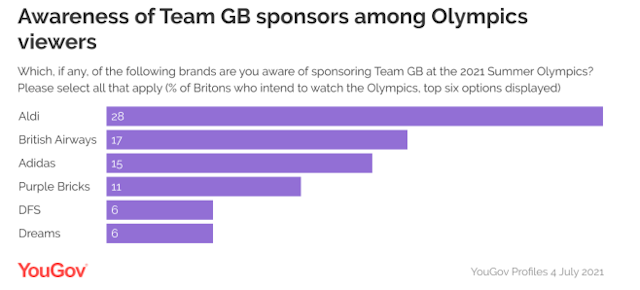

Ahead of the Games, there appears to be budding awareness of major sponsors – which suggests the money has been well spent. When it comes to the overall tournament, viewers are most aware that Coca-Cola (34%), Visa (26%), Samsung (20%), Toyota (19%) and Omega (13%) are sponsoring the Tokyo competition. Zeroing in on Team GB, three in ten would-be viewers know of Aldi’s sponsorship (28%), with BA a distant runner-up (17%) and Adidas a somewhat closer third (15%).

The property company Purple Bricks (11%) comes in fourth in terms of overall awareness, while the furniture retailers DFS (6%) and Dreams (6%) place joint-fifth. We’d expect these awareness figures to increase as the Games begin.

In the sports sponsorship world, ‘brand value synergies’ is a magic phrase for a reason, and our data shows that the public notice when a brand’s values don’t overlap with a sport’s. Of would-be British Olympic watchers, 61% say ‘the brands that sponsor sports don’t make sense’ (although it’s worth pointing out that this applies to sport generally and not the Olympics specifically).

These viewers are also more likely to want special discounts from sporting sponsors (31% v 23%). For those looking to attach themselves to a sports property, it’s worth remembering that authenticity counts. Brands that make the effort to create relevant, targeted marketing, advertising and special offers for Olympics viewers could bring home the gold this summer.

Amelia Brophy is head of account management at YouGov.

Content created with:

YouGov

At the heart of our company is a global online community, where millions of people and thousands of political, cultural and commercial organisations engage in a...

Find out more