US viewers’ AVOD appetite slumps as ‘seasonal’ viewing takes root

A seemingly unstoppable rise in the number of US viewers vacuuming up all the streaming video content they can train their remotes on has fallen into reverse with the user base for advertising-based video on demand (AVOD) services slumping from 93% in November 2020 to just 83% today.

The market is now entering a new era of cemented viewing habits and consolidation

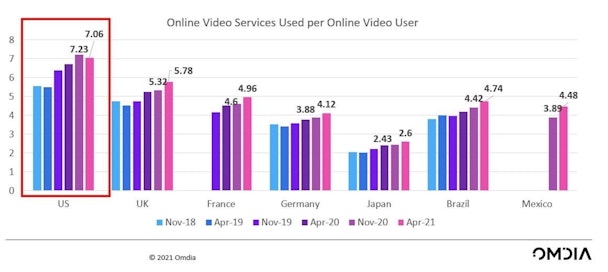

The precipitous double-digit fall is echoed by a drop in the average number of video streaming services embraced by individuals for the first time, dropping from 7.23 in November 2020 to 7.06 in April 2021.

Streaming services can no longer defy gravity

-

A cooling-off period was inevitable following a period of runaway growth, and reflects that the market is now entering a new era of cemented viewing habits and consolidation following the rampant proliferation of new streaming services and content.

-

Now a new report by Omdia suggests we are entering a period of retrenchment, with consumers beginning to turn away from AVOD in favor of paid alternatives.

-

Senior research director Maria Rua Aguete, speaking at the Connected TV Summit 2021, said: “After the 2020 explosion of VOD growth, we’re seeing a cooling of the market, partially driven by viewing habits normalizing and industry consolidation, but also from a wealth of new SVOD and studio services.”

-

Omdia attributes a softening of demand not to streaming fatigue, but instead to a long-anticipated realization among consumers that they can be ‘seasonal’ in targeting their monthly subscriptions towards specific content by taking advantage of easy-going sign-up rules which permit individuals to come and go as they please.

US leads the way

-

The highly influential US market is seen as an early indicator for the direction of the global market, where the number of online services per home continues to rise at a breakneck speed, hitting 5.78 services per user.

-

News that this growth trajectory has now stalled at 7 across the pond will leave many pondering whether this is the magic number for the maximum number of streaming services individuals are prepared to use.

-

US TV companies have been engaged in a stampede to corner the AVOD market, with a succession of deals from Disney’s integration of Hulu to Fox acquiring Tubi and NBC launching Peacock all making waves in 2019-20.

-

Other significant market entrants include Viacom CBS, which acquired Pluto TV and relaunched CBS All Access as Paramount+.

-

This headlong rush has come at the expense of broadcast networks and cable channels, which have been increasingly starved of investment as bosses switch their attention to the latest hot young thing.

Pay TV holds its ground

-

Away from the streaming drama, traditional pay TV services have held on with a broadly stable performance between April 2019 and April 2021, slipping only slightly in that period from 59 to 57%.

-

By comparison, AVOD slumped from 92 to 83% over the same period, while SVOD increased from 73 to 80%.