eMarketer: US Connected TV Upfront spend doubles to reach $4.5bn

While the traditional US TV Upfront market is expected to stabilize, it is spending on connected TV (CTV) and digital video advertising that is truly set to soar, according to exclusive eMarketer data. Tubi, Pluto TV, Roku, Hulu and YouTube are expected to be flush with committed dollars while the broadcasters will enjoy a return to pre-pandemic spending.

Tubi, Pluto TV and Roku are going to have a very lucrative Upfront season, according to new exclusive eMarketer data

Tubi, Pluto TV, Hulu and Roku are going to have a very lucrative Upfront season, according to new exclusive eMarketer data. US CTV Upfront spending is expected to double this year to $4.5bn. The figure is comprised of dollars committed in advance to ad-supported video-on-demand services (AVOD) including spending from the TV Upfronts, the IAB NewFronts and other meetings and events.

“CTV viewership has been exploding. It’s becoming less and less of a TV Upfront and more of a video Upfront,” says Eric Haggstrom, senior analyst, forecasting at Insider Intelligence/eMarketer. “CTV is one of the fastest growing areas within the digital ad market and, obviously, the overall ad market in general.”

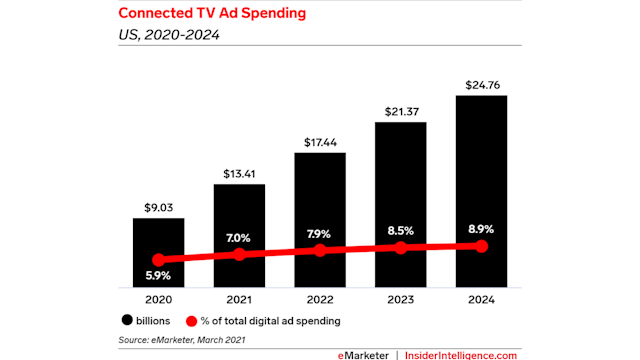

This CTV spending trend is expected to continue with eMarketer calling for $6bn in 2022 Upfront dollars. Overall, CTV ad spending is projected to hit $13.4bn this year, $17.4bn next year and $21.4bn in 2023.

There are a number of factors working in CTV’s favor this year. “A lot of the networks have been launching these new services. For the ad-supported services, in particular, they have been selling a lot of that inventory in the Upfront because it is very premium and it’s new,” says Haggstrom. “If you look at what’s happening with Disney+, Hulu, Peacock – there is a lot of investment in these services and the ad dollars are following.”

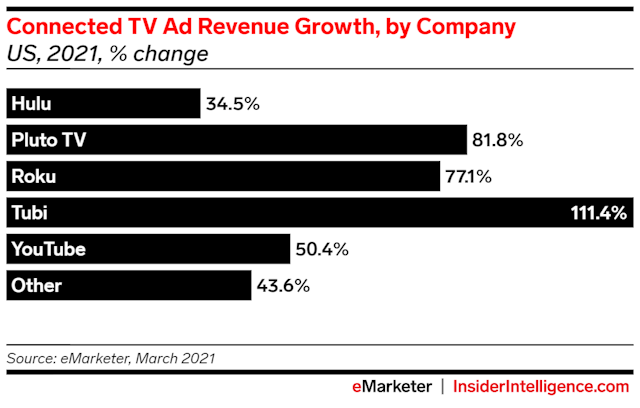

The biggest gainers for the year are expected to be Tubi (+114.%), Pluto TV (81.8%) and Roku (77.1%), per eMarketer projections. The allure is simple. Overall, these established players, as well as the never competitors, “offer better ability to target, as well as a unique audience that you can’t find on linear TV,” says Haggstrom. “Generally, a lot of these people are cord cutters, cord nevers or cord shavers, whatever fancy term you want to call them. Ultimately, they are watching less linear TV and are more difficult to reach.”

Snap and digital video ad spending explodes, TV returns to ‘normal’

CTV isn’t the only rising medium enjoying a surge. US Upfront digital video spending is expected to soar 42.5% to $6.9bn this year. What’s more, it’s expected to rise to $88bn in 2022.

“Non-CTV digital video ad players are starting to become more engaged as well,” says Haggstrom. “I would call out Snapchat specifically as a company that has been selling a good amount of Upfront digital video inventory. Snap has a rather compelling pitch to advertisers based on their demographics, targeting abilities, and they have been reaching out to TV advertisers aggressively. A number of their execs have come over from Hulu and some of these major TV players as well.”

Smaller players in this space, including Twitter, Facebook and TikTok, have also seen momentum. As has YouTube which is, of course, the biggest player.

And then there is the tried and true, as well as expensive, broadcast TV ad spend. The anchor of the Upfronts has stabilized at $19.9bn, which is slightly above 2019’s $19.2bn total. Last year spending sank to $18.5bn. This figure includes TV ad spending resulting from the national primetime TV Upfronts including broadcast networks and cable channels. It also includes digital spend as related to the major broadcasters.

Haggstrom says: “The big story is the TV Upfront is going to recover compared to last year, but the bigger story is everything is increasingly becoming more digital.”