Imagine there's no Facebook, where's the easy media buy?

More than 1,000 advertisers have pulled spend from Facebook this month as part of a mass boycott over its content policies. Let's imagine for a moment that this movement gains greater momentum; that SMEs, publishers and 2.6 billion users follow suit. If marketers were to make their temporary boycott a lasting one, where would they spend their money instead?

Media imagines a world without Facebook - where would the ad spend go?

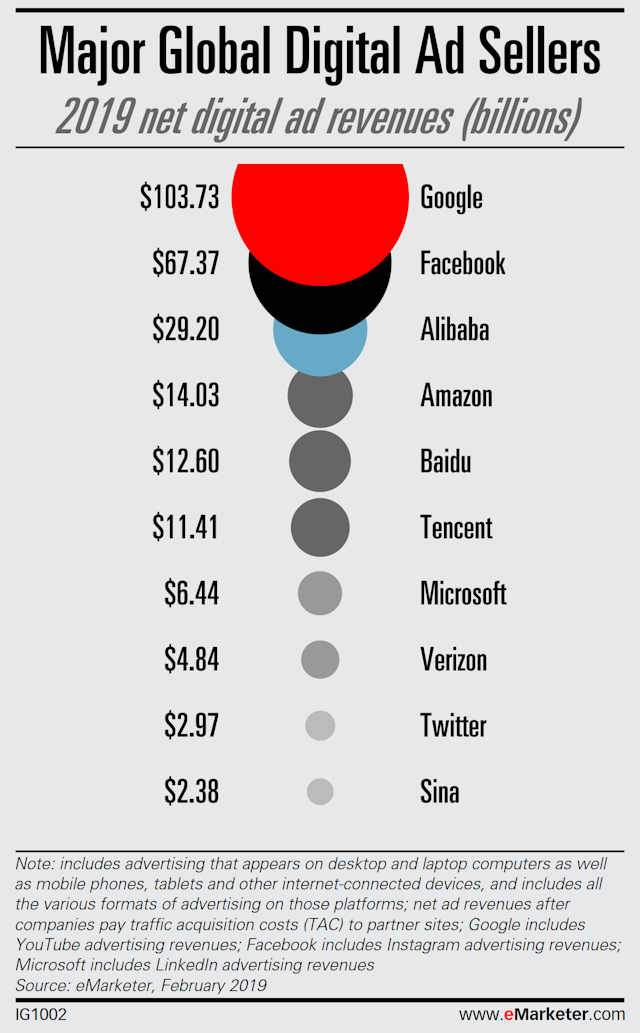

Before we play fantasy football with ad budgets, it's important to quantify just how far Facebook's revenues could go. "Senator, we run ads," chief executive Mark Zuckerberg drily told Congress in 2018 when asked how the company makes money. Facebook and Google then accounted for 63% of all online ad spend. In 2017, they both hoovered a fifth of all global ad spend. In the first quarter of 2020, Facebook's ad revenue stood at $17.44bn.

With this quarterly pocket change, SpaceX could launch 306 Falcon 9 vessels into space. Or combined with its Q4 2019 ad revenue, Facebook could just buy SpaceX. For the same sum, it could snaffle up both Slack and WeWork and reinvent the modern workplace.

So great is the quarterly ad revenue that flows into Facebook that a third of it ($5bn) could reportedly wipe out African hunger for a while.

Facebook’s income is almost exclusively tied to the ad product. Revenue marked ‘other’ (mostly hardware like Portal and Oculus) accounted for a mere $297m in the first quarter of 2020. This chart from eMarketer best shows Facebook's scale.

So imagine if the boycotts continued, and the war chest dried up. Imagine if, after the revolution, media buyers redistributed the wealth. Who would benefit?

Google wins again?

Myles Younger, senior director of marketing at media consultancy MightyHive, believes that YouTube would be a "clear choice" to take much of the spend.

"It may not be a traditional social network, but it is definitely a community, and at 1.7bn users, it’s one of the world’s largest digital communities. Facebook is strong on psychographic and demographic targeting; ditto YouTube, with all its content niches and recommendation-engine-fueled rabbit holes.”

It's easy to use and everyone uses it.

E-commerce?

Luke Judge, UK and US chief executive at digital marketing Incubeta, also thinks spend will funnel into the next biggest thing.

“We’d most likely see big brands invest in digital video ads with dynamic creative for CTV or YouTube," he says. SME retailers, in particular, are shifting towards the likes of Google Shopping, Not on the Highstreet, Etsy and eBay. “As we see more brands turning to short-form video, its likely SMEs will have an even greater reliance on YouTube.”

But maybe Amazon benefits. Its ad product is sneaking up the earnings chart, it benefits from being a storefront, a media owner and an ad giant after all. The duopoly has long-threatened to become a triopoly.

Judge says: “The issues of the past wouldn’t vanish with Facebook, there will still be problems with brand safety and I suspect Google would still remain cautious and steady its ground. But I can definitely see it giving up more space for Amazon to make a bigger impact on the industry.”

Paul Frampton, president Europe of Control v. Exposed, notes that a "majority" of direct-to-consumer (DTC) brands are heavily reliant on Facebook and Instagram "to drive discovery and purchase".

"Savvy DTCs, who are highly skilled in performance marketing, would find adequate alternatives most likely by shifting spend to the mid-funnel and mastering programmatic including connected TV."

Other social platforms?

Digital ad veteran Jon Mundy outlines what Facebook's social rivals need to offer to win as the alternative. “Google and Amazon are both able to give smaller businesses the targeting that they value from Facebook."

Larger brands may explore new platforms like Twitch (Amazon-owned remember) and TikTok (which has launched a particularly aggressive assault on Facebook but faces regulatory pressure). Neither is the place to replace Facebook's boomer audience though. Furthermore, there would be a battle to wean SMEs off Facebook’s “metrics and ROI” narrative.

Patrick Johnson, chief executive and chairman of digital ad agency Hybrid Theory, thinks "it is unlikely" that brands will simply ‘switch’ social media platforms at they “often provide little to no control over what their advertising will appear next to.

"They will instead prioritise channels that give them control of the ad, its context, and where they can carefully target the right audiences."

Matthew Goldhill, chief executive of Picnic, the first ad marketplace made of exclusively Google AMP pages, says that competitors have been picking apart Facebook’s ad model for years.

“Snapchat and TikTok, for instance, have both combined a highly immersive user experience with strong targeting and excellent, integrated formats, and both have identified brand safety as a priority.”

But they are not alone.

Will the media seize back spend?

With the decay of the third-party cookie, publishers’ relationship with audiences could be more desirable, with or without Facebook’s sudden disappearance.

Goldhill sees some rays of sunshine.

“News sites such as The New York Times, The Washington Post and The Guardian have well-constructed ad experiences alongside considered editorial policies, compared to Facebook’s ‘neutral’ – yet demonstrably harmful – network of clickbait and malicious falsehood.

"Scattered across the web, they don’t add up to a Goliath-slaying solution any more than a big-brand boycott does. But they are steps in the right direction."

Trying to form that Goliath-slaying solution across the media is The Ozone Project, the UK's leading ad alliance between top news brands and publishers. It claims to reach 99% of UK online adults every month. This is technically a deeper penetration than Facebook, with much less frequency.

Its chief revenue officer Craig Tuck said that brands went to Facebook for “broadcast-scale digital audience, in a known environment with engaged audiences”.

Who could provide that now?

It was a lack of trust and inaction that sparked the Facebook boycott. Tuck, naturally, positions Ozone as the alternative to Facebook spend: “We have the added assurance of advertising appearing in highly trusted, regulated environments alongside professional, editorially governed content.”

Emily Brewer, head of publishing at Teads, is on the same bandwagon. Perhaps spend would return to open web – “minus the guarantees or the trust needed to activate scale driven campaigns," she caveats.

“Clients would demand simple ways to tap into scale while guaranteeing the business outcomes that Facebook currently delivers.”

It’s a big ask.

Local media?

Maybe the scale comes from joining many local media into a single network. In the US, Vox Media and NBC Universal are trying to join the dots between cash-starved outlets.

Chris Waiting, chief executive of academic-edited title The Conversation, wonders if there would still be a sustainable local press if Facebook hadn’t scooped up SME spend.

“Local papers were how you found out the football results, the cinema listings, what the mayor was up to, or which pillar of the community had passed away. You'd use it to list a job, buy a car, find a restaurant - and businesses would pay to reach you.

“Facebook has none of the civic connection that local media once provided - money from local advertisers isn't reinvested in the community. It's siphoned away to enrich distant investors.”

Kristy Schafer, vice president of Americas at data management platform Permutive would like to see the money go back into quality journalism. “Publishers hold the keys to the future of advertising. They have the legal and technical relationship with the user. This puts them in a unique position to target users through a first-party relationship while respecting their privacy.

"In the long run, this will – when there are no more third-party cookies to rely on – be the currency for online advertising.”

Influencer communities

But perhaps, the question isn’t about choosing a platform or geography. In the influencing space, you could handpick creative and audience. This can be scaled up through publishers if need-be.

Oliver Lewis, group managing director and founder of News UK’s influencer agency The Fifth, urges investment to go directly into talented people who have “genuine cultural influence that are trusted by their audiences, have the ability to transcend channels and are creative with their format”.

Of course, he would though. He pointed out that there's probably more benefit putting money in a creative partner's pocket than Facebook's.

So what of Facebook?

Julia Smith, founder of The Digital Voice, thinks there is a window of opportunity to "balance up what has definitely been one-sided for a long time".

It's a race to deliver the best experiences, interactivity, reach and targeting, all wrapped up with trust and transparency.

In reality, however, Facebook isn't going anywhere, even if its advertisers are – for a while. Rather than permanent pivots, brands are likely to simply turn to these alternative platforms in the meantime before returning to Facebook in due course.

That's what one high-profile figure in this drama is convinced of, at least.

"My guess is that all these advertisers will be back on the platform soon enough."

The name of that media titan who can't imagine there's no Facebook? Mark Zuckerberg.