Post-pandemic, will consumers really remember how brands behaved during lockdown?

In the immediate aftermath of the UK government introducing a nationwide lockdown, compelling all but “key workers“ to stay at home, several high-profile business bosses came in for criticism for seeking ways to stay open. But will such controversial moves hurt their brands in the long-term?

Will brands pay price for failure to act appropriately?

Among the those facing the greatest criticism for the response to Covid-19 was Wetherspoon’s. Just a few days before the UK’s lockdown (24 March), the chain’s chief executive Tim Martin urged the government to keep pubs open and played down the risk it posed to the spread of coronavirus. When this call fell on deaf ears, the outspoken boss issued a video message to 43,000 staff informing that as a result of the forced closure they would not be paid until the government first reimbursed the company – which has an annual turnover of £1.8bn – through the furlough scheme. He suggested they find a job in Tesco instead.

Elsewhere, the Frasers Group faced similar criticism for its response after billionaire boss Mike Ashley lobbied the government to keep stores, which include Sports Direct and Evans Cycles, open. In a letter sent to staff, the company claimed that it would be critical as people take up “home fitness”, citing the fact it was trending on social media as evidence of its importance to households, and that “demand” for products would be up. It reportedly hiked the price of home gym equipment. However, amid a backlash from employees, MPs and customers over its disregard for government protocol, Ashely was forced to issue an apology and eventually it shut down its physical stores.

And in yet another example of the decisions of a billionaire boss backfiring, Virgin Atlantic found itself under a harsh spotlight over the past month for the decisions made by Sir Richard Branson. At the beginning of the crisis, he asked over 8,000 staff to take unpaid leave and has since faced fierce criticism for appealing to the UK and Australian governments for a loan to keep it afloat. Many MPs, commentators and members of the public have suggested that Branson – worth an estimated $4bn – should be willing to draw on his own vast reserves to keep the business running rather than rely on the taxpayer. He has since issued clarity on his own tax arrangements, which have come under scrutiny in the past, and offered to put his private island up as collateral in a bid to sway the general public and governments.

According to a report recently issued by Edelman delving into the public’s trust in brands during the coronavirus pandemic, the actions brands take will be remembered by consumers long after lockdown has lifted. Over two-thirds of respondents (65%) to the report suggested that the way a company responded to the crisis would have an impact on the likelihood of them buying its products in the future. A further 37% of respondents claimed to have switched brands or used a new brand as a result of the way it responded to the outbreak.

Morrisons, Apple, Pret a Manger, Marks & Spencer and Co-op, by contrast, have all been praised for the measures they’ve taken to keep staff and customers safe and financially supported as well as trying to give back to local communities and key workers.

Research like Edelman’s should arguably be taken with a pinch of salt, argues Craig Mawdsley, joint chief strategy officer at AMV BBDO. “The fact is that people have a lot more to worry about in their lives than what brands and companies are up to. If you ask them, then of course they will say it matters. But are they really thinking about that right now when they’re worried about their own jobs and whether they can feed their families?”

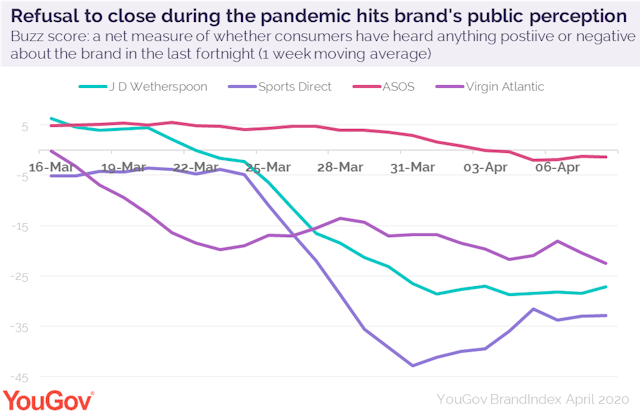

Despite Mawdsley’s misgivings, there has undoubtedly been a PR price to pay for companies that have hit headlines for their perceived failure to act appropriately. According to research from YouGov commissioned by The Drum, Virgin Atlantic, Wetherspoon’s and Sports Direct have suffered reputational damage.

Between 16 March and 8 April, Wetherspoon’s Buzz Score (a YouGov metric that measures whether someone has heard something positive about the company) had fallen from +6.3 to -27.1. Sports Direct’s score sat at a steady -3.9 until 24 March, before it slumped 39 points to -42.9. Ashley’s hasty apology coincided with an improvement of the score by 11.3 points to -31.6.

Finally, Virgin Atlantic’s Buzz Score dropped from -0.2 to -19.8 in the week leading up to lockdown and has continued to fall to a low of -22.5.

But would consumers change their buying habits in future as a result? Probably not according to some brand experts.

“There is little doubt that public sentiment seems hyper-aware of the behaviours of certain brands, and it has spread through both social and traditional media when there has apparently been a misstep by the likes of Virgin or Wetherspoon’s,“ says Rob Sellers, chief growth officer at ad agency Grey London.

“But how long is the collective consumer memory, and will the consumer attitudes we’re seeing towards certain brands right now have any bearing at all on the success of those businesses when we get back to something resembling the previous social and economic conditions we were enjoying before the virus hit us? I think it’s a case-by-case basis, but on the whole I honestly think that ‘the market’ has short memories.

“Will people annoyed at Virgin’s treatment of its staff genuinely not book tickets if the airline is running flights to the destination they want to go at a price they are happy to pay? I’m not sure. Will the average man on the street walk past his normal Wetherspoon’s when it reopens just because the chattering classes tutted at an initial dismission of sensible government guidelines? Nah. Even brands where more discretion and consideration drives the purchase decision can overcome historical black marks. One only has to look at Volkswagen. That went from Third Reich to hippy culture in one short generation… now it has to deal with more recent scandals, which it will recover from.”

It’s a sentiment echoed by David Frymann, strategy partner at Frontier, part of The Beyond Collective. He pointed to the usage of Facebook despite the Cambridge Analytica scandal and subsequent mauling Mark Zuckerberg received from governments on both sides of the Atlantic on its data practices. And post-lockdown, Frymann doesn’t anticipate these companies will have to woo customers back, except maybe in the case of Virgin Atlantic.

“Were the brands’ actions and the negative PR at odds with or in line with their core image? Wetherspoon’s is known as a cheap place to drink – not paying staff reinforces its perception as a cost-cutter, so in the future it will still spring to mind as the place to go for a cheap pint. Same goes for Sports Direct,” he continued.

“Virgin is a harder one to call. The brand’s equity in the eyes of its employees appears to be so high that according to Forbes they’d rather see the company survive than be on short-term full pay. I think everyone would expect more from Virgin. Especially given Richard’s musings on us all being human beings not human doings.

“As its actions are at odds with what you’d expect from Virgin, it probably does need a comms response if it hasn’t managed to overturn the negative PR with the positive PR surrounding its cargo flights flying PPE across the globe.”