Private equity firms continue to dominate marketing M&A with North America most active

The ad networks again were outmuscled in the marketing mergers and acquisitions (M&A) space by private equity firms. In the first half of 2019, five of the seven most active marketing M&A movers were private equity investments.

Five of the seven most active marketing M&A movers were private equity firms in first half of 2019

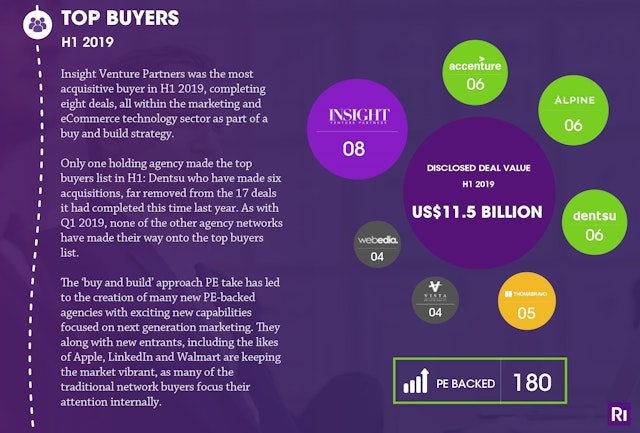

There were 180 private equity M&A deals across marketing services and marketing technology in the first half of 2019, accounting for around a quarter of the 746 deals captured by Results International.

Just under half of the private equity deals in Q2 2019 were the result of ‘buy and build’ strategies; integrating new capabilities into an existing brand.

In the year so far, Insight Venture Partners topped the chart with eight complete acquisitions in marketing and e-commerce.

It was followed by Alpine Investors, with six deals. Accenture was the only management consultancy to make the top buyers list, boasting six deals, matching Dentsu, the only holding group to make the top movers.

Accenture pursued creative agencies, snapping up Droga5, Shackleton and PXP/X. This consultancy cum creative trend was also illustrated by Deloitte’s acquisition of digital marketing agency Pervorm and KPMG’s acquisition of the Love Agency.

The most active sector in the second quarter was advertising and creative. It saw 115 (or 53%) of deals.

Meanwhile, WPP's Kantar sale went through just after the six-month window.

Results International pointed to the third largest ever deal in the marketing sector and the biggest of the year, Publicis Groupe’s acquisition of Epsilon at $3.95bn.

North America was the most active target region with 169 deals in Q2 2019. This was down slightly year-on-year by six deals.

Julie Langley, partner at Results International, said: “Private equity has been a key driver in marketing industry M&A for some time now, as PE buyers are increasingly comfortable with the sector.

“The ‘buy and build’ approach has led to the creation of many new PE-backed agencies with exciting new capabilities, and they’re combining with new entrants, including the likes of LinkedIn and Apple, to keep the market vibrant as many of the traditional network buyers focus their attention internally."

Langley concluded: "We’re seeing an increasing range of formats for engaging with customers, with marketers ‘bleeding’ across markets and channels, and the acquisition appetite is for agencies that have the technology, creative ability and capabilities to manage this process at scale.”