Marketers are wrong to write off TV, research finds

TV has many marketers conflicted. “They want addressable and attribution and want to cut linear budget,” Justin Evans, vice-president, data strategy, for Comcast Spotlight, told The Drum. “Then, at the water cooler, they’re talking about all the shows they’re binging on.”

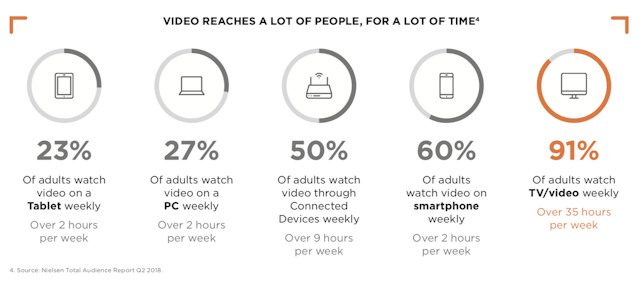

91% of US adults watch 5 hours of TV a day

The reality is, with the abundance of TV content and the myriad ways to access it, adults are watching more TV than ever — 91% watch more than five hours a day in the US, according to Nielsen. That’s 65% more time than adults spend with non-video digital.

“Why would you want to invest in new tools in a medium that you think is ‘dying’?" Evans asked rhetorically, pointing out that, in fact, the opposite is true. TV is being reborn through content, distribution, and data. Comcast Spotlight calls it The New TV.

Evans explained that the shift to New TV started with the likes of the Sopranos — premium content on pay cable channels such as HBO — that boasted the sophistication of a feature film. Over the ensuing years that quality became available on basic cable (e.g. Mad Men on AMC), and then through subscription video and streaming services.

“Today’s TV is virtually unrecognizable to traditional shows,” Evans told The Drum.

Producers are investing in content quality and quantity today. Producers spent about $67bn on new content in 2018, according to MoffettNathanson Research. And FX Network research shows there were 495 scripted series produced in 2018. “There’s not only great content to choose from as a viewer, there’s lots of it,” Evans said.

And, there are countless ways to access that content — from a 50-inch wall-mounted TV to a smartphone; from cable to OTT; from networks to streaming services. All this choice is enabling that five-hours-a-day TV habit.

But what really sets New TV apart today is data, Evans said.

Data is available from a variety of sources, including advertisers, cable and satellite providers, measurement providers (e.g. Nielsen), set-top boxes and TV manufacturers. Accessing that data in a privacy-appropriate way, the report points out, allows marketers to segment beyond the broad demographic swaths of age and gender toward more targeted audiences, such as those in-market for a specific item. This approach equates to a shift from a content focus (advertising based on the programming and broad segments) to an audience focus (ads based on consumer data for targeted reach).

“You can drill down in a geography, say, Portland, to consumers who are looking for a truck, and now you’ve gone from TV delivering top-of-the-funnel awareness to the middle or even lower funnel. You’re seeing those who are ready to buy,” Evans said.

According to Comcast Spotlight’s report 'The New TV: Redefining Video for Viewers and Advertisers,' in one test that tracked website visits during a campaign, using a mix of audience- and content-based targeting led to a 13% lift versus content-based targeting alone, which saw a 5% lift.

The ability to track results and provide attribution is part of the next stage in New TV: TV as a full-funnel solution. “Attribution will make TV as accountable as digital is today,” Evans said. “Big data is revolutionary in the TV experience for advertisers and viewers.”