Hulu, Roku look to grow ad revenue by 2022, but hurdles continue to stifle programmatic growth

Hulu and Roku have planned to grow their ad reveunes to reach the reported 204 million Americans expected to watch connected TV by 2022, an eMarketer study revealed.

Even though the amount of people using CTV looks to significantly over the next few years, marketers haven't bought in yet / Thought Catalog via Unsplash

That number is expected to make up over 60% of the US population, with over 183 million viewers already added to the US connected TV audience this year. However, even with consumer adoption rate and demand for connected TV ads, brands stuck in the web of TV fragmentation have not been able to keep up.

This year, The Drum’s focus on video’s future has highlighted some of the issues marketers have faced in recent years to address the proliferation of OTT, CTV, streaming services, and other platforms all jockeying for viewers’ eyeballs and attention. The growing amount of Americans watching through connected TV may have increased, but not to the scale that some marketers feel comfortable in to reach them.

Measurement and attribution have been a well-documented struggle for TV networks with the growth in streaming services. Yes, this has led to ABC, NBC, Turner and others building cross-platform infrastructures to ensure a proper revenue flow and address brands’ need to get consumers attention. But the reliance of older standards set forth by Nielsen among others has made it tough for marketers to find ways to bring connected TV into the fold.

Programmatic ad buys have been talked about as a solution — The Drum’s Programmatic Punch made note of how some players like Verizon-owned Oath have found results through that method. According to eMarketer’s data, even though majority of growth potential in digital video comes from that space, connected TV sales mostly take place through private sales and real time bids, hindering growth.

The lack of variety has made it easy for ads via CTV to air repeatedly — an overcompensation of the lack of reach viewers have compared to their linear TV counterparts. Even so, Hulu and Roku have both found success in these troubling times, and expect to grow even further in the coming years.

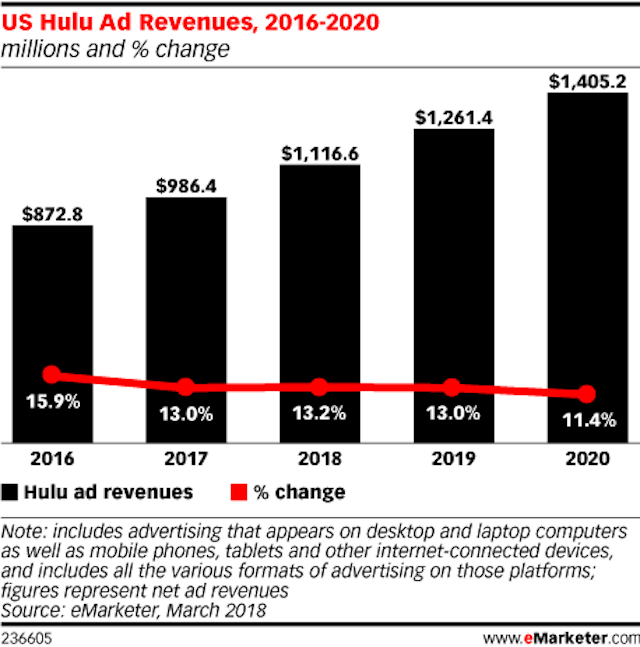

By 2020, Hulu’s ad revenues should reach $1.4bn, up from its current level of $986.4m this year. That marks a forecasted double-digit growth for the rising streaming service, which includes its on-demand and live TV functions across desktop and mobile.

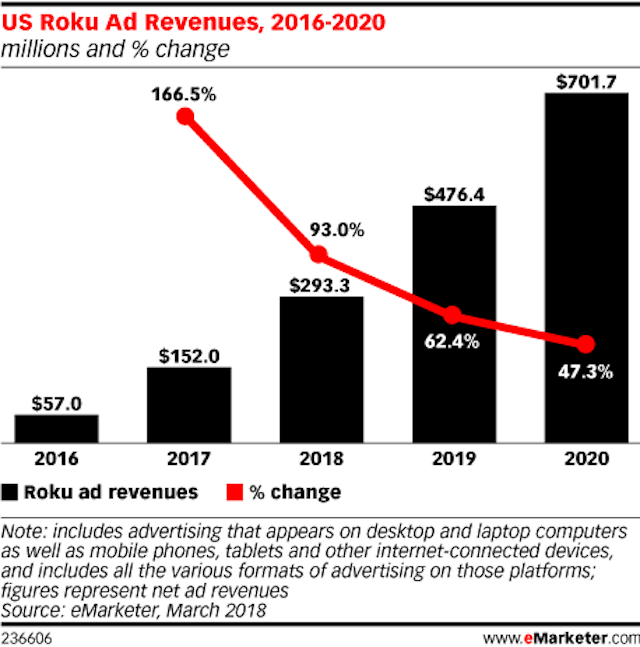

Roku’s ad business is much smaller than Hulu’s, but its potential for growth is even higher. It's currently on pace to make $150.2m in revenue by the end of 2018, but look for the company's revenue to skyrocket to about $701.7m in 2020. Ad products sold by the company include home screen ads during device powerup, sponsorships, and in-stream video. The latter, according to the study, has been increasing in adoption lately.

The potential for brand-side marketers to take advantage of this massive, and rapidly increasing, shift in consumer viewing habits is there, but it seems to require a lot more heavy lifting to coordinate proper marketing tactics across the screens.

Content created with:

Hulu

Hulu is an American subscription video on demand service owned by Hulu LLC, a joint venture with The Walt Disney Company, 21st Century Fox, Comcast, and as of August...

Find out more

Roku

Roku pioneered streaming to the TV. We connect users to the streaming content they love, enable content publishers to build and monetise large audiences, and provide...

Find out more