ITV restyles itself as ‘more than TV’ – now it needs to find more than advertising

“More than TV” is how Carolyn McCall describes the strategy she’s been working on for ITV since becoming its chief executive in January. It could just as easily be called more than advertising.

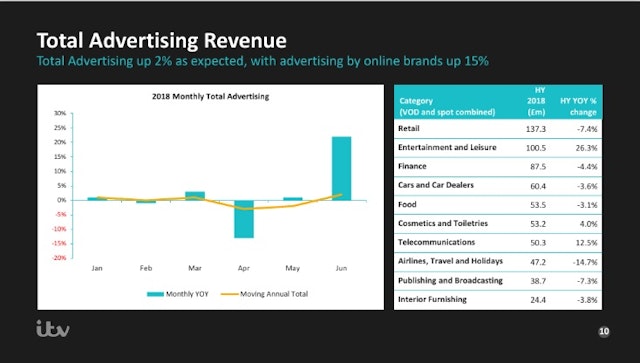

On the day ITV trumpeted that its ad revenues were up 2%, McCall chose to give investors a first glimpse of her “strategic refresh” for the broadcaster which includes launching a Netflix-like streaming service and creating a “direct to consumer” business to reduce its dependence on advertising.

For while ITV’s advertising bottom line has been buoyed by Love Island and the World Cup this summer, McCall knows it can’t ride that wave forever.

In fact, much choppier advertising waters appear to lie in wait now Gareth Southgate’s waistcoat has been relegated to the bargain bin.

ITV's ad revenue from retailers is already down 7.4% year-on-year; the airlines, travel and holidays category down 14.7% and food down 3.1%. And though total ad revenue was up 22% and 9% in the World Cup months of June and July – helped by England’s surprise progression to the semi-final – ITV’s forecast for August is -7% and September 0 to -5%.

It was against this backdrop that McCall reminded investors on Wednesday (25 July) that ITV is today a business that derives income from three different pools: advertisers; broadcasters and platform owners for whom it produces content; and increasingly customers in the form of competitions, voting, live events and a trial of pay-per-view boxing.

“The message was about differentiation,” says Tom Harrington, a senior research analyst in the broadcasting team at Enders Analysis, who was present for McCall’s address. “Moving away from being a business that’s solely dependent on advertising revenue which is at best going to plateau.

“The major addition was this emphasis on direct to consumer revenues which in terms of the size of ITV’s entire business are quite small at the moment, but it's a start.”

ITV’s £41m direct to consumer revenue for the first half of 2018 is dwarfed by the £890m it made in total from advertising. But this category is up £12m on the same period last year and McCall is targeting “at least £100m” a year from here out. The launch of a new subscription video on demand service (SVOD), which she mooted in her presentation, would come under this column in the books.

McCall said ITV has been “speaking to partners” about working together on such a project and Harrington believes it is “most likely” the BBC would be among any collaborators. The two broadcasters already have a joint SVOD venture together in the US, dubbed BritBox, and attempted to work together on a similar service in the UK a decade ago. Called Project Kangaroo, it failed to get off the ground after being blocked by the now defunct Competition Commission in 2009.

Today's TV regulator, Ofcom, has been tacitly putting Project Kangaroo back on the agenda by urging public service broadcasters to collaborate to safeguard their futures. “It makes a lot of sense,” says Harrington, “but the PSBs haven't really been able to work together on almost anything here, so it'll be surprising if they can get that going with any haste.”

ITV’s launch of a Netflix rival would create something of a dichotomy given that its production arm, ITV Studios, counts the US streaming giant as a client. Commissions include Queer Eye for the Straight Guy and, announced Wednesday, a new futuristic action thriller called Snowpiercer. These come out of a Netflix content budget rumoured to be in the region of £6bn a year, whereas ITV’s was confirmed by McCall as £1.1bn. “Netflix and Amazon are globally players and their budget reflects this," she said. "We do not believe we need to increase this to support the broadcast business over the next three years."

That might be enough to sustain strong domestic programming, but will it be enough to draw box set-hungry subscribers from the established OTT players? “That’s going to be a problem,” says Harrington. “if your content isn't best in class it’s going to be very hard to compete [with Netflix and Amazon].”

In total McCall is pledging to spend £60m over the next three years to fund her strategy, with £40m having to be raised from as yet undisclosed cost cutting. The money will be used to improve ITV’s current free video-on-demand service, the ITV Hub, and create an in-house data centre to identify and target consumers under the auspices of new chief technology and chief data officers.

ITV will also ramp up spending on its own marketing in a bid to, at a minimum, maintain its current advertising share. “Research shows we are not really credited with the amazing creativity and energy we have,” admitted McCall. “We are seen as cosy and traditional by many people. We need to ensure we appeal across all platforms and demographics. There are many viewers who only watch a limited amount of ITV content a week.”

McCall said ITV had identified 15 million “lite” viewers who it could win back more often. “Through increased marketing investment off-screen we can target them consistently, drive brand reappraisal, increase viewing of our content across platforms and build deeper and better relationships.”

For McCall, this investment in ITV’s own brand is also her attempt to change a frustrating narrative she has observed ever since she announced her intentions to join the broadcaster from easyJet.

“Before I joined ITV I heard an awful lot about the state of TV,” she said. “That no one watches live TV anymore, that young people aren’t watching TV, that advertisers are moving all their spend to the tech giants, that TV can’t compete with the huge budgets of Netflix and Amazon. There is of course no doubt that the media market is changing and how people choose to watch is changing; viewing is evolving, and the pace of change is rapid.

“But what I’ve found very striking is just how resilient ITV is. Viewers in the UK watch 203 minutes of TV per day. And while it’s down on the previous year it’s a significant number, despite all the new and disruptive launches over the last five to 10-year period. Over 70% of all TV is still watched live.”

To change the script, McCall has had meetings with over 50 advertisers and media buyers since taking up her post and is now planning to set up a new client team to forge direct relationship with advertisers. “They want that, they need us to understand their business and help them in a much tougher economy,” she said.

Catherine Becker, the chief executive of VCCP Media, is encouraged by McCall’s plans. “It's in our interest to have a strong ITV,” she says. “To have a place where we can advertise at scale is really important [because] Netflix and Amazon Prime can’t do that.”

More sport and appointment TV formats such as Love Island are what advertisers crave, according to Becker, who also welcomes McCall’s attempts to “dispel myths” around her medium. “The likes of Facebook and Google have been very good at stating their case but Facebook and Google are now using TV and cinema and outdoor, the more traditional media, themselves. So if it's working for them, that's always a good argument for me.”

In words redolent of the “evolution not revolution” plan immortalised by fictional BBC controller and Alan Partridge nemesis Tony Hayers, McCall summarised her strategy as a “refresh, not a reboot”. Whether it’s the latter that ITV will really be craving once its summer of love comes to an end remains to be seen.