Rubicon Project axes 100 staff as it counts the cost of killing its buy-side fees as quarterly revenue drops 57%

Rubicon Project has confirmed it has made 100 staff redundant amid “significant cost reduction efforts” as it reported a 57% annual drop in revenue for the December quarter, following the decision to drop its buy-side fees in late 2017.

The revelations come a year into the leadership of Rubicon Project CEO Michael Barrett

The company confirmed the cuts were made in January this year, with the decision taken to reduce "general and administrative" costs in line with its current operations, with a company spokesperson confirming that it would have a balance sheet of more than $100m as a result.

Rubicon reported revenues of $31.4m for the December quarter representing a 57% annual fall, a telling number as the figure represents the financial toll of its decision to drop its buy-side fees on November 1, 2017.

However, the adtech outfit’s leadership is confident it can weather the storm, with Michael Barrett, Rubicon Project chief executive officer and his C-suite cohorts telling listeners on its quarterly results call that dropping its buy-side fees, along with its decision to offer the option of both first- and second-price auctions to advertisers, would help bolster demand, thus attracting supply.

Despite the stark reduction in revenue numbers, Barrett told investors that he was confident that Rubicon Project has a robust enough balance sheet to withstand any adtech “take-rate war” waged by competitors eager to match them on a cost basis and that he expected revenue to return to growth by the fourth quarter.

The financial disclosure comes exactly a year to the day after Barrett assumed control of the company. With the company’s ‘new look’ leadership making seismic alterations to its offering, its new chief executive told investors that it was “still early days” when it comes to assessing the long-term impact of decisions taken.

Just weeks into his leadership tenure, it emerged that Rubicon Project was to be sued by The Guardian for undisclosed fees, a development that prompted the company’s leadership to address its fee structure, resulting in it dropping its buy-side fees.

Barrett went on to state that his company had forecast that its decision to drop buy-side fees would help accelerate the ongoing round of M&A in the sector – Rubicon itself having made a sizable purchase in mid-2017 – as they believed that its rivals would lack the balance sheet necessary to survive any such “price war.” The company’s leadership further explained that since making this alteration in its offering demand had risen and that its sell-side fees haven’t experienced any notable downward pressure since.

“We’re not anticipating another round of the take-rate wars,” he said on the call.

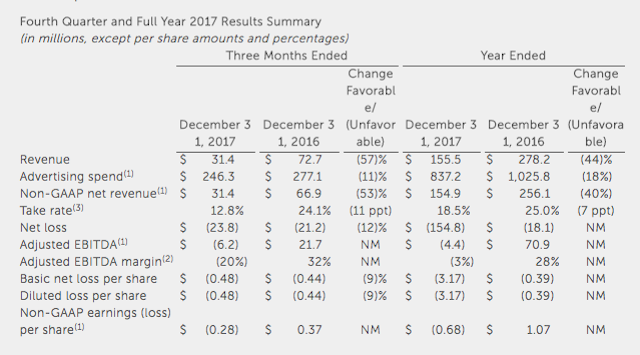

Revenues for the three months to December 31 were $31.4m, compared to $72.7m 12 months earlier, amounting to a net loss of $23.8m, while revenue for the 12 months to December 1, 2017, totaled $155.5m a 44% fall year-over-year (see chart).

"Today, in conjunction with its fourth quarter and full year 2017 earnings, the company announced significant cost reduction efforts including headcount and other operating expense reductions," read a statement confirming the cuts.

"Rubicon Project made this decision in order to bring its cost structure into better alignment with revenue and, together with the company’s strategic initiatives, help position the company to return to financial growth. As a result of these actions, Rubicon Project expects to be adjusted EBITDA positive in Q4 of this year. These actions will have minimal impact on the quality of the solutions the company offers, and on the service clients have come to expect from Rubicon Project."