Telaria confident of 'exponential' revenue growth, reports 67% surge after parting with Tremor Video

In its first quarterly earnings filing since selling off its demand-side platform (DSP) business and its subsequent rebrand, Telaria (formerly Tremor Video) reported revenues of $12.7m for the three months to September 30, a rise of 67% year-on-year.

Telaria CEO Mark Zagorski says the rebrand was designed to underline its sole commitment to its SSP offering / Telaria

The numbers equated to gross profits of $12m for the quarter, representing a 68% year-on-year increase, with revenue for the nine months to September 30 totaling $28.8m (up 54% year on year), representing a $26.3m profit for the period.

In a statement, Telaria chief executive Mark Zagorski described the Q3 as a “strong quarter” and underlined its renewed strategy of doubling down on its supply-side platform (SSP) business. He added: “Our results underscore our position as the leading independent video SSP, committed to transparency and premium inventory, focused on advanced solutions for CTV [connected TV] and OTT [over-the-top].”

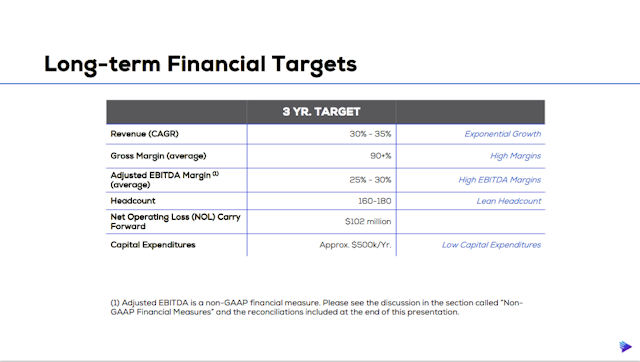

In a presentation to financial analysts, Telaria's leadership presented figures mapping out its forecasted future under the current strategy, with the company expecting "exponential" revenue growth over a three-year period (see image below).

Telaria sold its DSP operations to mobile advertising outfit Taptica, which still operates under the moniker Tremor Video DSP, for $50m amid a flurry of mergers and acquisitions in the adtech sector during the third quarter.

At the time of the sale, leadership of the sell-side business described its SSP as the “biggest growth driver” of its operations and has since appointed Zagorski to head up its operations.

Speaking with The Drum ahead of its latest quarterly results, Zagorski spoke about how the rebrand was geared towards demonstrating that it was a fundamentally different company now, compared to its previous guise.

Simply put, "many companies try to do too many things,” according to Zagorski, adding that Telaria “could not be further from the ad network model,” and that “the current brand embodies that.”

Concerns over conflicted business models – ie where adtech outfits were both buying and selling inventory – and well as inventory quality, had led many on either side of the media industry to question the “black box” of some companies.

Such suspicion is simply not acceptable, particularly as the business begins to partner with media companies whose legacy lies in the traditional broadcast media sector in a bid to monetize premium inventory, according to Zagorski.

To this point, Telaria aims to allay such concerns over advertising quality with an increased emphasis on offering private marketplace (PMP) deals, as well as inking multiple fraud-free agreements with partners, as well as urging its publisher partners to adopt the ads.txt protocol, a major transparency push of 2017.

“The quality of the ad is as important as the context,” said Zagorski, adding that the industry still needs to act when its comes to agreeing more broadly definitions of ad fraud.