Zuckerberg to sell up to 75 million shares to fund philanthropy as he drops no-vote stock drive

Facebook chief executive Mark Zuckerberg has withdrawn plans to reclassify the company’s stock in order to retain full control while funding his philanthropy, settling a major class-action lawsuit with shareholders.

The Chan Zuckerberg Initiative was founded in December 2015

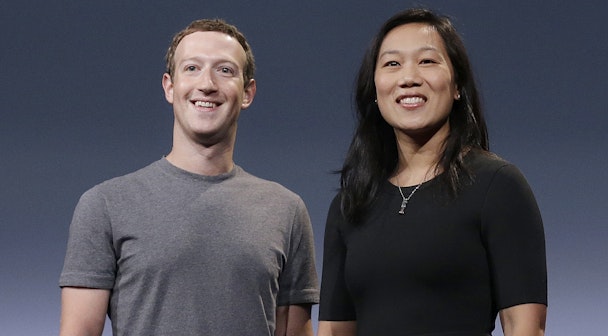

Instead, the tech founder intends to accelerate the sales of shares to fund the philanthropic projects outlined in the Chan Zuckerberg initiative – a limited liability company founded by Zuckerberg and his wife, Priscilla Chan, to “advance human potential” and “promote equality”.

In a Facebook post announcing the new plan, Zuckerberg said he anticipates “selling 35-75 million Facebook shares in the next 18 months to fund our work in education, science, and advocacy.” At today’s price of around $170, that represents roughly $6bn to $13bn.

The founder’s former plan to reclassify stock to fund this philanthropy was challenged by shareholders.

The plan, first announced in April 2016 as part of its earnings release, would mean that people could buy into Facebook with what’s called “Class C” stock – that gives them no voting rights. The restructure would allow Zuckerberg to make acquisitions without much resistance from investors, while letting Facebook “resist the short term pressures that often hurt companies,” he wrote.

What’s more, by issuing the non-voting shares, it would allow Zuckerberg and Chan to “be able to give our money to fund important work sooner”.

Zuckerberg admitted on Friday (22 September) he felt that reclassification was the “only way” to keep voting control while funding his philanthropy.

“Today I think we have a better one,” he wrote. “Over the past year and a half, Facebook's business has performed well and the value of our stock has grown to the point that I can fully fund our philanthropy and retain voting control of Facebook for 20 years or more. As a result, I've asked our board to withdraw the proposal to reclassify our stock – and the board has agreed.”

The founder and his wife still plan to give away 99% of their Facebook shares during their lives.