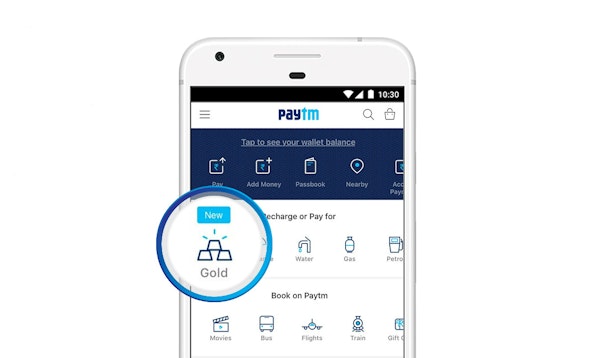

Paytm Gold introduces cashback in a bid to dominate the Indian digital payments market

Paytm continues its domination of the Indian digital payment market by now allowing customers to get their cashback as Paytm Gold.

Paytm Gold introduces cashback in a bid to dominate the Indian digital payments market

Paytm Gold, launched in April, has been attracting thousand of customers, making the platform the country’s largest jeweler in terms of footfall within days of launch. The scheme is live at over 16,000 pincodes, enabling every Indian to save in gold

This is a step to further bolster Digital Payments, which will power the Indian economy in future. Paytm earlier received the final licence from the Reserve Bank of India for its payments bank entity.

Krishna Hegde, senior vice president at Paytm, said: “We have observed that many of our customers were shopping and converting their cashback into pure gold. To encourage this trend further, we are introducing cashback as Paytm Gold. This will transform the way the Indian consumer saves.”

TPaytm Gold bought from MMTC-PAMP is stored in their 100% secure insured lockers at no additional cost to the customer. Paytm aims to encourage the habit of saving each time they spend, thus achieving long-term wealth creation for its users. Accumulated gold can be delivered or sold back to MMTC PAMP instantly.

Mehdi Barkhordar, chairman at MMTC-PAMP India, said: “Our partnership with Paytm is built on the foundation of making it easier for every Indian to buy, store and redeem highest quality gold. Launching cashback as Paytm Gold is a natural extension for us, as it would allow every customer to put aside a portion of their money every time they are transacting.”