News Corp revenues nears $2bn to 'break even', as CEO Robert Thomson takes aim at Google

News Corp has posted revenues of $1.98bn for the three months to March 31, a “break even” figure, as the outfit’s leadership spoke of its upcoming digital ad network, plus vilified Google for its inaction over cleaning up the internet.

Investigations by News Corp titles during the first half of 2017 helped highlight brand safety issues posed by adtech / News Corp

The owner of titles such as the Times of London and Wall Street Journal, reported largely positive results based on the back of its digital gains, but also took the opportunity to take a further broadsword at its digital foes.

In his remarks to investors, chief executive Robert Thomson reiterated his opinion that that the world's two-largest media owners (in terms of media spend) facilitated dangers to both advertisers and wider society.

Additionally, he warned that brands spending money on their automated platforms risked being "juxtaposed with jaundice" next to suspect content. Commenting on the upcoming launch of the News Corp's owned ad network he said it will provide: "real reach, without fear of guilt by association."

Digital is performing well for News Corp

News Corp cited strong digital gains as helping to drive total revenues up by 5% year-over-year with its total revenue from “Digital Real Estate” hitting $219m.

On the company's subsequent earnings call with investors, Thomson said how its ongoing efforts with its recently acquired digital assets such as Unruly Media, as well as content marketing arm Storyful were also helping to shore-up revenues.

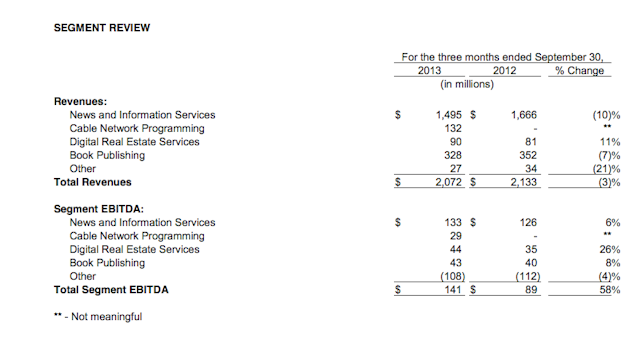

Digital revenues represented 24% of “segment revenues”, with digital also accounting for almost a third (29%) of its masthead revenues, according to the filing (see chart below for a further segment full breakdown).

"The appetite for premium news and thoughtful commentary is undiminished," said Thomson, commenting on its accelerated gains in digital subscriber numbers, adding that the elimination of Google's 'first click-free scheme' proved a boon for this aspect of its business.

Thomson then went on to point towards the likelihood that its additional digital subscribers for products like Dow Jones products will enrich its audience data pool, plus act as an up-sell opportunity for its existing advertisers.

But losses from print still prove an issue

Despite the media giant emphasizing the positive aspects of its performance during the quarter, the overall loss from continuing operations during the period was $0.01 per share, compared to $0.26 the year prior.

A further breakdown of the figures also revealed that overall advertising revenues hit $705m (accounting for a 4% increase) during the period (the third quarter of News Corp’s financial year), compared to $671m 12 months beforehand. Albeit, revenues from circulation and subscription were down 1% from 12 months beforehand to hit $618m.

Other digital highlights included in the quarterly filing were:

- The Wall Street Journal average daily digital subscribers were 1,198,000, compared to 893,000 12 months beforehand

- The Times and Sunday Times closing digital subscribers were 185,000, compared to 174,000 12 months beforehand

- The Sun’s digital offering reached more than 80m global monthly unique users in March 2017, compared to 36m in the prior year

Thomson's ongoing war-of-words with the duopoly

In a statement commenting on the results for the reporting period, News Corp chief Thomson, said: “The quarter was also characterized by an intensifying social and commercial debate over the dysfunctionality of the digital duopoly, and the lack of transparency in audience and advertising metrics.

“With brands in search of authenticated audiences and trusted advertising environments, we firmly believe that our mastheads offer veracity and value, and we are rapidly developing a new digital ad platform to offer clearly defined demographics from across our range of prestigious properties.”

On the company’s subsequent investor relations call, Thomson took the opportunity to attack the internet’s ‘duopoly’ of Facebook and Google, highlighting the threat reliance upon them poses to advertisers, as well as wider societal problems.

In his opening gambit to investors, he said that his own editorial team's investigations into brand safety (which led to many advertisers pulling the plug on spend with user generated content platforms such as Google's YouTube and also helped set the dominant narrative at this year's NewFronts series), highlighted many of the ills posed by the duopoly.

This reliance has led to the commoditization of quality content, resulted in a situation where distribution platforms are better rewarded than the providers of the content they carry, helped promote the spread of pirated content plus fake news, and meant that brands can be "juxtaposed with jaundice on extremist websites".

He went on to say: "We are in discussion with Google and Facebook about brand enhancing environments, and hope that they will help in fashioning a healthier ecosystem that rewards creators of content... at this stage it's fair to say that Facebook is more responsive and responsible."

News Corp's 'brand safe ad network' is coming in 2H 2017

In addition, he further teased plans for its upcoming advertising network, slated to launch later in 2017, with the News Corp leadership reporting that it is already in negotiations with brands over its slated launch.

Facing questions from financial analysts on the subsequent earnings call, over how it aimed to further boost advertising yield via its enhanced digital subscriber numbers, Thomson said: "It's a question that we're spending a lot of time and energy across our markets looking at."

Efforts to monetize this audience data, plus the valuable audience segments they are likely to enhance, should result in improved average revenue per user (ARPU) via way of improved CPMs, as well as subscription revenue.

He went on to add: "The ability to increase yield as we identify reader demographics is obviously at the heart of the new advertising platform we're building here in the US.

"We know that across the US monthly, including realtor.com, we have around 220 million visitors combined along with our newspaper market audiences, so that is a valuable source of audience for advertisers, and we're doing our very best to monetize it in a way that makes sense to advertisers."

Thomson went on to take one last attack at the duopoly, and their "third-party networks" which many advertisers use in order to make their campaigns hit scale (often to the detriment of their own brand safety).

"[Advertisers] increasingly find themselves on third-party networks unable to be sure of the company that they're keeping," he concluded.

Inside News Corp's programmatic plans

News Corp has been preparing the launch of its ad network in recent weeks, with the appointment of Jesse Angelo as chief of digital advertising solutions to help coordinate the launch os its upcoming offering by leading its charm offensive on advertisers.

The new offering is being touted as a “one-stop-shop” for brands eager to extend their reach across News Corp titles, and will essentially be based on its News Connect product, launched in Australia in 2015, which combines audience data from across a number of News Corp Australia’s different titles.

In an earlier quarterly earnings call this, Thomson explained the basic pitch to investors: “Affinity and integrity are far too often missing in the modern marketplace... A tweak to an algorithm, or a fact check here or there does not solve the basic problem.

"Ad agencies and their programmatic ad networks are also at fault, as they sometimes artificially aggregate audiences, and these are then plied with content of dubious provenance: the agencies win; the fabricators of the take win; and advertisers and society both lose.”

Elsewhere, News Corp has been shifting its investments with adtech outfits, having earlier this year dumped its stock holdings in under-fire adtech outfit, following its more recent $10m investment in rival outfit AppNexus – a similarly vocal critic of Google.