CarbonTV takes the lead in OTT Advertising as the fall begins

Found Remote recently launched a new partnership with MediaRadar, a leading ad-sales intelligence platform to understand how the major OTT platforms are diversifying their marketing efforts.

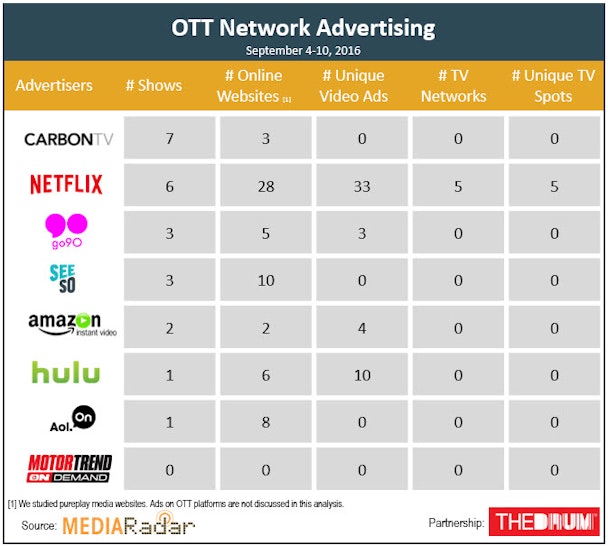

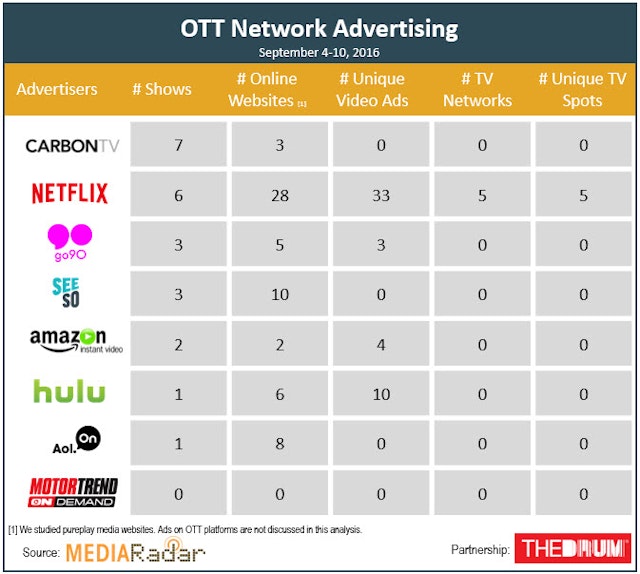

MediaRadar chart for Found Remote

For the beginning of September, CarbonTV took the lead as they promoted the following shows. American Elements, Heartland Bowhunter Behind The Draw, It's My Backyard, Ranch Real Estate, Roadworthy, Thousand to One, and Women Who. Here's the chart and full insights.

KEY FINDINGS:

- Carbon TV. For the week of September 3-10, Carbon TV marketed most individual programs. This was largely consistent with the ad placement in the prior period. What’s interesting however is that these programs are marketed to a highly concentrated audience. Ads showed up on sites including Texas Fish & Game, KFRM “The Voice of Plains”, and Cowboy Showcase.

- Go90 Overview. Go90 is Verizon’s mobile video service. The idea is to get more people to switch to Verizon by offering compelling content. Although anyone can access this for now, Verizon subscribers can watch without using up their data plan. To adapt to the form factor, Go90 is largely created short-form content. They are marketing Tween Fest and The Dabble Dudes more than any other program. Like almost all of Go90’s content, these shows are targeting a young audience.

- Emmy Marketing. The Emmy’s aired on Sunday, Sep 18. In the period when you could still vote for your favorite shows, marketing was up sharply. Firms like Netflix and Amazon were actively evangelizing their programming to win. For example, Netflix had 54 nominations this year alone (9 wins).

- How Voting for the Emmy’s impacts OTT marketing spend. Voting for Emmy’s ended at10pm on Friday, August 29. Almost immediately after voting closed, both Netflix and Amazon decreased their marketing substantially. For example, week-over-week, Netflix reduced it’s marketing from 21 to 6 shows, a 71% drop. Spending on linear TV contracted from 14 networks to 5, a 64% decline.

- Post-Emmy Analysis. While Emmy-related marketing dried up, there was still significant marketing for OTT shows. For example, Carbon TV and Seeso both stayed consistent with their level of marketing week-to-week. And Netflix and Amazon too did still invest. For example, Fearless, Grace and Frankie, Last Chance U, Narcos, The Get Down and even Fuller House were in active rotation. Amazon marketed Goliath and One Mississippi almost equally

MediaRadar revolutionizes the way ad sales teams do business. This innovative SaaS tool streamlines communication, delivers advanced analytics and quickly identifies new business opportunities. Through a customized intuitive dashboard, clients easily view analytics and actionable advertising insights for over 2.6 million brands. Instantly receive insights that combine TV and print with digital analysis, including new ad formats like online video, mobile, and native. MediaRadar can also pinpoint new business and determine revenue potential. It also helps sales reps plan their pipeline and prioritize the most important points to pitch. This amazing service eliminates the guesswork, so ad execs can focus their time pitching. MediaRadar is a cross-platform solution that is constantly innovating with the ad tech landscape. No longer is it necessary to piece together information from multiple tech products to build a pitch; ad teams can get all their information with ONE tool.

You can access the Future of TV hub here. Sign up to receive The Drum's Future of TV newsletter.