Brands are drilling down on transparency, and here are some of the reasons why

UK brands are increasingly excited – yet still concerned – over the potential adtech offers their marketing plans, as programmatic spend in the country is tipped to top the £2.6bn mark. To help further awareness and address questions over transparency, marketing trade body ISBA has issued a set of guidelines to its members, below are the key highlights.

Marketers and doubling down on transparency / Pixaby

In a sign of the growing interest in automated marketing, yet persisting lack of awareness about it, ISBA (the trade body for brand-side marketers) has issued a document dubbed The Programmatic Guide, to help promote greater awareness among its membership.

ISBA has claimed that despite the marked increase in media spend using such technologies, its members are increasingly concerned that their media agencies are not doing enough to promote transparency as regards their media management practices, and is now acting to bolster levels of education.

ISBA's partnership with Infectious Media

The trade body has paired with independent media agency Infectious Media to draft and distribute the documents, with the three-part guide issuing instructions on how to plan and create programmatic campaigns, as well as how best to evaluate the ROI such technologies can achieve.

“In the past year we have seen opposing trends: major advertisers have come out in favour of programmatic and have vowed to buy as many channels programmatically as they can; but this has been against a backdrop of concern about the risks and waste in the programmatic industry,” reads the document. It also goes on to cite eMarketer research on barriers to spending more on programmatic (see image).

ISBA’s director of media and advertising, Mark Finney, said, high attendance numbers to its events focusing on programmatic advertising are indicative of the levels of interest in the use of such technologies. Although its members are increasingly perplexed at the ever-increasing complexity of the adtech ecosystem, especially when it comes to issues such as whether or not their ads are actually viewed by humans, click fraud and ad misplacement, etc.

Lack of transparency

“Members are also worried about their media agencies’ lack of transparency, agency trading desks acting as both agent and vendor and the whole issue of rebates. This problem is exacerbated by incomplete disclosure on the part of media agencies regarding their media management practices. If they made more effort to demystify their processes it might make advertisers less inclined to mistrust,” he added.

To address such matter, the guide offers marketers practical advice on scrutinising the operating structure of their media agency network, and how to adjust accordingly to the market realities posed by the emergence of adtech (see below).

Martin Kelly, chief executive of Infectious Media, added: “Something we hear a lot from our clients is their frustration with the opaque structures of the traditional global media agencies and the lack of awareness over what programmatic advertising can and should be delivering.”

The document also contains a number of testimonials from a host of eminent brands, including marketers representing: Mondelez, Netflix, P&G, etc (see image below).

Chris Howard, head of digital at Shop Direct, also participated in the study, he added: “Despite the growing importance of programmatic advertising, many marketers aren’t keeping up with the pace of innovation and are still unaware of the potential benefits it can bring, not least in massively improving targeting on mobile.”

This concern over transparency, and the ROI provided by many adtech companies comes in the aftermath of the recent ANA report into media rebates in the US. It also tallies with recent research from ExchangeWire Research and OpenX that claimed despite the ongoing increase in programmatic, the number of advertisers confident that it delivers a return on investment is on the wane (95 per cent to 86 per cent).

Programmatic trading will be top three-quarters of all digital spend

Meanwhile, the ISBA guidelines come a week after a report from research outfit eMarketer forecast that three-quarters of UK digital display ad spend will be invested using such technologies next year, with total spend using adtech tipped to top the £2.6bn mark.

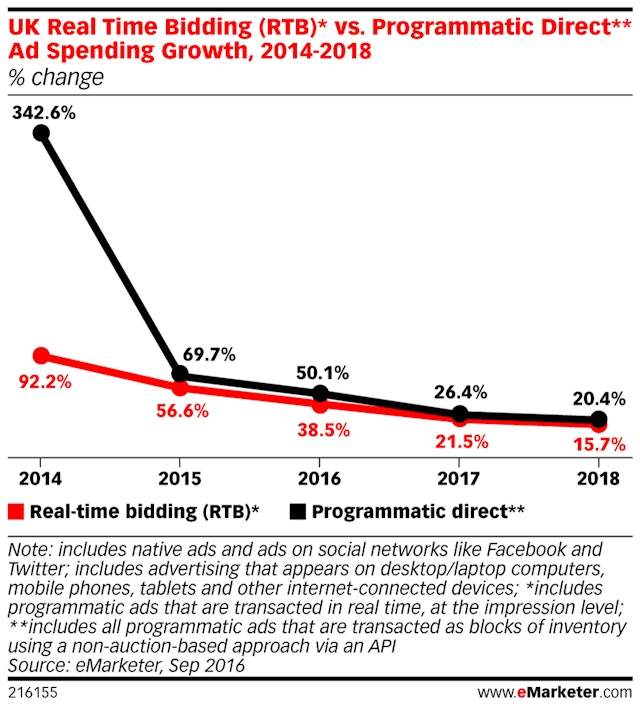

Emarketer’s numbers represent an increase of 44 per cent year-on-year, with trading using programmatic direct – a pre-agreed approach to using adtech to trade media, instead of an auction-based approach – set to overtake real-time bidding (RTB).

RTB has traditionally dominated the programmatic space in the UK, but this year both RTB and programmatic direct spending will reach parity, at £1.33bn, according to eMarketer numbers. Additionally, the research outfit predicts programmatic direct will account for £2.03bn, ie 52 per cent of all programmatic spend, by 2018 (see graph below).

The rise of programmatic direct

Bill Fisher, UK analyst at eMarketer, added: “Much of the programmatic direct total is accounted for by social media ad impressions, which are predominantly traded this way. However, outside of social, people are coming round to the greater degree of certainty offered by this way of trading. Even within the RTB total, private marketplaces — small, invitation-only auctions — are becoming increasingly prevalent as people seek more control over the programmatic trading function.”

Video and mobile to spur programmatic growth

Additionally, the report also goes on to further breakdown the forecasted spending patterns, with eMarketer predicting that almost three-quarters of total programmatic advertising inventory will be spent on such technology this year, equating to £1.99bn worth of investment. That proportion will reach 82.1 per cent by 2018, when mobile will account for £3.2bn ($4.89bn) in spend.

Programmatic video will remain slightly behind the curve — just 51 per cent of digital video inventory will be traded programmatically this year – 70 per cent for the overall display market. This is largely due to the lack of premium inventory currently available. Although programmatic video spend growth will outstrip programmatic mobile spend over the next few years, according to eMarketer.

A free copy of the report from ISBA and Infectious Media can be downloaded here.