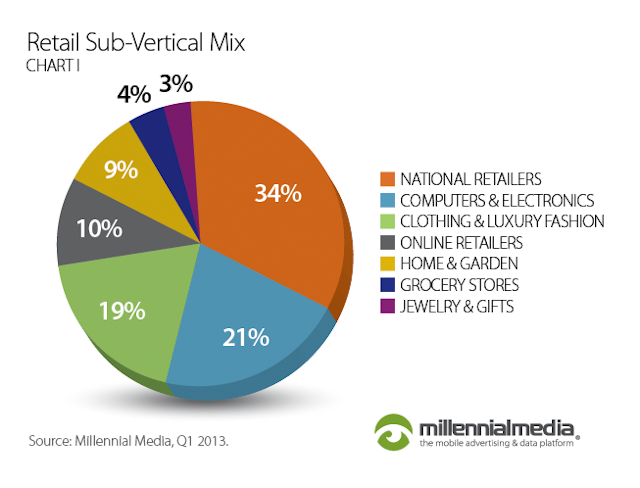

National retailers have invested more in mobile (smartphone and tablet) advertising than any other type of retailer, accounting for 34 per cent of total retailer mobile spend in Q1, according to Millennial Media and comScore’s latest Mobile Intel Series.

Mass merchandisers, big box stores and large franchises leveraged their mobile advertising campaigns around national holidays and seasonal events, with retailers traditionally spending about three times more on mobile in Q4 than they do in any other quarter. Computers & electronics and clothing & luxury fashion were the next highest spending sub-verticals in Q1 2013.

Overall retailers were found to be the fourth largest spenders on mobile ranking just behind telecommunications, entertainment and finance brand verticals. The finding of the report also show that retail advertisers allocate their mobile spend differently than other brand verticals, working towards more innovative targeting features, with retailers citing increased foot traffic and site/mobile traffic as the main goals for mobile ad campaigns. 37 per cent of retailers said mobile campaigns helped drive consumers into their stores, with many brands with this goal including Store locators within their creative helping potential customers find their closest physical location. Surprisingly an increase in site/mobile traffic was the second most popular goal (34 per cent), with more retailers preferring to use mobile advertising to drive customers back to bricks and mortar stores. In comparison with all advertisers, retail campaigns focussed on increasing foot traffic at four times the platform average. Of its mobile strategy high street retailer Marks & Spencer’s head of digital innovation Kyle McGinn, said: “We want M&S to be accessible to customers 24/7 and make it easy for them to shop with us the way they want to. Mobile and tablets are at the heart of that and by the end of last year accounted for 18 per cent of M&S.com sales. As more and more customers opt to interact with us in this way, mobile has become embedded into our marketing strategy and is an essential way for us to engage customers in our products, services and offers.”

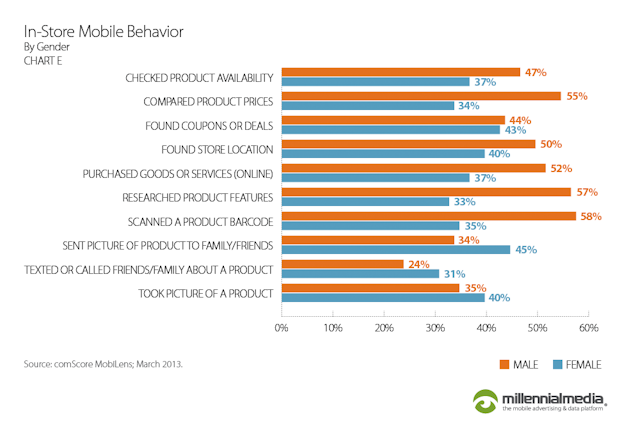

The latest Mobile Intel Series results highlights that retail customers are now more comfortable using their mobile at all stages within the purchase funnel, from pre-purchase research to checking availability and using their device in store. Men and women were found to use their devices in different ways with men more likely to scan a barcode and compare prices and women a third more likely to engage in social behaviours e.g. contacting friends/family members about products. Because if this, retail brands can use their mobile advertising to target male and female shoppers in different ways to address these influence factors. Store locators (which are used in 41 per cent of retail campaigns) can be a more effective tactic to target men and ads with social network links could be more effective for attracting female shoppers.

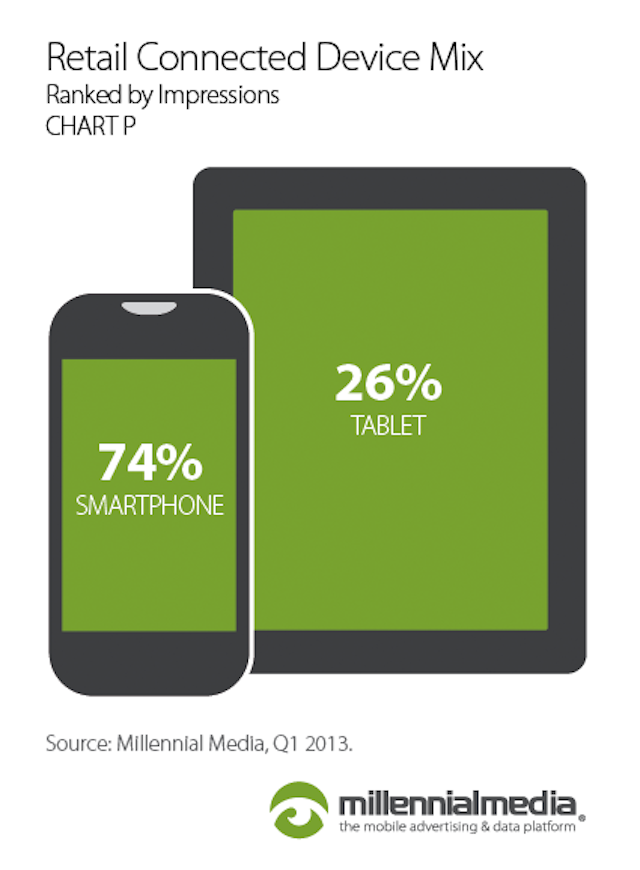

In terms of impressions for retail campaigns on mobile in Q1 2013, 74 per cent came from smartphones and 26 per cent from tablet. Savvy retail advertisers were found to leverage location-based targeting to ensure messages reached potential customers in the right place, with clothing brands and national retailers two of the largest sub-verticals to use this mobile feature.Despite coming out as the top spender in mobile advertising the Mobile Intel Series suggests that options remain on the platform for retailers to further attract new consumers and drive them to make purchase, for example new features such as dynamic video and voice command ads. With mobile increasingly taking over from desktop as the go to platform retailers are reminded to consider audiences, not devices with creating campaigns.