After FTX fiasco, ad agencies are rethinking relationships with crypto clients

Agency executives are having a change of heart when it comes to helping promote cryptocurrencies, getting stricter with payment terms and even walking away altogether.

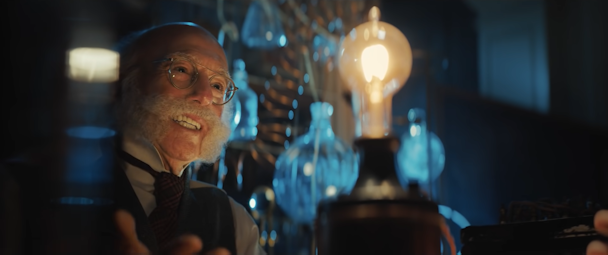

A still forom Dentsu Creative’s Super Bowl ad for FTX, starring Larry David / FTX

The bankruptcy of cryptocurrency exchange FTX and the fall from grace of its boy-king founder Sam Bankman-Fried has diale up the scrutiny applied to the wider crypto sector. Bankman-Fried will soon answer questions from a Congressional financial services committee, while his rival Binance is under investigation by the US Justice Department, the IRS and Singapore’s police force.

Less scrutinized is the role of ad agencies in helping to promote these companies’ services. Agencies were quick to embrace the crypto hype, picking up lucrative clients in the space as they invested heavily in advertising. Crypto.com, FTX, Binance, Coinbase and eToro have all pumped millions into marketing, including big-ticket ads during February’s Super Bowl. These campaigns helped deliver the biggest audience yet to crypto companies.

Advertisement

Accenture Song’s North American unit produced a conversation-starter of a spot for Coinbase, broadcasting a live QR code that would take viewers directly to its site – where they’d receive $15 worth of Bitcoin. The agency later won a Cannes Lion Grand Prix for its work.

Dentsu Creative’s ad for FTX, meanwhile, portrayed comic legend Larry David as a time-traveling Luddite determined to pooh-pooh each new idea that crossed his path, from the wheel to the lightbulb – implying that those refusing to jump on the Bitcoin bandwagon would be similarly left behind. Earlier spots created by the agency had Gisele Bundchen and American football star Tom Brady ringing around famous friends to encourage them to invest.

Recent events have vindicated David’s fictional self. And the falling values of the most popular cryptocurrencies relative to fiat have left other high profile campaigns looking hubristic.

Analysis from The Intercept showed that, if someone had bought $1,000 of Bitcoin or Ethereum the day that Crypto.com‘s first Matt Damon (‘Fortune favors the brave’) ad was released, they’d have ended up down at least $640 a year later.

Advertisement

Sarah Tan, global marketing director at R3, thinks we’re likely to see far less above-the-line ads for crypto platforms or products in the near future. “Venture capitalists who are still in crypto won’t want to see their investments going to advertising. There are other pressing issues that need to be fixed.”

As a result, she suggests that we won’t see a repeat of this year’s crypto-funded Super Bowl. “All the crypto sponsorships we’ve seen in 2022 are going to disappear in 2023. Either their sponsorships will be rebuffed, or the crypto companies themselves will not renew.”

Unlike some 80,000 of Bankman-Fried‘s customers, Dentsu Creative was not left high and dry. A spokesperson confirmed to The Drum that it had been paid in advance for its creative work and for subsequent media planning and buying, though they declined to discuss the relationship in further detail.

Suggested newsletters for you

By comparison, Alldayeveryday – the creative and production company that made eToro’s 2022 Super Bowl spot – told The Drum that it hadn’t asked to be paid in advance by its client. “We did not require all the money upfront and eToro was a great partner on the financial side – there was trust there from the get-go as we were super under the gun time-wise to make the Super Bowl deadlines,” says Michael Karbelnikoff, the company’s owner.

With hindsight, however, Dentsu’s cautious arrangement looks wise. But it wasn’t the only agency dealing with crypto firms to put in place stricter pay deals. Geoff Renaud, the chief marketing officer of Invisible North, spearheaded the agency’s pivot to become a supplier to crypto trading platforms and other web3-oriented companies in 2020. Since then, the marketing agency has worked with Algorand, FTX, Coinbase and Kraken. “Being in the picks and shovels business has been really good to us,” he says.

But after the price of Terra – a so-called ‘stablecoin’ – crashed in June he says the agency has become more bearish. “It was a jumping-off point for caution. We’re much more hawkish now on pay terms.”

R3’s Tan tells The Drum that FTX’s fall could tarnish other crypto clients in the eyes of agencies. “No agency that wants to get paid is going to work for a crypto company now,” she says. ”The appeal of working for a disruptive category or servicing the underdog has faded and funding has dried up.”

Ethical issues

There’s also a chance that agencies might spurn crypto trading advertisers for reasons of morality, not just liquidity. Agency Atomic worked with eToro between 2015 and 2017, when the crypto trading platform was first expanding into the UK market. Chief executive Jon Goulding says its team was “very driven, very financially literate and very ambitious. They were under pressure to get new customers and new deposits – new account holders are absolutely mission critical to getting scale, probably more so than any other scale-up brand.”

The agency produced a campaign, advising punters to ‘take the bull by the horns’ and consider opening a trading account with the platform. But since that contract wrapped up, Goulding says his stance on the sector has shifted and that he wouldn’t consider working with them today. “I would say that any of those cryptocurrency brands are tantamount to online gambling” he adds.

Customers trading in cryptocurrencies, he argues, “may wake up to significant gains, but whether you win or lose is not actually down to anything within your control. [Stock] trading is a profession and you can educate yourself and become really good at it... but cryptocurrencies are just manufactured and controlled by other individuals. There’s no skill factor to it at all.”

Widespread criminal fraud within the crypto space may also dampen adland’s desire to help promote trading platforms to the public. According to UK police unit Action Fraud, £226m was reported lost to crypto fraudsters over the last year – a 32% increase on 2021.

Despite pulling in its claws in the summer, Renaud is still confident in the long-term viability of crypto clientele and doesn’t share Goulding’s moral hang-up. “Of course, there’s a speculative element to it. But underneath that, there are revolutionary behaviors and technologies being birthed. That’s why 10s of billions of dollars and some of the smartest people in the world are pouring into the space. It’s not all because they’re a bunch of degenerate gamblers.“

Regulation of the space (very little exists outside China, where trading is banned) will make it safer for agencies as well as consumers, Renaud argues. “We’re incredibly concerned and skeptical about the lack of regulation. I don’t want to see friends and family get wiped out again, I don’t want to see the incredibly wild price volatility. I’d like to have a community around a shared asset or shared goal and for that to be sustained, rather than fall off a cliff.”

Atomic still counts a number of online stock market trading platforms, such as Equiti, among its clients but Goulding says these “are very different, fully regulated“. “They have a bigger purpose and are helping people become wealthier and to educate themselves about money. They’re not just about basically finding ways to get money off you.”

He suggests other agencies should steer clear of cryptocurrency trading brands in the same way they might with tobacco companies or bookies. “I think, personally, that cryptocurrencies should be on up there with cigarettes on the banned list. There are some fundamental issues with that whole sector and I think that if you as an agency are participating in that, you are semi-endorsing the practices that go on.”