Amid Google Lens update, Google Americas president shares tips for commerce success

Retail and commerce are undergoing a massive sea change, as consumer behavior shifts and new technologies come to the fore. The Drum quizzes Allan Thygesen, who heads up Google's $100bn-plus advertising business in the Americas and across various global partners, on what retail marketing success will look like in the new era.

Google is gearing up to tackle the future of retail / Adobe Stock

As consumer behaviors shift in response to evolving public health norms, consumer data privacy debates heat up and web3 begins to materialize, the landscape of commerce and retail is witnessing rapid change.

Among the chief players sure to inform the direction of retail and retail marketing is Google, whose technologies like Google Lens are already reimagining product discovery and whose policies — including the controversial and yet unfinalized Privacy Sandbox — are laying the groundwork for a new kind of advertising ecosystem.

Now, Google’s president of the Americas and global partners Allan Thygesen shares four tips for thriving in the new retail and commerce landscape.

Suggestion 1: Go big on automation

Principally, Thygesen encourages greater investment in automation. “The journey is getting so much more complicated — being able to respond to that both from a resource perspective and an effectiveness perspective is incredibly important, [and it] can really only be done with machine learning and automation,” says Thygesen.

For instance, he says, an AI-driven forecasting tool can predict forthcoming product search trends, which frees retailers from operating reactively and enables them to tailor their strategies to emerging shopping trends — from the national campaign level down to store-level stocking.

He also suggests leaning into automated bidding, which can free up resources and time in the media planning and execution pipelines. As it stands, more than 80% of Google advertisers are already using automated bidding. The approach has proven highly effective for many retail advertisers. Online marketplace Etsy, for instance, witnessed a spike in searches for “sweatshirts” and “hoodies”. It used this information to update its merchandising, content marketing strategy and ad copy. As a result, it saw nearly a 50% increase in sales of hoodies and sweatshirts via its Google Search and Shopping campaigns.

Suggestion 2: Embrace the omnichannel world

Covid-19 did not simply disrupt consumer behavior in the short-term; it permanently reconfigured the buyer journey, upending how consumers search and shop on a daily basis. It came as no surprise when ecommerce activity skyrocketed early in the pandemic — global ecommerce sales spiked nearly 24% from 2019 to 2020 as consumers stuck at home ordered everything from home office supplies to weekly groceries online. And although the trend didn’t maintain its growth rate, it continued steadily; from 2020 to 2021, ecommerce sales rose an additional 15%, from an estimated $4,248bn to $4,938bn.

It’s become blatantly clear that the reopening of brick-and-mortar stores has yet to inspire a mass comeback. Consumer behavior has changed for good; shoppers are still browsing and buying via web, social media and even smart TV. In fact, a recent Ipsos survey found that 54% of US shoppers used five or more communication channels to shop over a two-day period alone.

“The journey has a lot of touchpoints,” says Thygesen, “your digital presence has never been more critical to driving both online and in-store experiences. Retailers need to be online-first, but not online-only.”

More than ever, shoppers are searching for local brick-and-mortar retailers — but they prefer to know what’s on the shelves before they head to the store. In fact, Google searches for terms like “near me” and “in stock” have grown over 90% year-over-year. And Google is helping to address this demand; it has added an “in-stock” feature that pulls up listings for local retailers who have products in stock that match a user’s search keywords. It’s extending this feature — which retailers can connect to via Google Merchant Center or through an approved third-party — beyond organic search to encompass ads as well, enabling retailers to promote their current merchandise to local shoppers.

Plus, Google, like many others, is looking toward the next iteration of the internet, which is sure to upend retail and commerce in yet unknowable ways. In fact, Thygesen says the company’s metaverse plans are in full swing. “Our view is that we want to meet shoppers where they are. That's why we're building richer experiences into all of our services… for shopping you will see more blended and omnichannel experiences.”

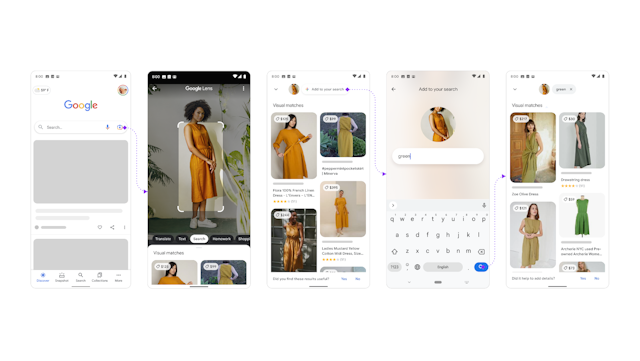

He points out that Google Lens, which was rolled out in October of 2017, already “brings together the physical and digital worlds of commerce” through AR. The company has increasingly invested in the commerce potential of the product; Thursday morning it unveiled a new feature called Multisearch in Lens that enables users to snap a photo or use a screenshot — then type in keywords — to conduct a combined image-keyword search for products. Google suggests that with Multisearch in Lens, a user might screenshot an article of clothing they like and then query “green” to find it in another color, or take a photo of their dining table and search “coffee table” to discover a complementary table.

The company is funneling resources into AR beyond Google Lens, too; it has unveiled an AR-powered beauty shopping experience on Google Search and YouTube that enables users to try out specific products on a diverse range of models. Popular beauty retailer Ulta is working hand-in-hand with Google to develop new integrations for the offering. Per Thygesen, the tech company is focused on “leveraging behavior that consumers are already doing and technology that we can deploy at scale on behalf of retail.”

Suggestion 3: Spend on video, the medium of the future

In 2020, 96% of consumers increased their consumption of online video, and nine out of ten said they wanted to see more videos from brands and businesses, per research from Wyzowl. In other surveys, consumers cite unexpected inspiration as a perk of integrating YouTube into their shopping experience. Essentially, the influence of video content has never been more apparent. “Video — [paired] with social proof — can be a really powerful tool to close the loop between inspiration and action,” says Thygesen.

He gives the example of Nordstrom Media Network, which wove new product feeds into its interactive video campaigns on YouTube. In doing so, the media arm of the luxury department store achieved a double-digit return on ad spend for one of its brand partners.

Of course video ads — particularly those placed within the connected television (CTV) ecosystem — come with unique measurement challenges. As tried-and-true methods of cross-platform media measurement come into question, the advertising industry is seeking innovative approaches to media measurement that will provide advertisers and publishers with an apples-to-apples view of cross-channel campaigns.

Even with its shortcomings, however, video is likely still worth investing in. New in-stream ad formats are drawing engagement, while mobile-first and social video are taking off, giving retailers new means by which to connect with target audiences.

Suggestion 4: Invest in trust by putting privacy first

Thygen echoes what Google executives have been saying for some time: the era of user tracking-based advertising is over. “It really is time for the digital advertising industry to evolve so that it works for everyone in a privacy-safe way,” he says. He argues that the best way forward is for retailers to build up robust first-party data practices — and loyalty programs will become increasingly valuable means by which to do so.

It’s a far-reaching concern among marketers that the shift to first-party data strategies — catalyzed by the impending loss of third-party cookies, paired with increasingly stringent regulations and policies enacted by the Apples and Googles of the world — will limit their ability to target and measure ads effectively. Thygen, however, says it’s not so. On the contrary, he asserts that focusing on privacy-centric first-party data approaches to advertising will translate to a business advantage. “We've done some research with Boston Consulting Group that shows that companies who link their first-party data sources… can generate one-and-a-half times their revenue on a single advertisement or communication outreach. There's a direct business benefit to doing… the right thing.”

While Google has led the charge on reconfiguring the industry in light of consumer demands for privacy — making the decision to eliminate third-party cookies from Chrome in 2023 and proposing new, more obfuscated methods of ad targeting in its Privacy Sandbox — it has not gone uncriticized. Most recently, the tech titan has been hit with a lawsuit from Texas, Washington state, Indiana and Washington, DC, which alleges that the company deceitfully collected location data on users who had opted out of such tracking.

Even so, at the corporate level, Google is pushing a message of privacy-first advertising — and attempting to back its proclaimed ethos with innovations that will enable advertisers to serve targeted ads and measure the impact of their campaigns with precision while promising users greater transparency and say over how their personal information is used.

“Some of the efforts we've made [have centered] on aggregation and optimization, leaving the data on the device, adding differential privacy to inject noise and make it harder to extract out individual information. And there's a variety of other privacy-preserving technologies that are being developed to help preserve [users’] identity information.”

He maintains that even Google’s most restrictive advertising policies are “not limiting” to retailers looking to measure return on ad spend. “We actually believe that when you combine first-party data, modeling and privacy-preserving tech a la Privacy Sandbox or other solutions, you can end up in a better place.”