Gaming app ad spend reaches $26.7bn globally, according to AppsFlyer report

More gaming app marketers to prioritize profits over growth in 2023 as economic uncertainty impacts the market, says Sanjay Trisal, general manager of INSEA/ANZ at AppsFlyer

Marketing budgets will face intense scrutiny, making the gaming landscape more complex / Adobe Stock

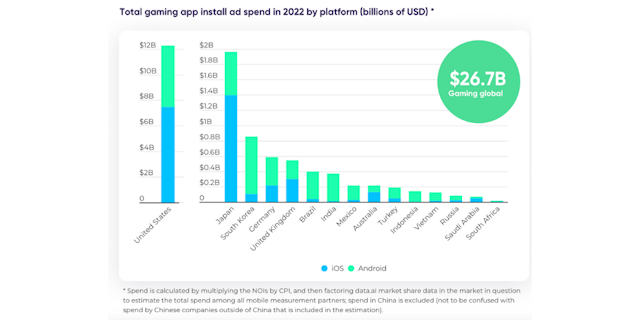

As the post-Covid era unfolds, life has almost returned to normal under a very different macroeconomic climate. While the effects of the downturn are becoming increasingly apparent in metrics like overall app installs by consumers, the gaming app economy still showed resilience, with nearly $27 billion invested in ad spend by gaming marketers and developers worldwide in 2022 to acquire new users, according to AppsFlyer’s newly published report, State of Gaming App Marketing 2023 edition.

Advertisement

The study contains an in-depth analysis of key trends shaped by the pandemic and forecasts on what marketers and developers can do to adjust to the “new normal.”

Here’s everything advertisers need to know.

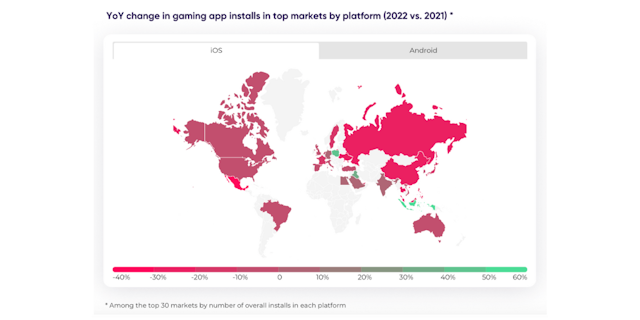

App installs improve on Android and slightly decline on iOS

Overall, Android game app installs rose slightly, by 8% compared to 2021, whereas iOS game app installs showed a slight decline, with a -5% drop. Based on advertising investment, the United States remains the largest target market for gaming app marketers by a significant margin, followed by markets like Japan and South Korea in APAC.

The regional picture was decidedly mixed. The US saw a 19% growth in gaming app installs on Android but also a -1% drop-off on iOS. Asia continues to field the strongest growth players. The Philippines showed a 30% uplift in Android, while Indonesia presented a 64% growth in iOS, demonstrating the region’s continued dominance as a growth market.

iOS was also an underperformer in several major APAC economies such as China (-30%), Japan (-13%), and Australia (-9%), indicating a shift in the mobile gaming industry in these markets for which companies may need to rejig their growth strategy moving forward.

Ad spend remains high despite the slowdown in installs across the world

Global spending is dominated by two major markets: the US and Japan. According to our report, these spends are mostly dominated by Matching Games, which account for 20% of the total ad spend and are even more pronounced on iOS by 23%. The second and third top gaming genres include hypercasual and RPG.

“Measurement will always be critical, as emphasized in our report,” says Sanjay Trisal, general manager of IN/SEA/ANZ at AppsFlyer, when asked for an analysis. “Especially in 2023, where efficiency in marketing will take center stage, the measurement of marketing efforts will be the pillar that supports it. Marketing budgets will face intense scrutiny, while the ever-changing privacy landscape with SKAN 4.0 and now the Google Privacy Sandbox will make the mobile gaming landscape more complex.”

Advertisement

The economic pressure helps reshape budgeting strategies for most marketers. To add to that, the general install trend is also slowing down across the globe, pushing businesses to prioritize return on ad spend (ROAS) performance instead of mere user acquisition.

“Despite these challenges, the mobile gaming industry has been resilient, and there are still opportunities that gaming studios can take advantage of," says Trisal. "In fact, as per an in-depth survey by Venture Insights, 60% of respondents in Australia and 54% in New Zealand play games on their mobile phones. In addition, according to PwC, with a 2021-2026 CAGR forecast of 8.2%, Australia is set to overtake both UK and Canada in the gaming segment. Developing technologies like Web3 and adoption of 5G will also contribute to these tailwinds to redefine mobile gaming.”

Our report also uncovers the increasing trend of marketers leveraging owned media channels and building a community in an effort to cut costs. You can download more insights and tips on tackling 2023 on the full report here.

Suggested newsletters for you

Content by The Drum Network member:

AppsFlyer

Brands trust AppsFlyer’s privacy-preserving, measurement, analytics, and engagement technologies to help them make good choices.

Find out more