E-commerce remains competitive for Australia despite global slowdown of spend

According to the International Trade Administration, Australia’s e-commerce market is growing rapidly, predicted to reach $32.3bn by 2024. Being the 11th biggest market for e-commerce, Australia is still seeing opportunities despite the slowdown trend that’s happening globally.

Mobile e-commerce represents a significant opportunity in the local market

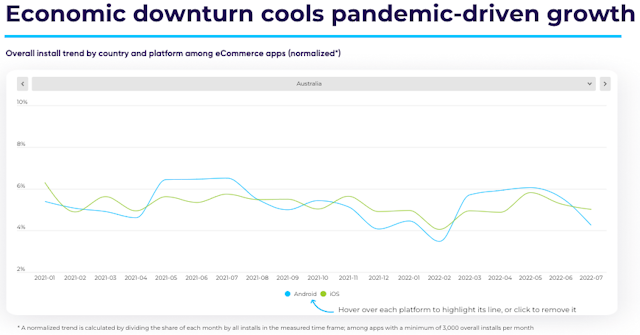

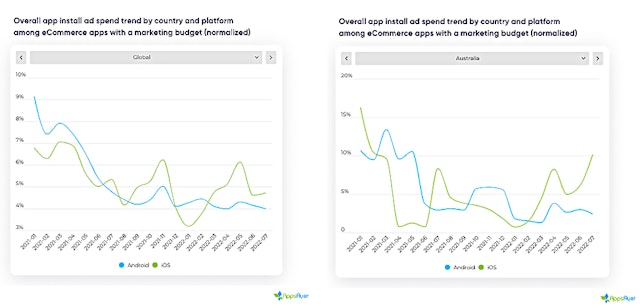

In the recently published State of Ecommerce Report 2022, AppsFlyer found that globally, e-commerce app marketers spent $6.1bn on user acquisition. Though the numbers sound like a huge investment for the vertical, this is already a result of a 50% plummet compared to the previous year. Following the surge in online shopping in the past couple of years, 2022 appears to have ushered in a new phase for e-commerce app marketing: post-Covid "fatigue". The world has now learned to live with Covid-19, and with it came a natural slowdown after the spike in 2020 and early 2021, when the Omicron variant hit.

Advertisement

Though so, the chart below says otherwise for the Australian market. Despite the slowdown that’s happening, iOS in Australia is looking at an increased trend of overall app install ad spend in Q1 2022.

Adding the fact that Mobile e-commerce represents a significant opportunity in the local market. With mobile penetration at close to 100%, mobile apps are a major strategy for most retailers including MyDeal.

MyDeal is one of the fastest-growing online marketplace in Australia. Until today, the marketplace has more than one million active users and six million product varieties, connecting merchants and customers through a single platform.

Advertisement

One of the core focuses for MyDeal in this shopping season is to provide customers with a seamless shopping experience. To do this, MyDeal engages with users through mobile apps in both iOS and Android and recently launched a campaign called SHOPAPP.

With the SHOPAPP campaign, the marketplace is looking to optimize and extend customer journeys from web-to-app. Not only does this provide a seamless experience for the customers but also helps drive app acquisition that contributes directly to revenue. Users acquired through SHOPAPP have 42% better average revenue per user (ARPU) than any other app acquisition campaign.

Suggested newsletters for you

“We’ve recently launched the SHOPAPP Campaign to better engage with our customers,” said Suhaib Anwar, head of growth & martech, MyDeal. “By providing a web-to-app experience, we hope to provide a better shopping experience for our customers as well as improve our app growth. Powered through OneLink by AppsFlyer, we were able to further incentivize our users who were ready to make a purchase on the web by encouraging them to download our app -which helps us with our app growth as well.”

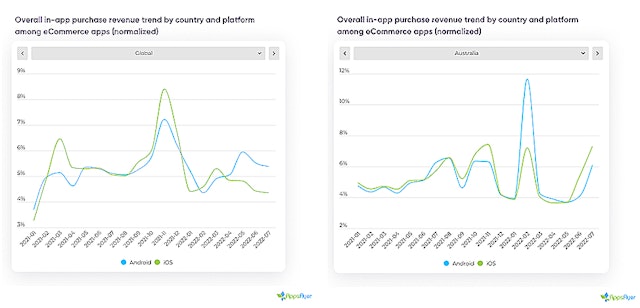

From the State of E-commerce report by AppsFlyer, it is seen that the shopping season in Australia fluctuates throughout Q4 to Q1 of the following year. When narrowed down to November in particular, there’s a huge spike during the end of the month. The 25th to the 27th are the best days for in-app purchases (IAP) in many markets namely Australia, the US, India, Brazil, UK, France, and more. Clearly, consumers await these sales and then storm the online shops.

By tapping into this momentum, MyDeal mentioned that the marketplace is anticipating 20% more sessions on its website which would in-turn drive more app downloads.

“Slowdown of e-commerce spending is forcing marketers to focus on efficiency, but Australia continues to see improvements and opportunities in the market, especially for iOS. To better grasp this shift, app marketers and developers should be focusing on customer experience and personalization. This will allow apps to achieve not only new user acquisition, but also retain existing ones, building a loyal customer base,” stated Antony Wilcox, director of growth at AppsFlyer, Australia & New Zealand.

AppsFlyer’s State of E-commerce App Marketing, 2022 Edition is an anonymous aggregate of proprietary global data from 5.1 billion app installs from 700 apps and 26 billion remarketing conversions. Download the full report here.

Content by The Drum Network member:

AppsFlyer

Brands trust AppsFlyer’s privacy-preserving, measurement, analytics, and engagement technologies to help them make good choices.

Find out more