Meta cements its position as best platform for UK consumer eyeballs with daily usage leap

Attest’s UK media consumption tracker shows Facebook and Instagram growing at a faster rate than their competitors in the first quarter of 2022.

Attest’s UK media consumption tracker helps brands to make effective media planning decisions

Since rebranding to Meta, the technology giant has seen a leap in daily usage across Facebook and Instagram in the UK, Attest’s latest UK media consumption tracker results show.

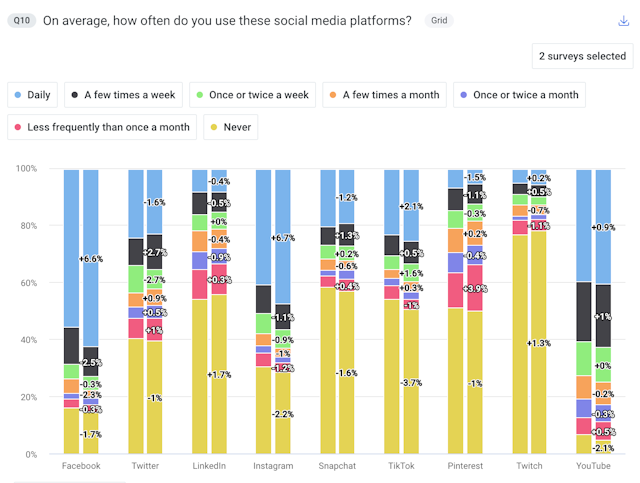

Data for the first three months of 2022 shows that Facebook chalked up a 6.6 percentage point increase in the number of British consumers using the platform daily (from December 30 2021 to March 28 2022). Likewise, Instagram has recorded a 6.7 percentage point increase, making Meta unrivaled for potential advertising exposure.

It means the two platforms, which already dominate market share in the UK, are growing usage at a faster rate than any of their competitors. However, TikTok also shows notable growth over the quarter, gaining the most new users (non-usage among UK working-age consumers declined by 3.7 percentage points to 51%).

Meanwhile, Twitter – just bought by Elon Musk for $44bn (£34.5bn) – records a more disappointing performance, with a 1.6 percentage point net loss in weekly users. The percentage of Brits who say they ‘never’ use the platform stands at 39.6% in comparison to Facebook’s 14.4%. It remains to be seen if Musk’s ownership will generate renewed interest in Twitter – it’s something that marketers trying to decide where their social media spend should be going will want to keep a close eye on.

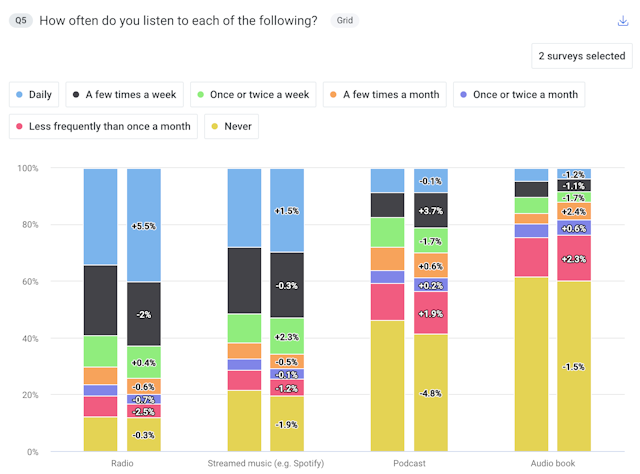

Growing potential for radio and podcast advertising

Also trending up in the first quarter of the year is radio listening. The data shows a 5.5 percentage point increase in UK consumers listening to the radio daily; this means 40% of Brits are now tuning in to their favorite stations each day.

Likewise, the number of people who listen to podcasts is growing, with conversion of non-listeners into listeners. There’s been a 4.5 percentage point reduction in the number of people who say they never listen to podcasts. At the same time, we see a 3.7 percentage point increase in people listening to podcasts ‘a few times a week.’

In other audio consumption news, audio books are trending down, with a reduction in daily and weekly listeners, while streaming music makes modest gains. Interested in data for newspapers and magazines, digital news and content subscriptions? View the live tracker.

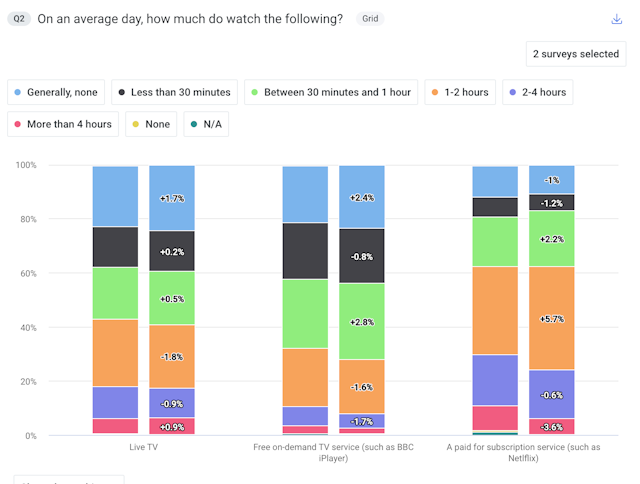

Binge watching continues to decline

The boxset bingeing many Brits engaged in during lockdown is long gone; the Q1 data shows a 3.6 percentage point decline in people watching subscription streaming platforms for more than four hours a day, bringing the figure down to just 5.7%. Meanwhile, we see a 5.7 percentage point increase in the more modest viewing time of one to two hours.

Viewing of live TV and free on-demand services is also trending down in the first quarter. Nearly a quarter of Brits don’t watch any live TV now (1.7 percentage point increase), and 24% don’t watch free on-demand services (2.4 percentage point increase). However, the time Brits spend watching TV overall (all types combined) has increased slightly since the beginning of the year, with top shows for the quarter being Bridgerton and Peaky Blinders.

Paid streaming services hold firm, with a 1 percentage point reduction in the number of consumers who say they don’t watch any. Netflix, which made headlines recently for losing subscribers for the first time in a decade (and took a giant hit to its share price as a result), appears to still be going strong in the UK. It shows a 4 percentage point increase in the number of people watching the platform at least once a week. However, the number of viewers does not necessarily equate to paid subscribers – account sharing is something Netflix has vowed to crack down on.

Meanwhile, rival Disney+ chalks up a 7.3 percentage point increase in weekly viewers, indicating faster growth (37.6% of Brits now watch the platform regularly). Amazon Prime, Netflix’s closest competitor, also achieves a 3.3 percentage point boost in weekly viewers, but still lags behind, with 47.4% of Brits watching regularly in comparison to Netflix’s 76.4%.

Attest’s UK media consumption tracker helps brands to make effective media planning decisions. To receive a quarterly bulletin direct to your inbox, sign up here.